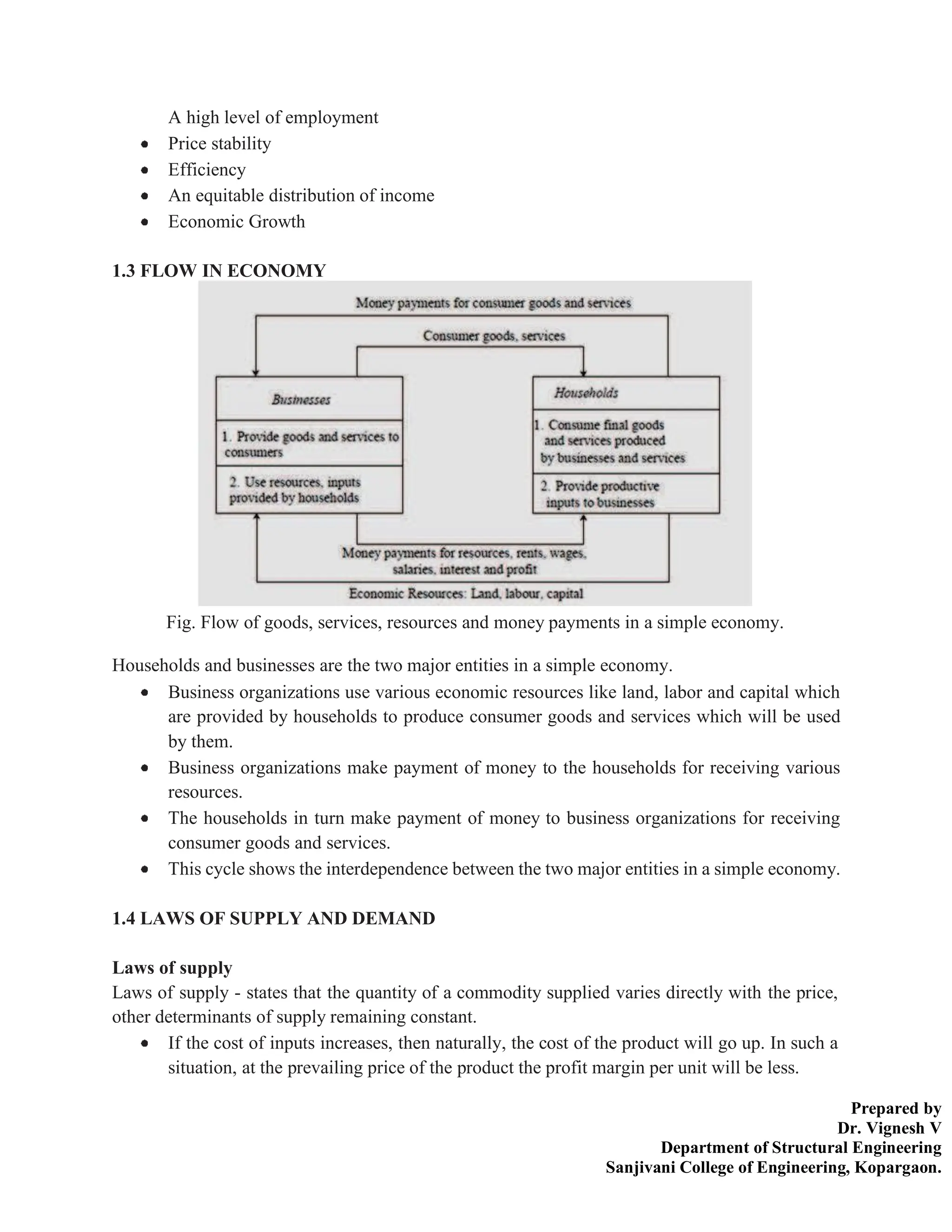

