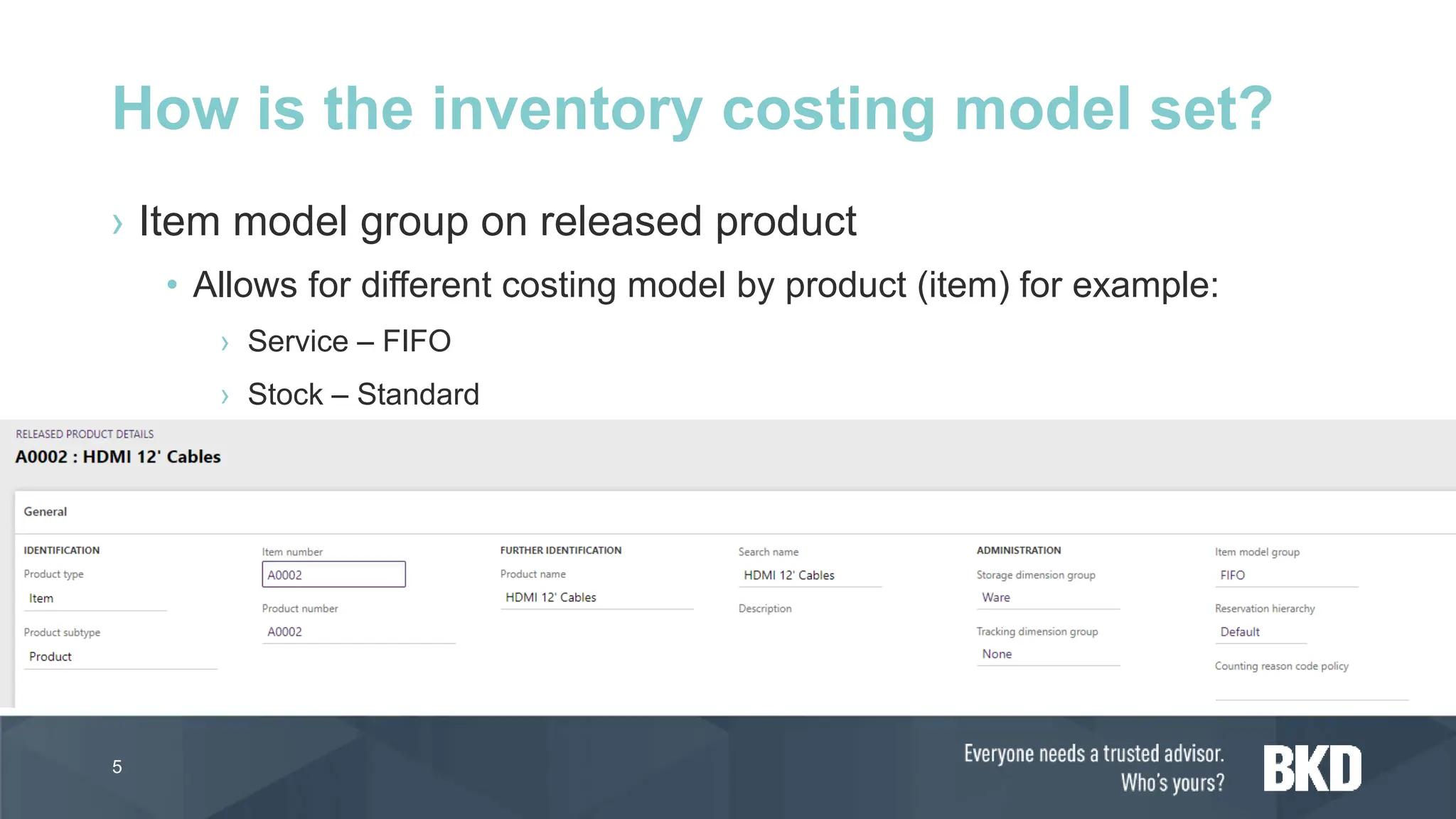

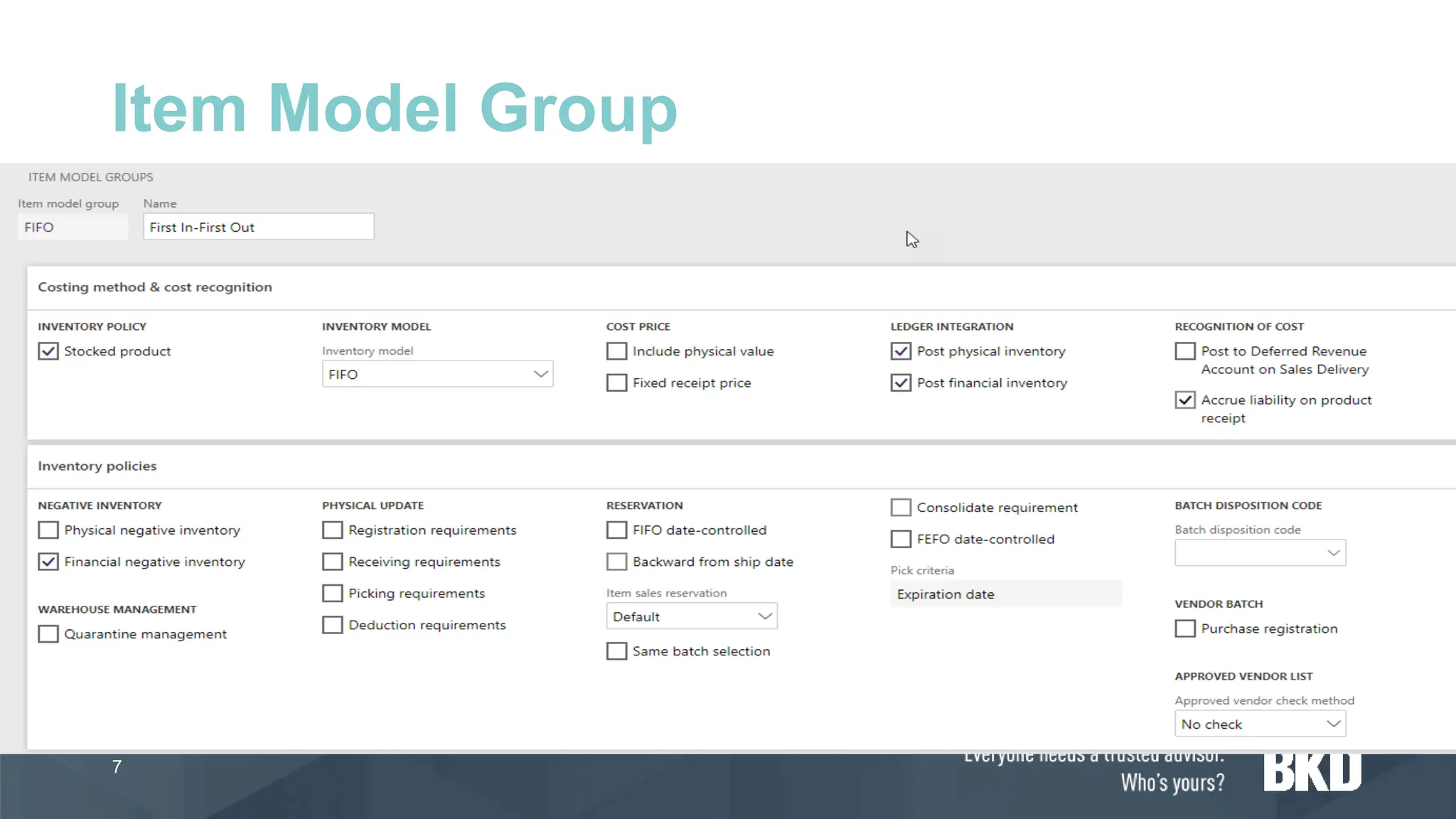

