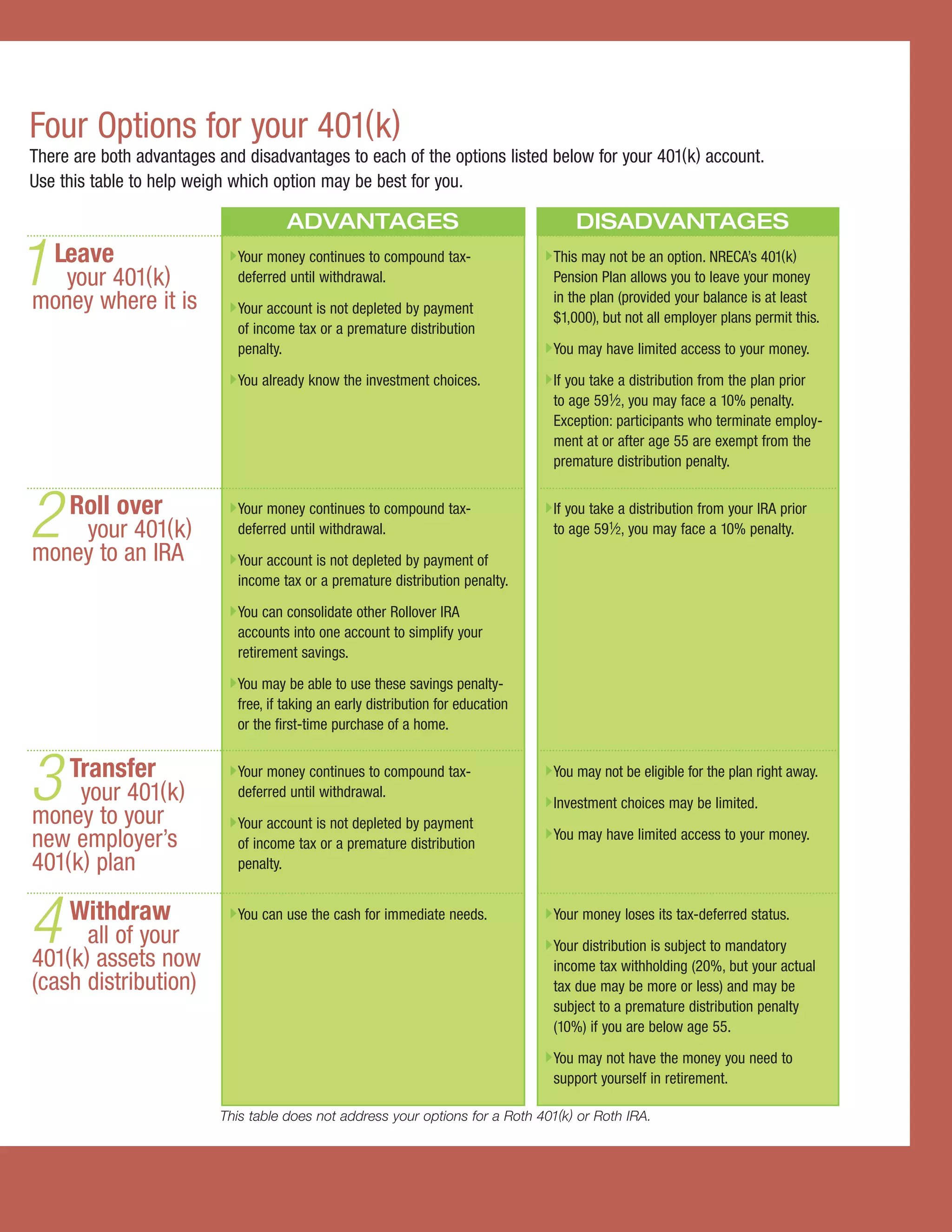

This document provides information about options for a 401(k) account when leaving a job or retiring. The main options are leaving the money in the current 401(k), rolling it over to an IRA, transferring to a new employer's 401(k), or withdrawing the funds. Rolling over to a Homestead Funds IRA is presented as one choice that provides investment options and control over access to funds. Key details are provided about rolling over to a Roth IRA and the tax implications. Overall the document aims to help readers understand their choices for managing 401(k) savings after leaving a job.