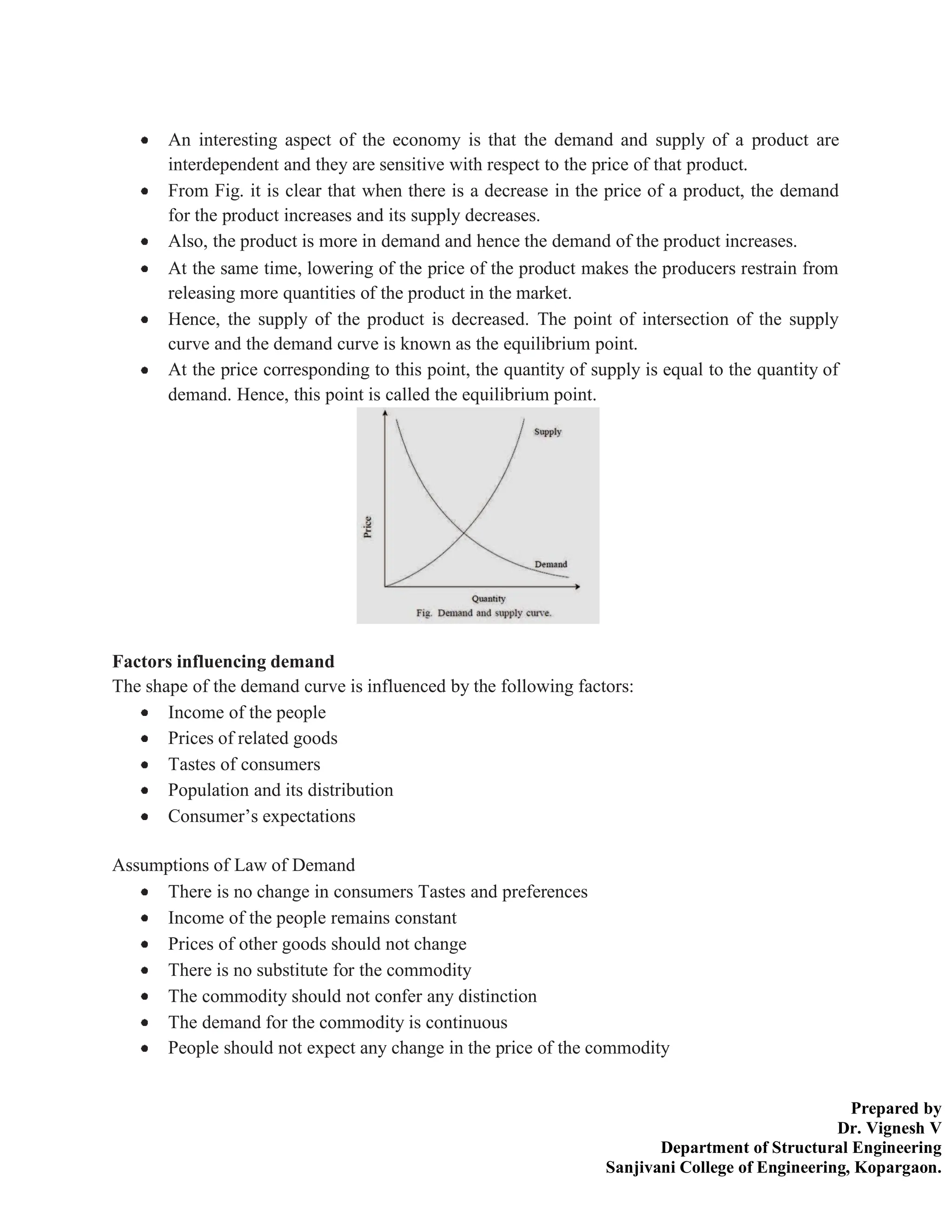

