Embed presentation

Download to read offline

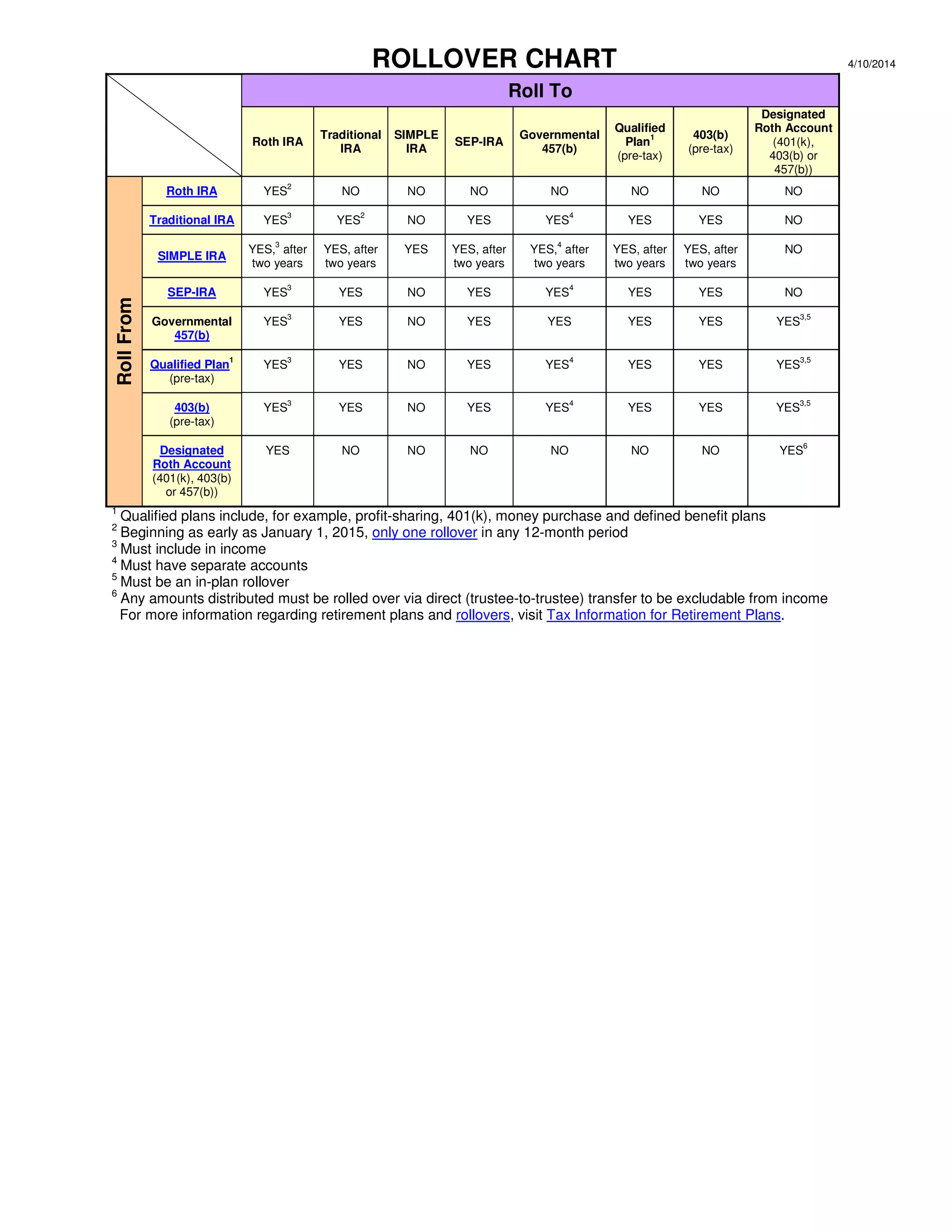

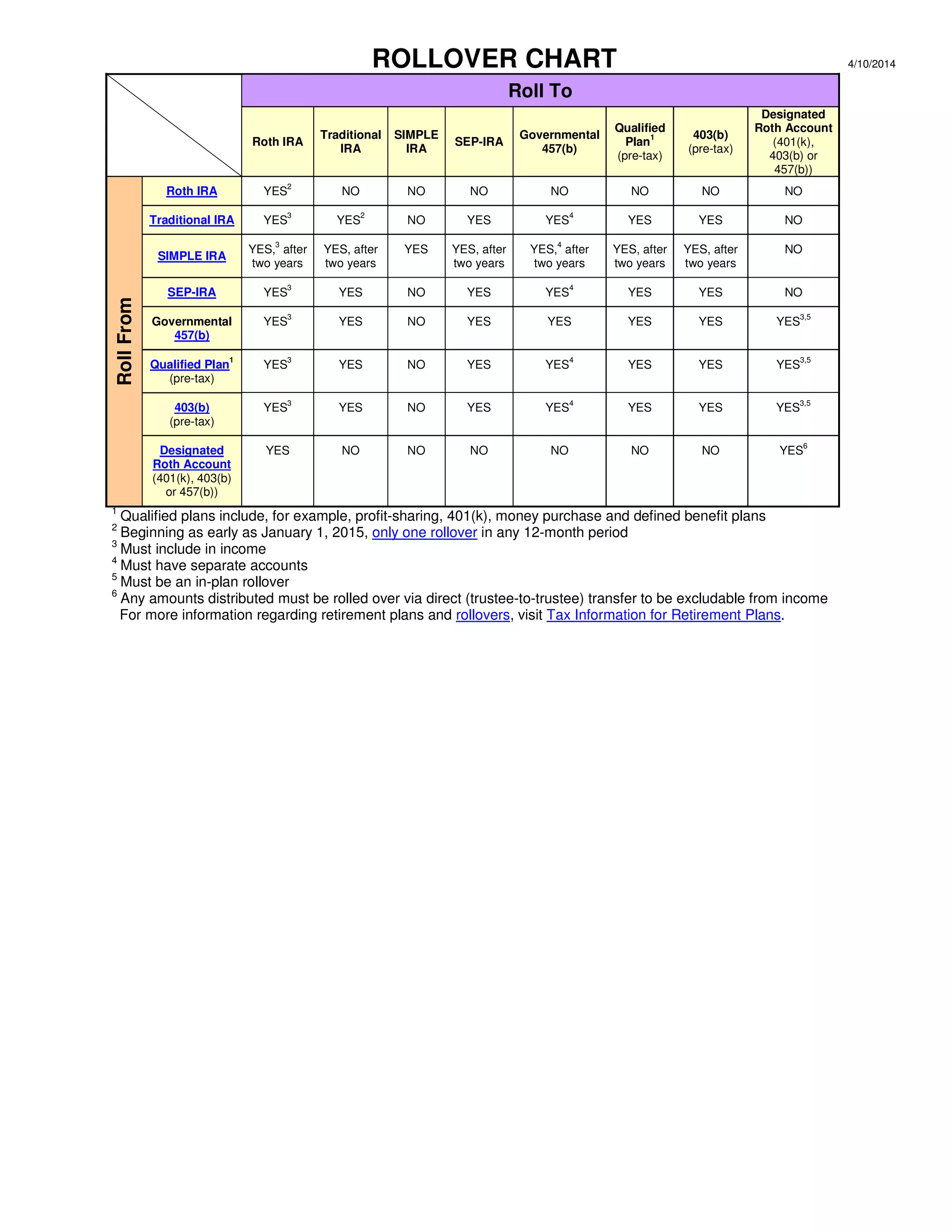

The document outlines the rules for rolling over various retirement accounts such as Roth IRAs, traditional IRAs, and 403(b) plans. It specifies conditions and eligibility for rollovers including tax implications and required waiting periods. Additionally, it emphasizes that rollover amounts must be transferred directly to be excluded from income.