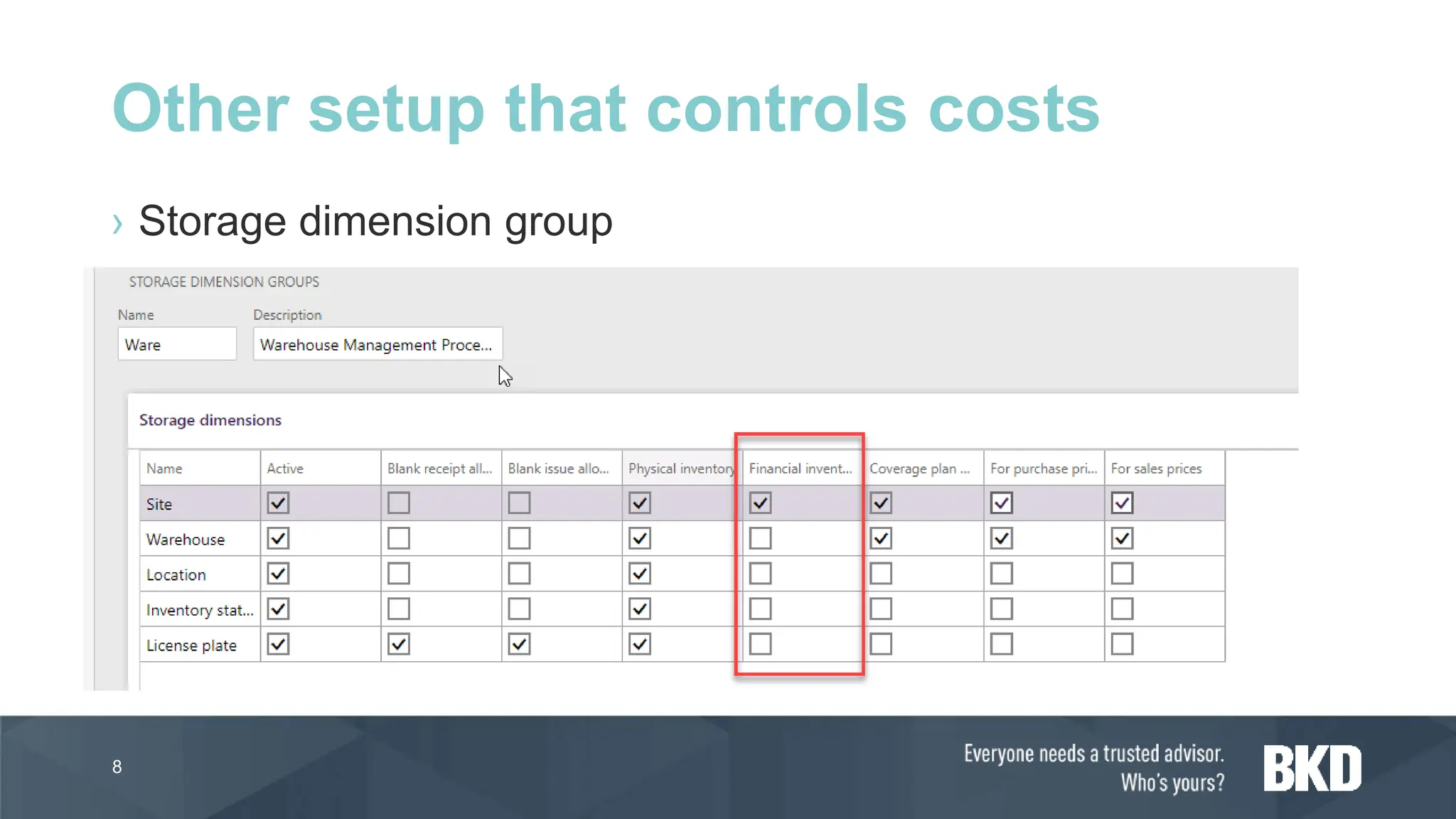

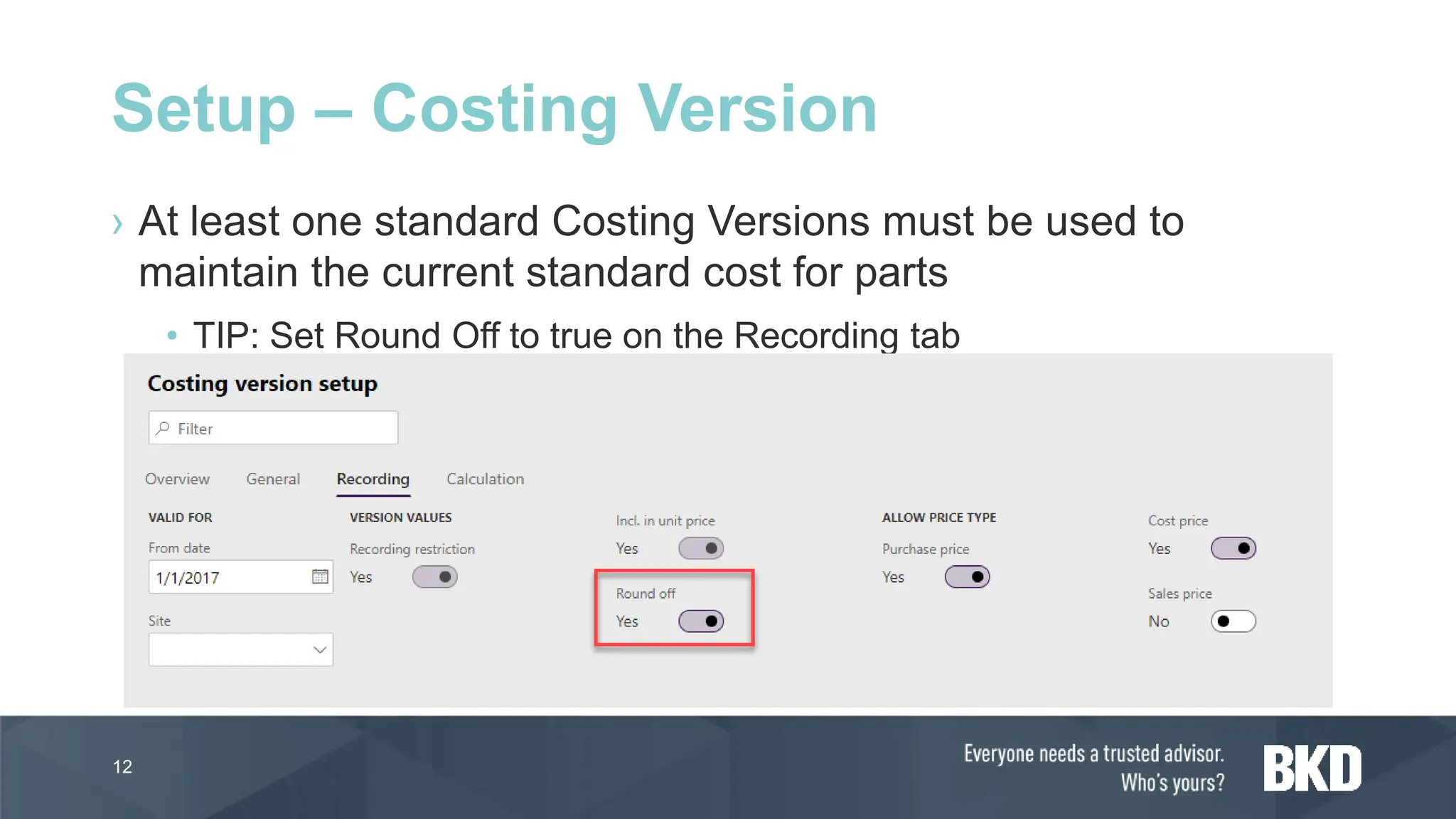

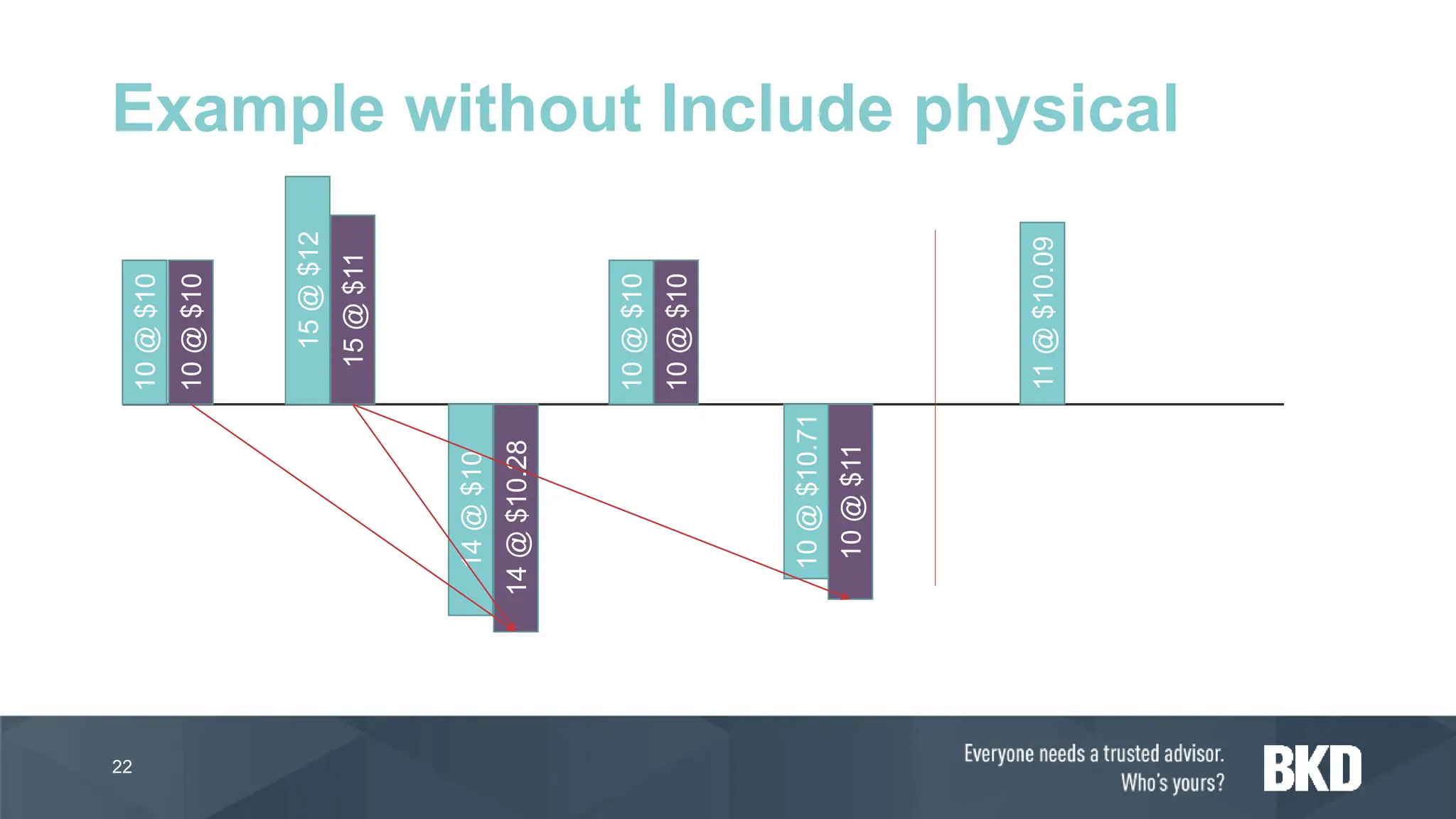