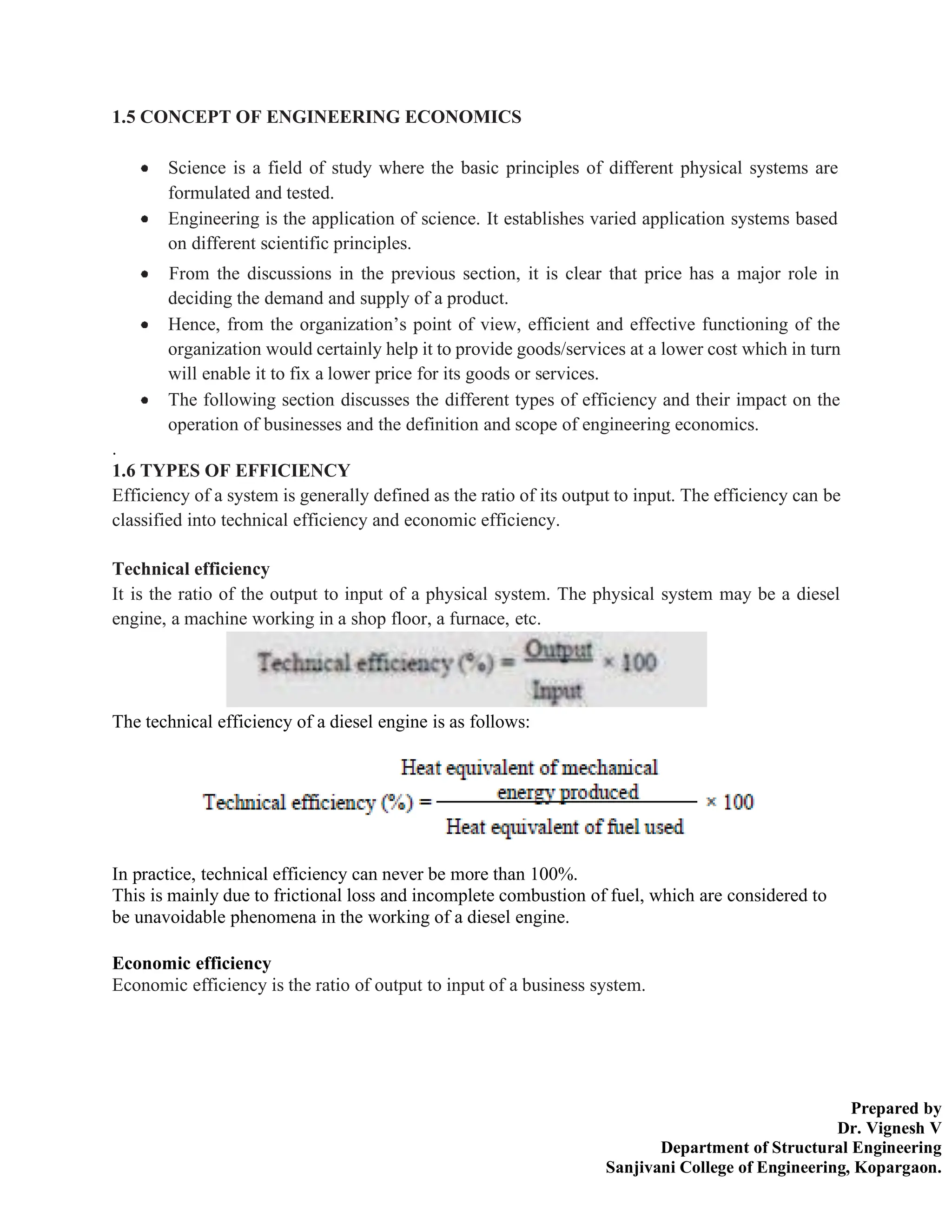

