Embed presentation

Download to read offline

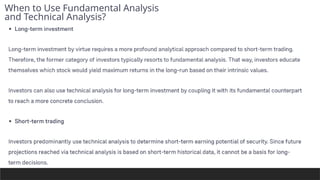

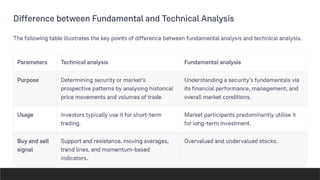

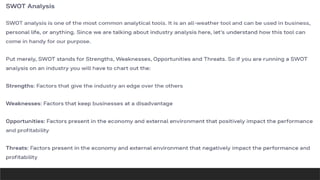

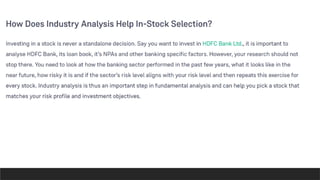

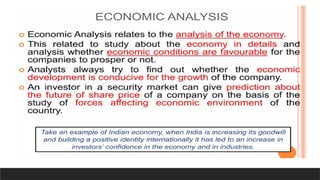

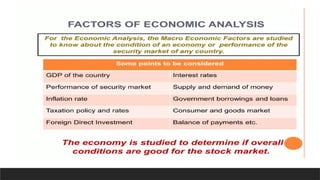

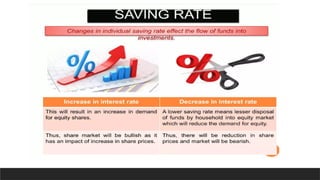

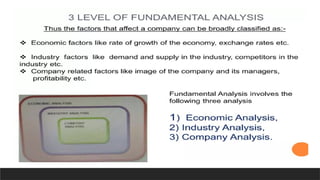

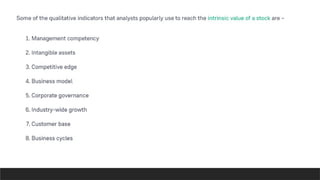

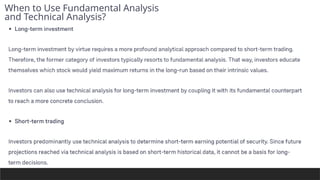

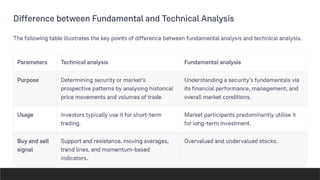

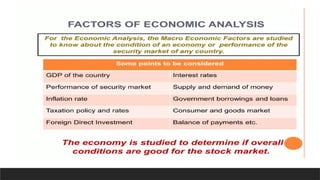

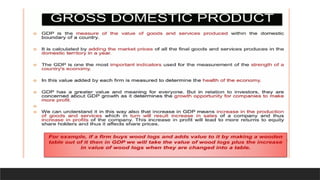

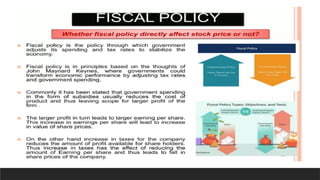

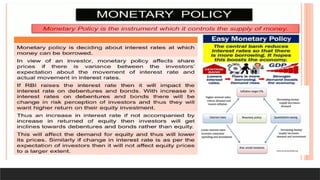

Fundamental analysis focuses on understanding a stock's intrinsic value by examining macro and microeconomic factors. Analysts evaluate elements such as economic conditions and company management to assess stock prices. The document contrasts fundamental analysis with technical analysis, highlighting when to utilize each method.