This project report summarizes research on non-banking financial companies (NBFCs) in India. It includes an industry overview of NBFCs and RBI regulations for them. It also analyzes the macroeconomic factors impacting NBFCs and performs a five forces analysis. Additionally, it discusses the future of NBFCs and selects potential investment opportunities based on financial analysis, including an overview of Shree Global TR and Bajaj Holdings & Investment Limited.

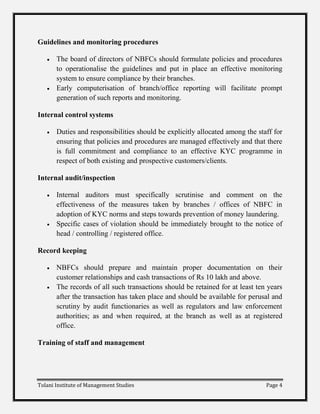

![Return On Net Worth(%) -- 0.56 --

Adjusted Return on Net Worth(%) -1.56 0.56 0.03

Return on Long Term Funds(%) -0.44 0.16 0.04

Liquidity And Solvency Ratios

Current Ratio 1.79 2.22 0.89

Long Term Debt Equity Ratio 2.50 2.47 --

Management Efficiency Ratios

Asset Turnover Ratio 5,230.55 564.92 474.62

Number of Days In Working Capital 159.96 429.12 117.07

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit -- -- --

Dividend Payout Ratio Cash Profit -- -- --

Earnings Per Share -0.16 0.06 --

Book Value 10.48 10.65 10.59

Bajaj Holdings

Bajaj Holdings & Investment Limited [(BHIL) – erstwhile Bajaj Auto Limited ]

was de-merged as per Order dated 18 December 2007 of the Hon‟ble Bombay

High Court, whereby its manufacturing undertaking has been transferred to the

new Bajaj Auto Limited (BAL) and its strategic business undertaking consisting of

wind farm business and financial services business has been vested with Bajaj

Finserv Limited (BFS). All the businesses and all properties, assets, investments

and liabilities of erstwhile Bajaj auto Ltd, other than the manufacturing

undertaking and the strategic business undertaking, now remain with BHIL. (For

details of the scheme refer Demerger News) .

Post-demerger, BHIL holds more than 30% shares each in BAL and BFS. Going

forward, BHIL will focus on new business opportunities. BAL and BFS will be

able to tap (on an arm‟s length basis) into BHIL‟s cash pool to support future

growth opportunities. BHIL by having 30% stake in both BAL and BFS will

Tolani Institute of Management Studies Page 12](https://image.slidesharecdn.com/ipmreport-120205065416-phpapp02/85/Ipm-report-12-320.jpg)