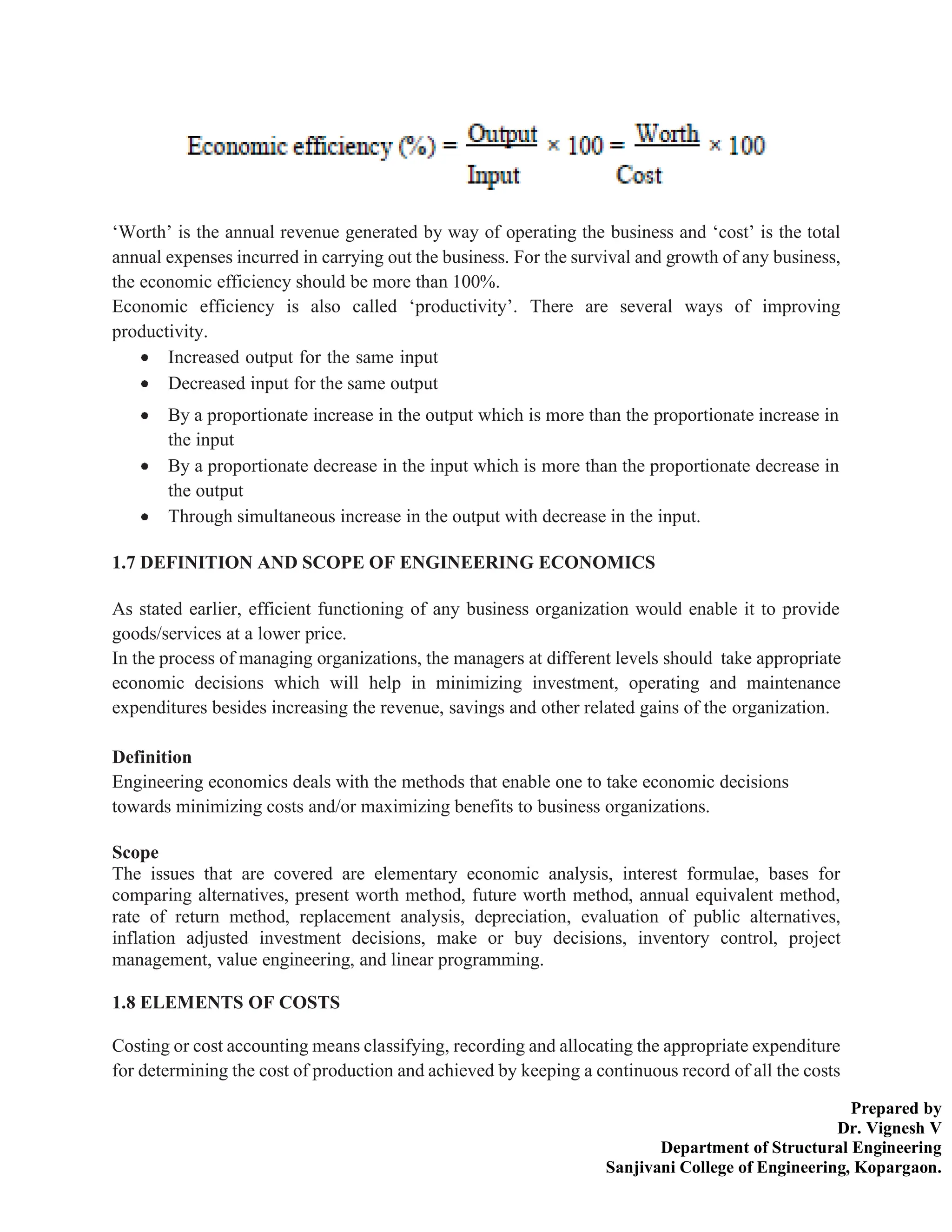

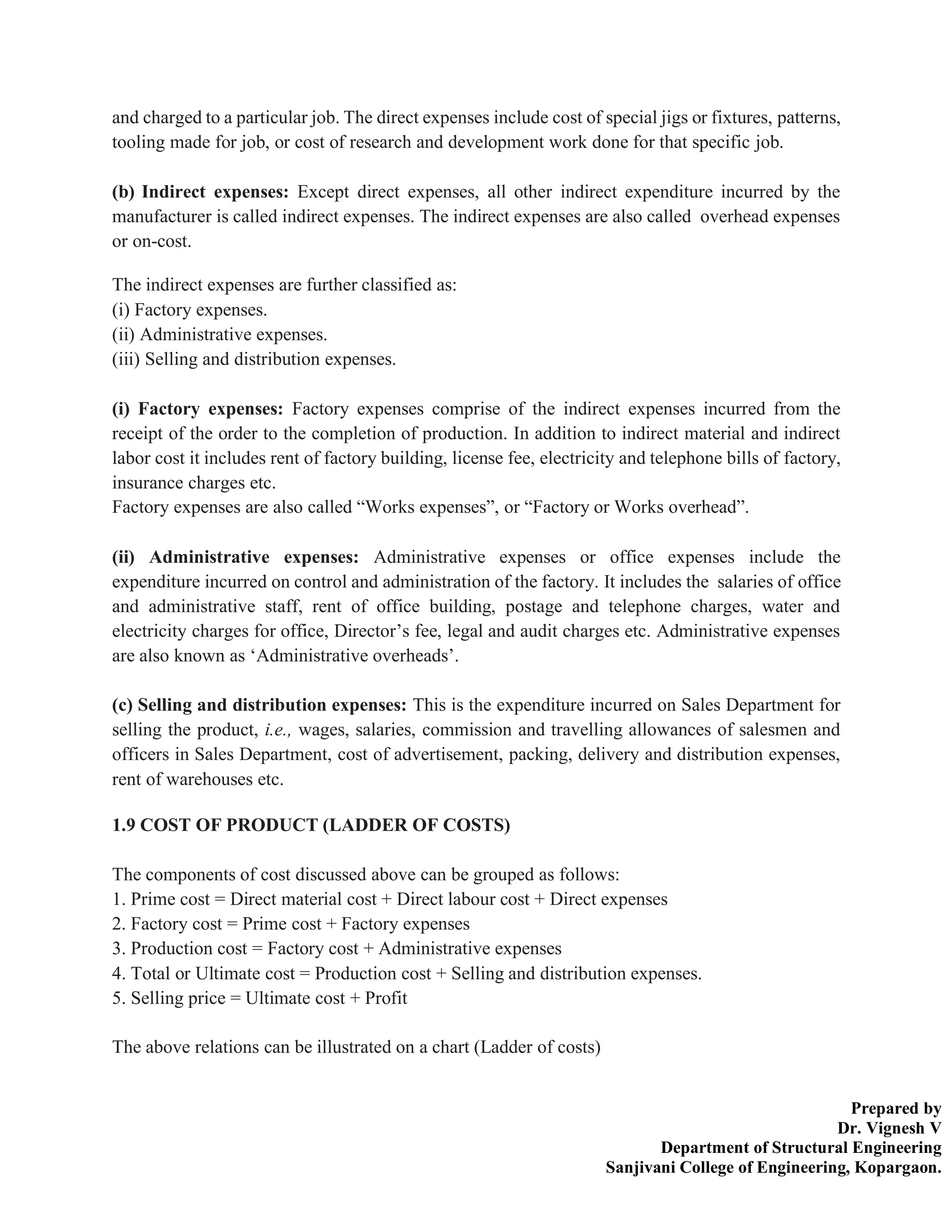

