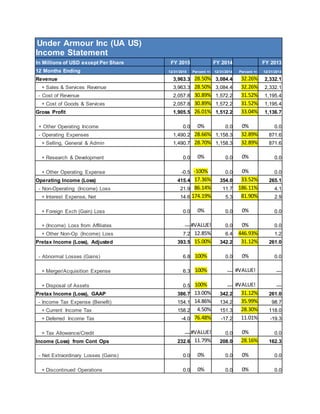

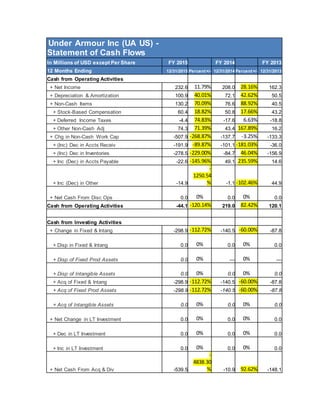

Under Armour reported revenue growth of 28.5% in 2015 compared to 2014, driven by increases in apparel, footwear, and connected fitness sales. Gross profit increased by 26.01% but gross margin declined slightly due to currency impacts and increased costs. Operating expenses grew 28.66% due to higher marketing costs for sponsorships. Net income increased by 11.79% despite the margin declines and expense growth, showing continued strong overall financial performance.