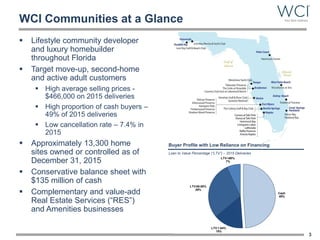

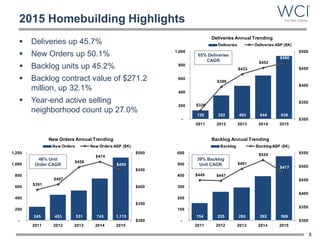

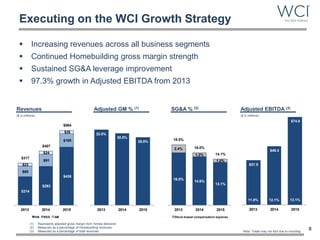

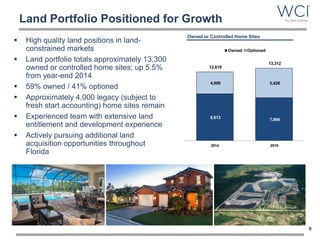

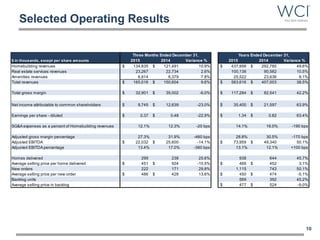

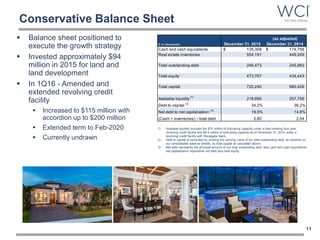

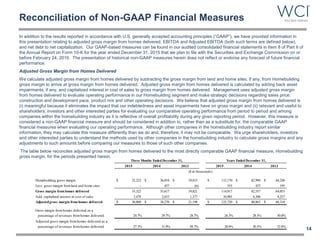

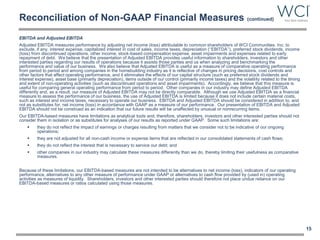

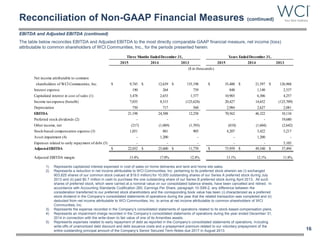

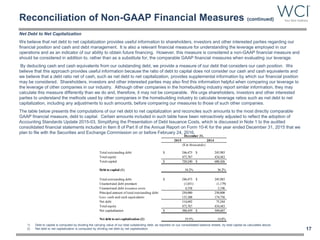

WCI Communities reported strong full year 2015 results, with revenues increasing 38.5% to $563.6 million. Homebuilding revenues grew 49.6% to $438 million due to a 45.7% increase in home deliveries to 938 homes. Adjusted EBITDA increased 50.1% to $74 million. The company has a conservative balance sheet with $135 million in cash and an undrawn $115 million revolving credit facility. Management is positioned to continue executing its growth strategy through land acquisition opportunities in Florida.