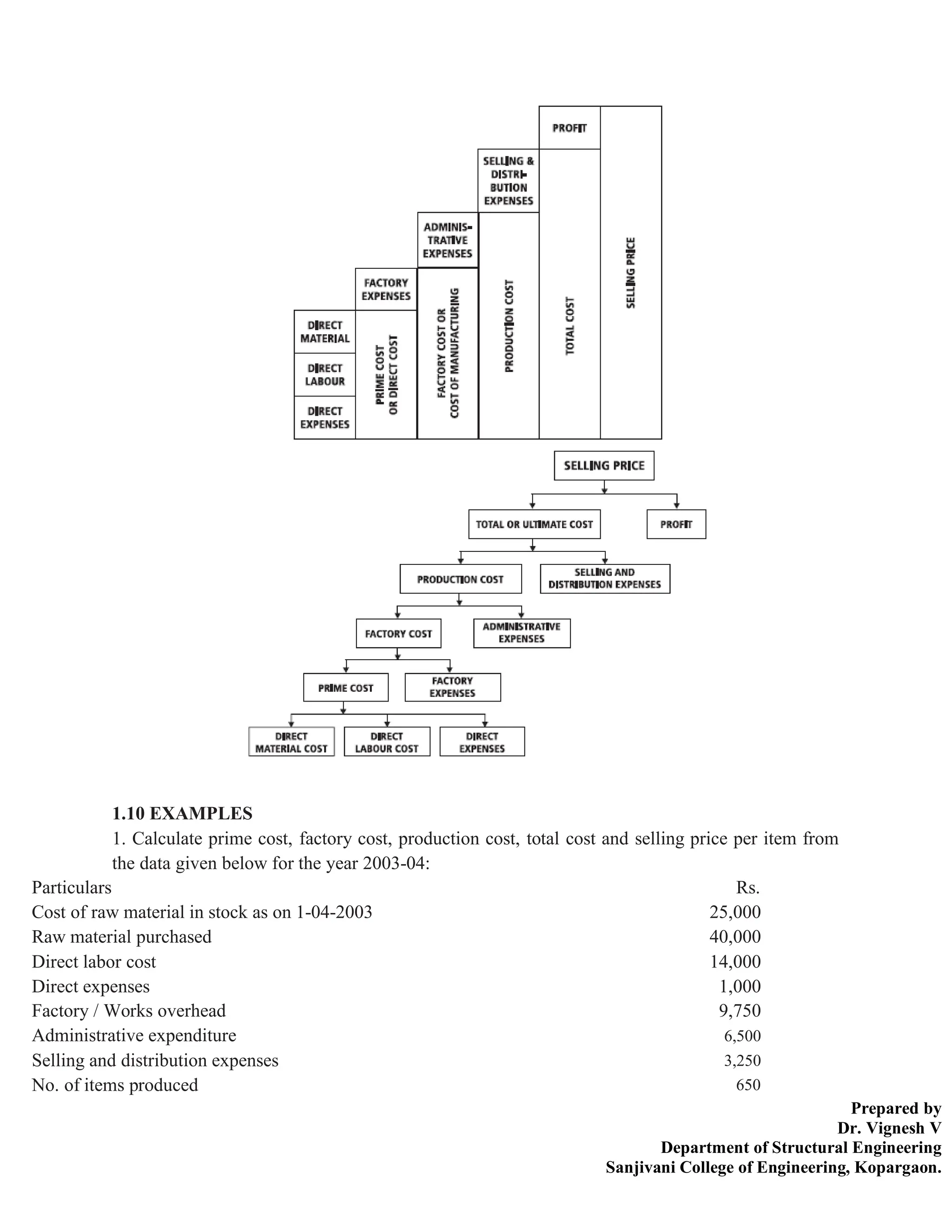

