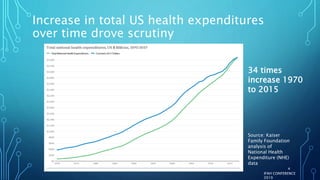

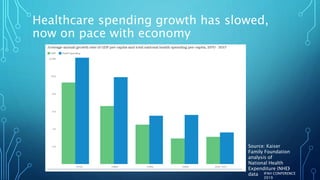

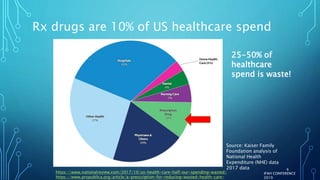

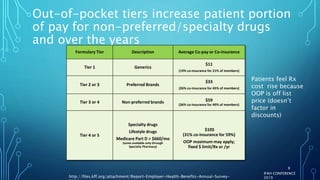

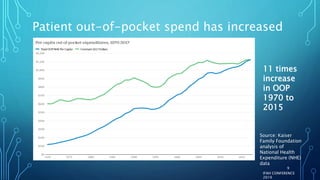

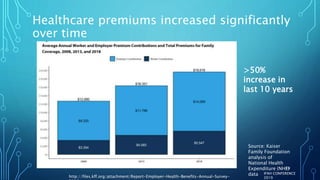

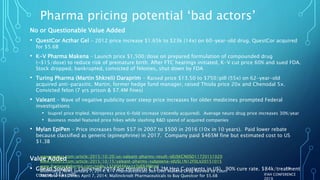

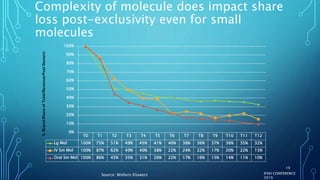

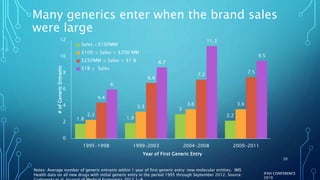

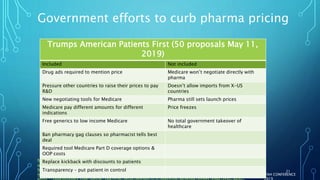

The document discusses the complexities of pharmaceutical drug pricing in the U.S., highlighting unusual market dynamics, increasing healthcare expenditures, and examples of significant price hikes by pharmaceutical companies. It outlines that patient out-of-pocket costs have escalated due to a disconnect in payment structures, resulting in scrutiny over healthcare spending and pricing models. Potential methods for reducing prices include increased competition, regulatory changes, and greater pricing transparency, but the overall drug pricing landscape remains fraught with challenges.