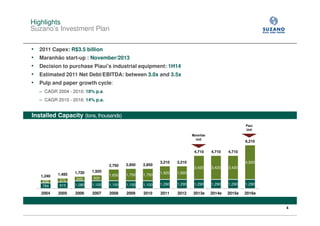

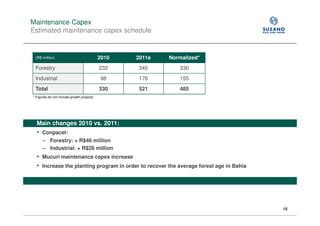

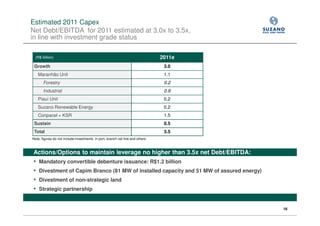

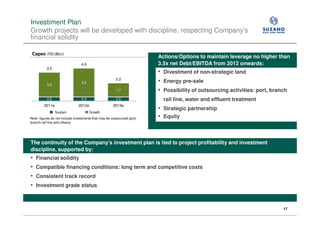

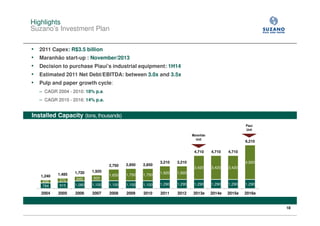

Suzano's investment plan outlines its capital expenditure plans through 2016. Key points include:

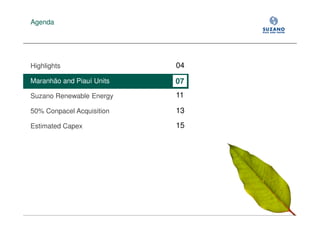

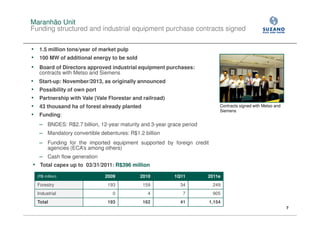

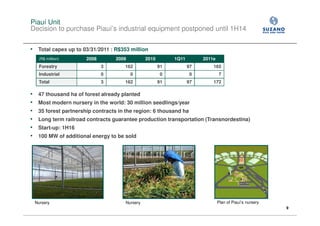

- 2011 capex is estimated at R$3.5 billion, with the Maranhão mill starting up in November 2013 and a decision on purchasing equipment for the Piauí mill in 1H14.

- Growth targets include a 14% compound annual growth rate in pulp and paper capacity between 2010-2016.

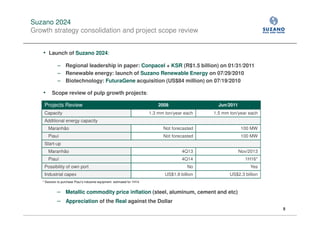

- The plan reviews the scope of the Maranhão and Piauí pulp mill projects, increasing capacity to 1.5 million tons per year and adding 100MW of energy capacity for each.

- Suzano Renewable Energy is advancing negotiations to produce 3