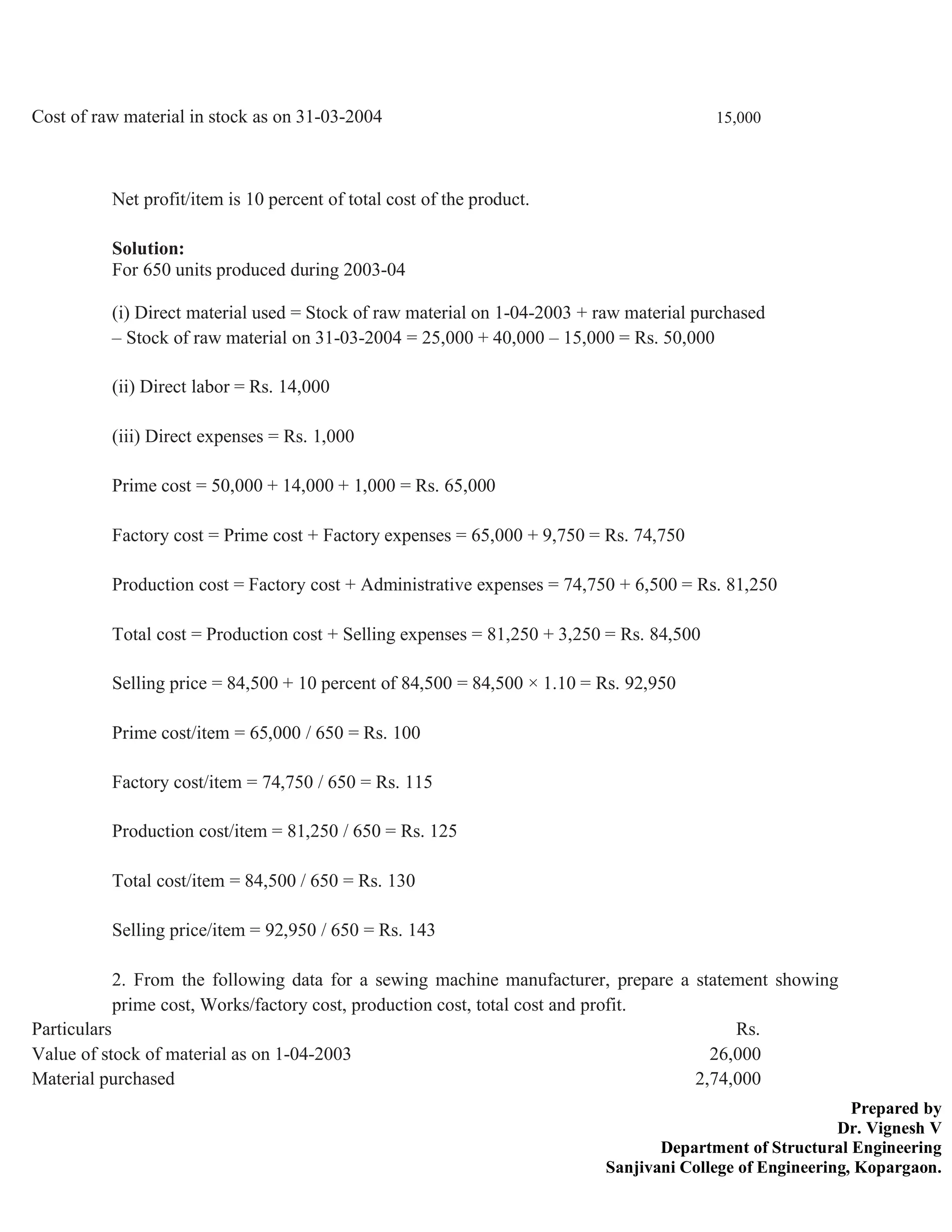