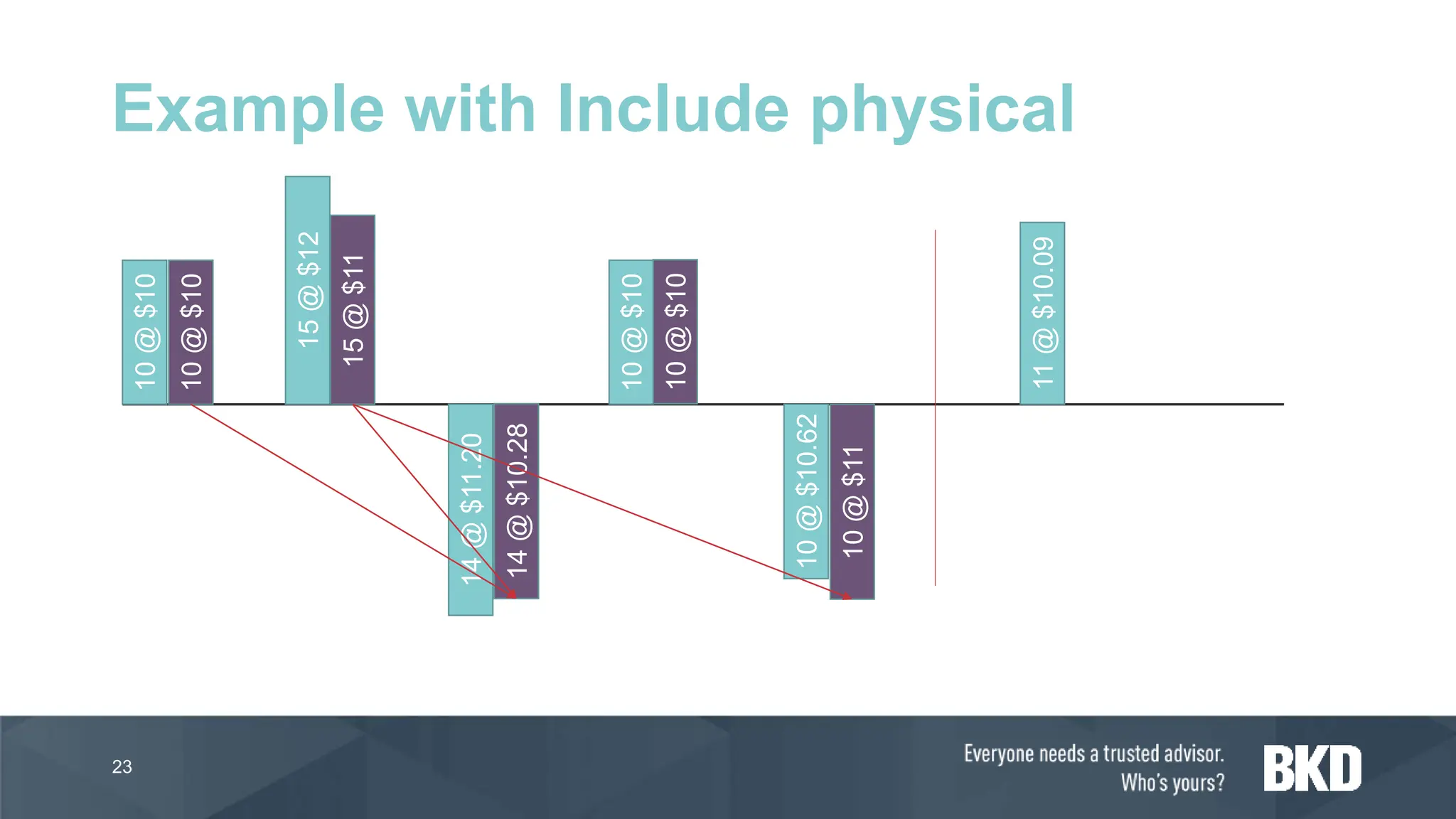

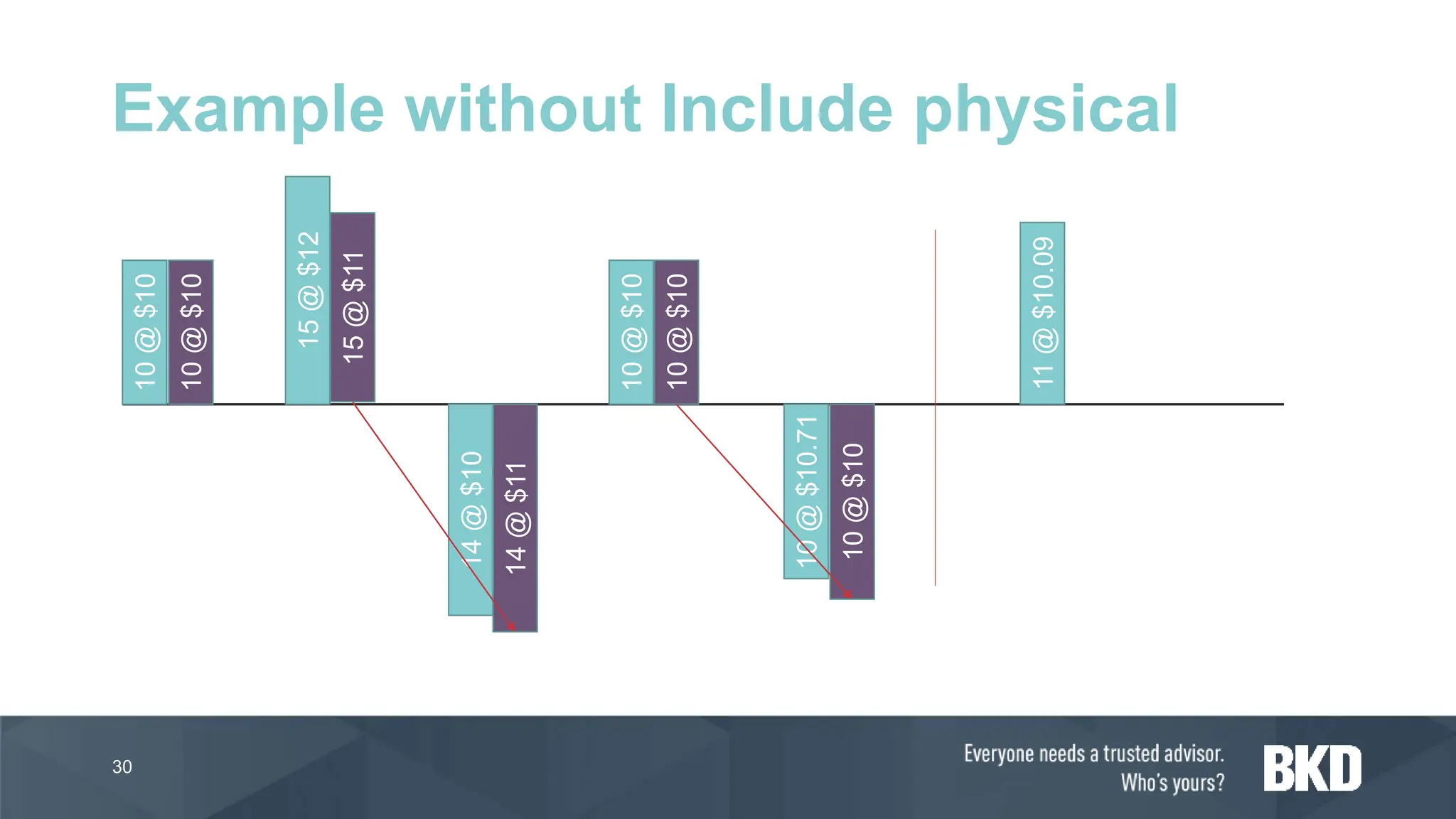

