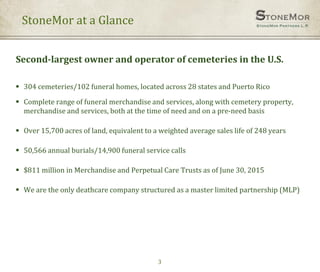

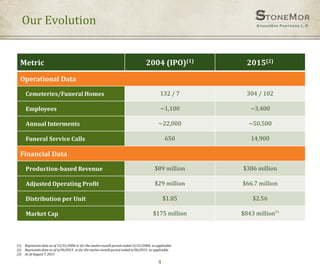

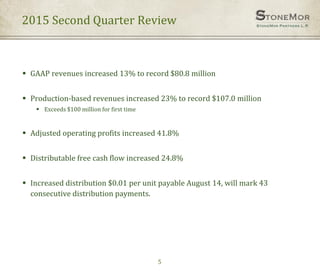

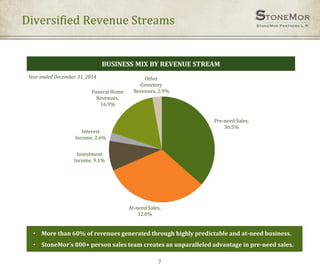

StoneMor Partners L.P. provides an investor presentation that includes forward-looking statements about the company's status, plans, assumptions, and financial projections. Their major risk is uncertainties in cash flow from pre-need and at-need sales, trusts, and financing that could impact financial projections and distributions. The presentation provides an overview of the company, its evolution since going public, recent financial results, acquisition strategy, and the deathcare industry outlook.