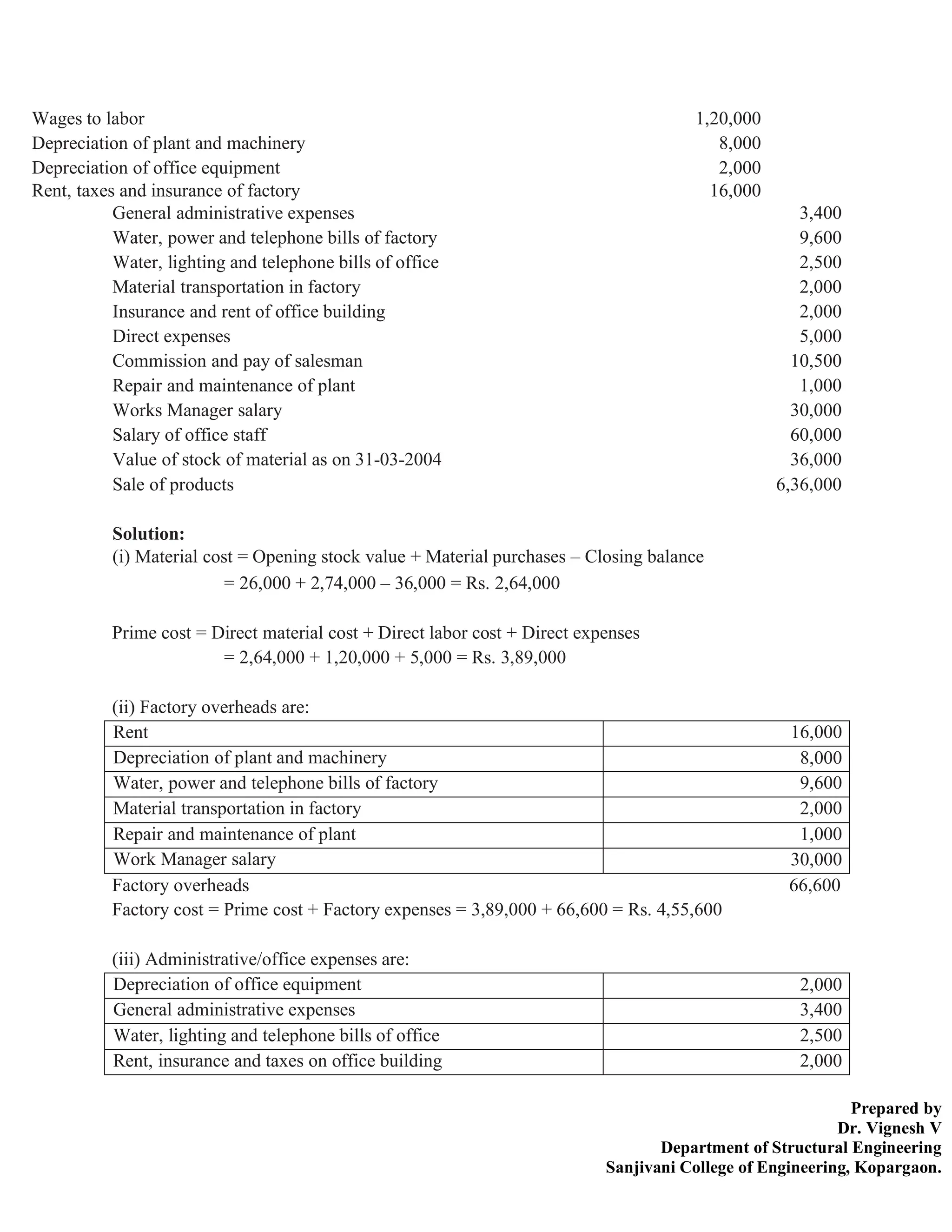