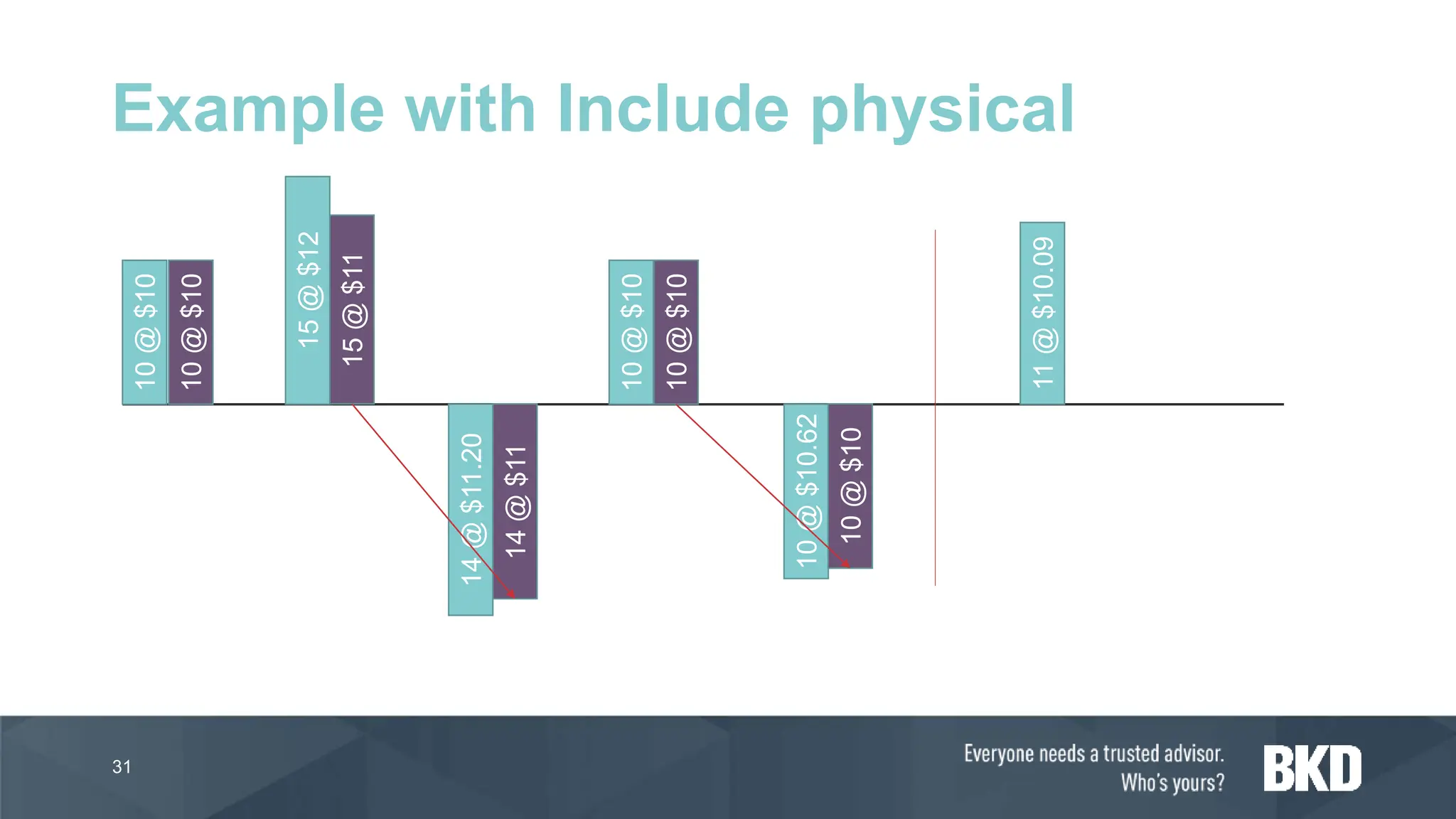

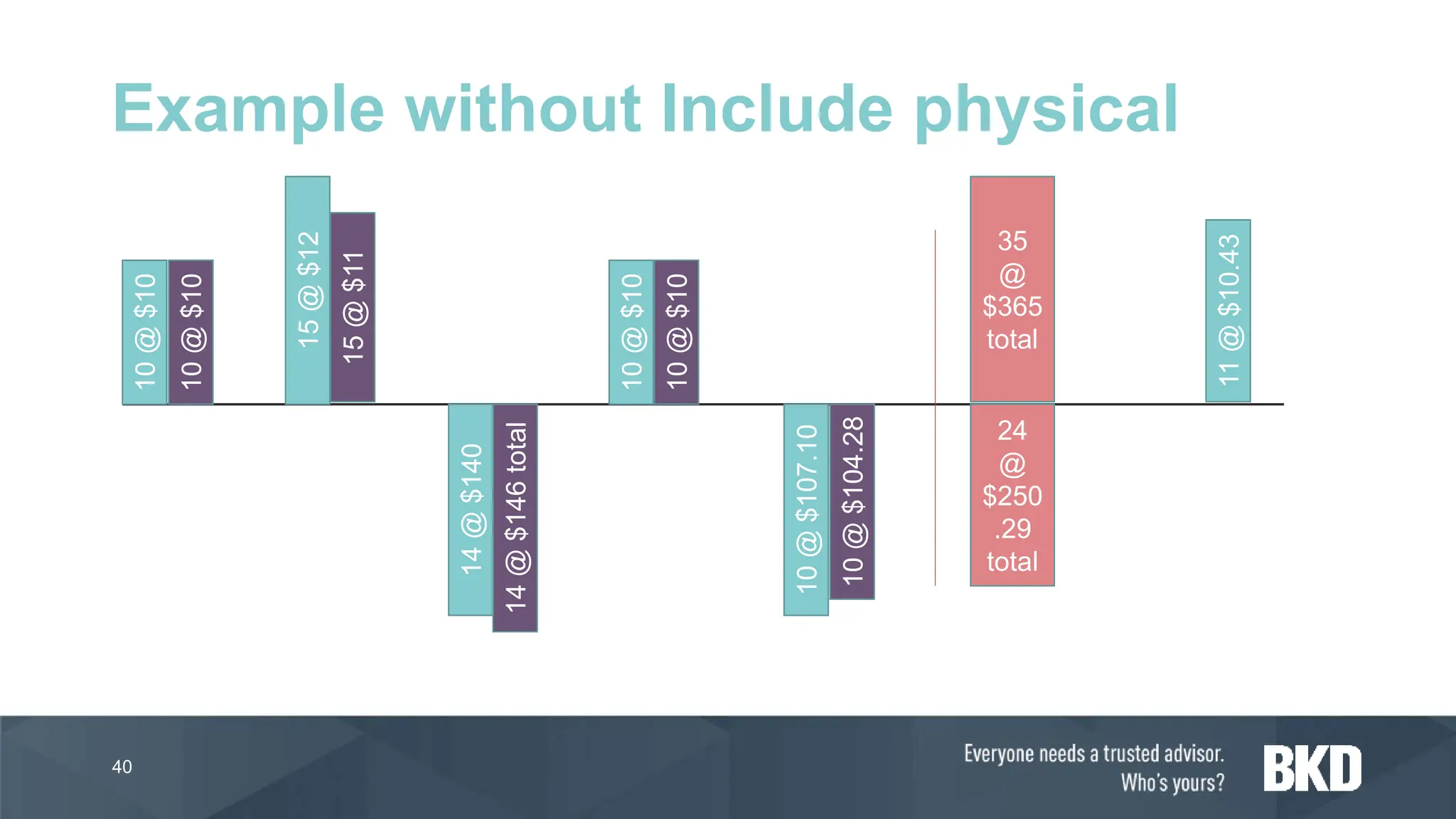

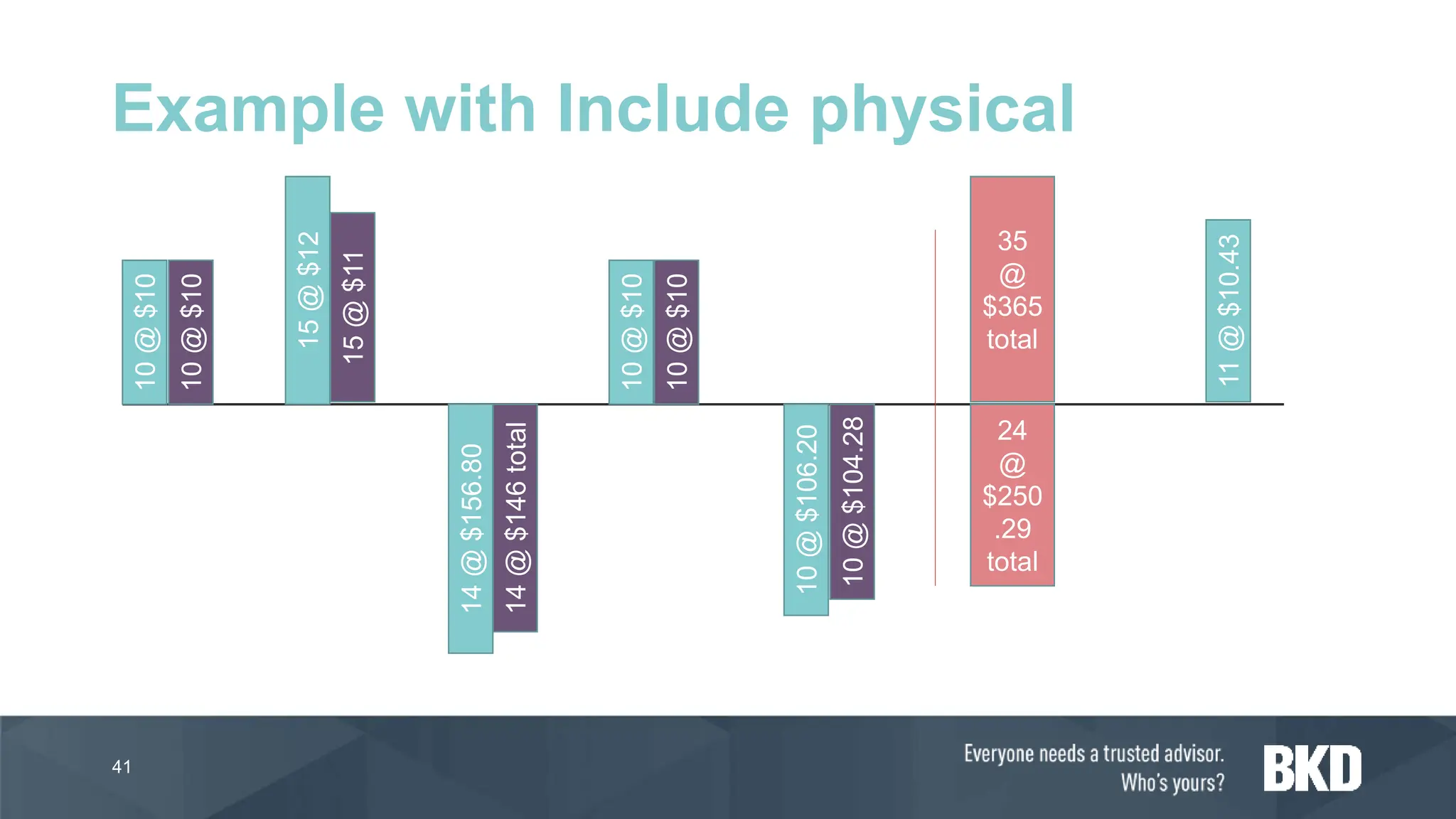

The document discusses the different inventory costing models available in Dynamics 365 Finance and Operations (D365 F&O). It defines Standard, FIFO, LIFO, Weighted Average, and Moving Average costing models. For each model it covers the month-end processes, pros and cons, and provides examples. It also announces two additional summit presentations on production planning and order picking in D365 F&O.