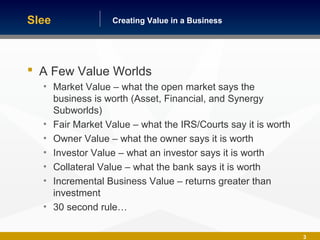

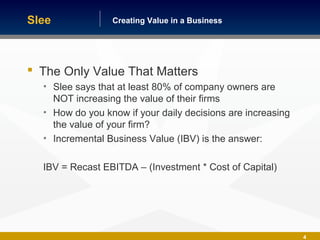

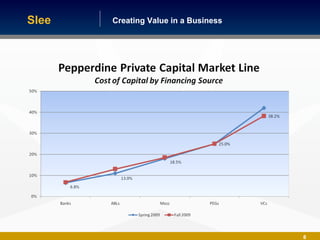

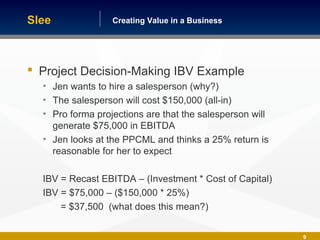

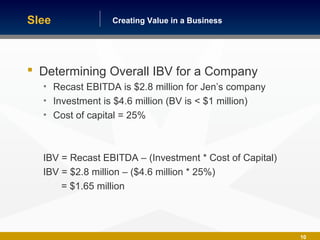

The document discusses creating value in a business through incremental business value (IBV). It explains that there are multiple perspectives that can determine a business's value, such as market value, owner value, and investor value. However, the value that truly matters is IBV, which is calculated as Recast EBITDA minus the cost of investment times the cost of capital. The document provides an example to show how IBV can be used to evaluate whether a potential new investment like hiring a salesperson will increase the overall value of the business. It also demonstrates how to calculate the total IBV for an entire company.