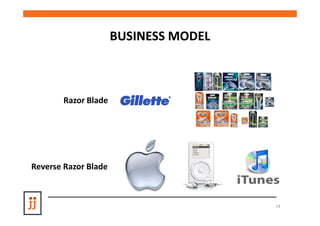

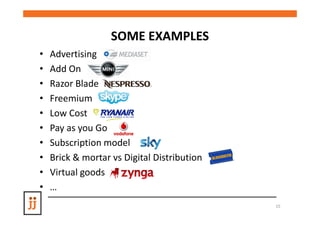

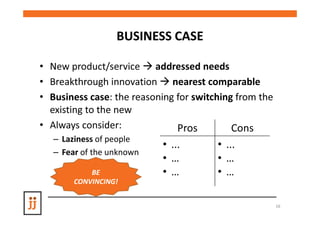

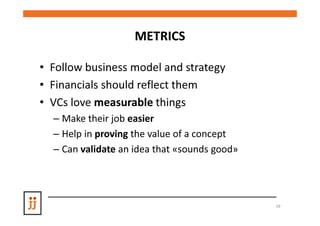

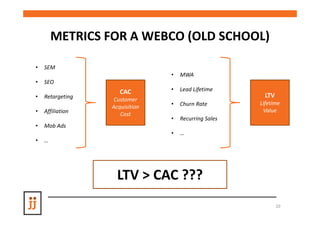

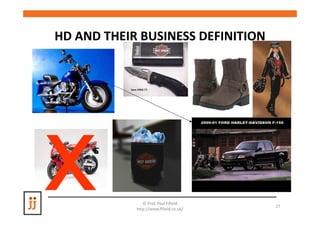

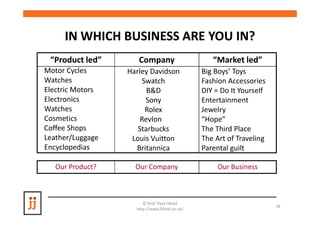

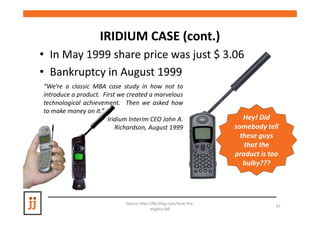

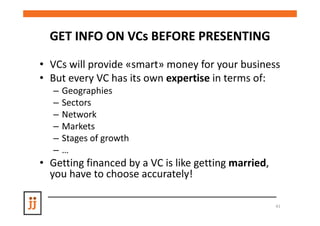

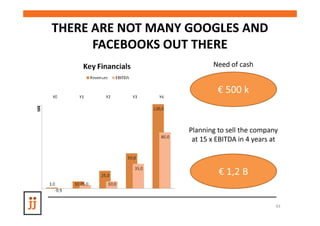

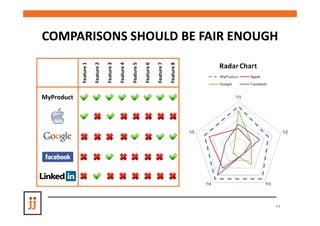

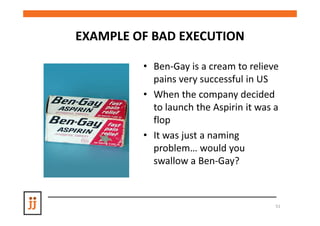

The document outlines a workshop focusing on critical mistakes to avoid when presenting to investors, presented by Andrea Baldini and Tomaso Rodriguez. It emphasizes the importance of communication and presentation structure, effective product representation, understanding business models, providing metrics, and transparency with potential investors. Key principles include the need for execution, identifying market segments, knowing your audience, and preparing for feedback to enhance investor presentations.