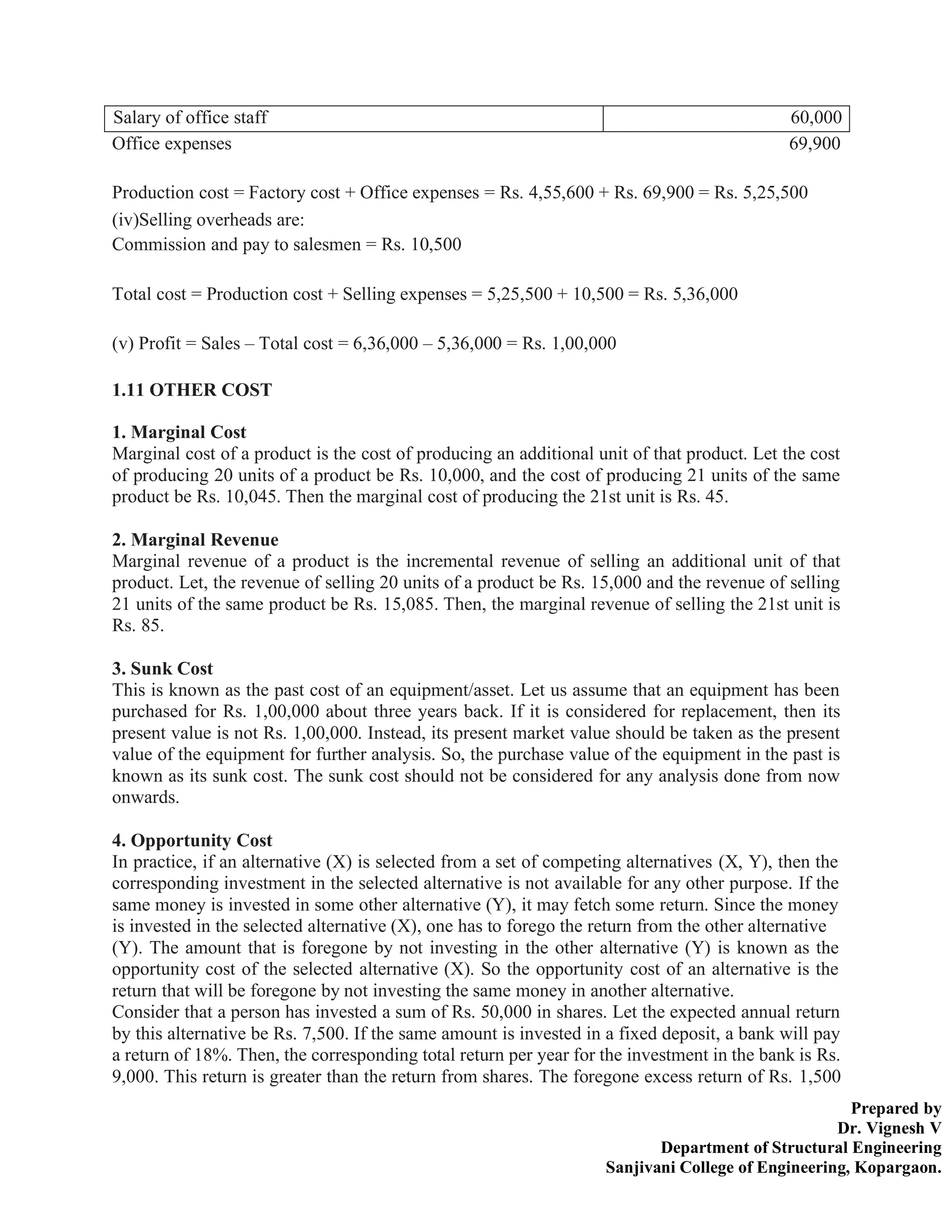

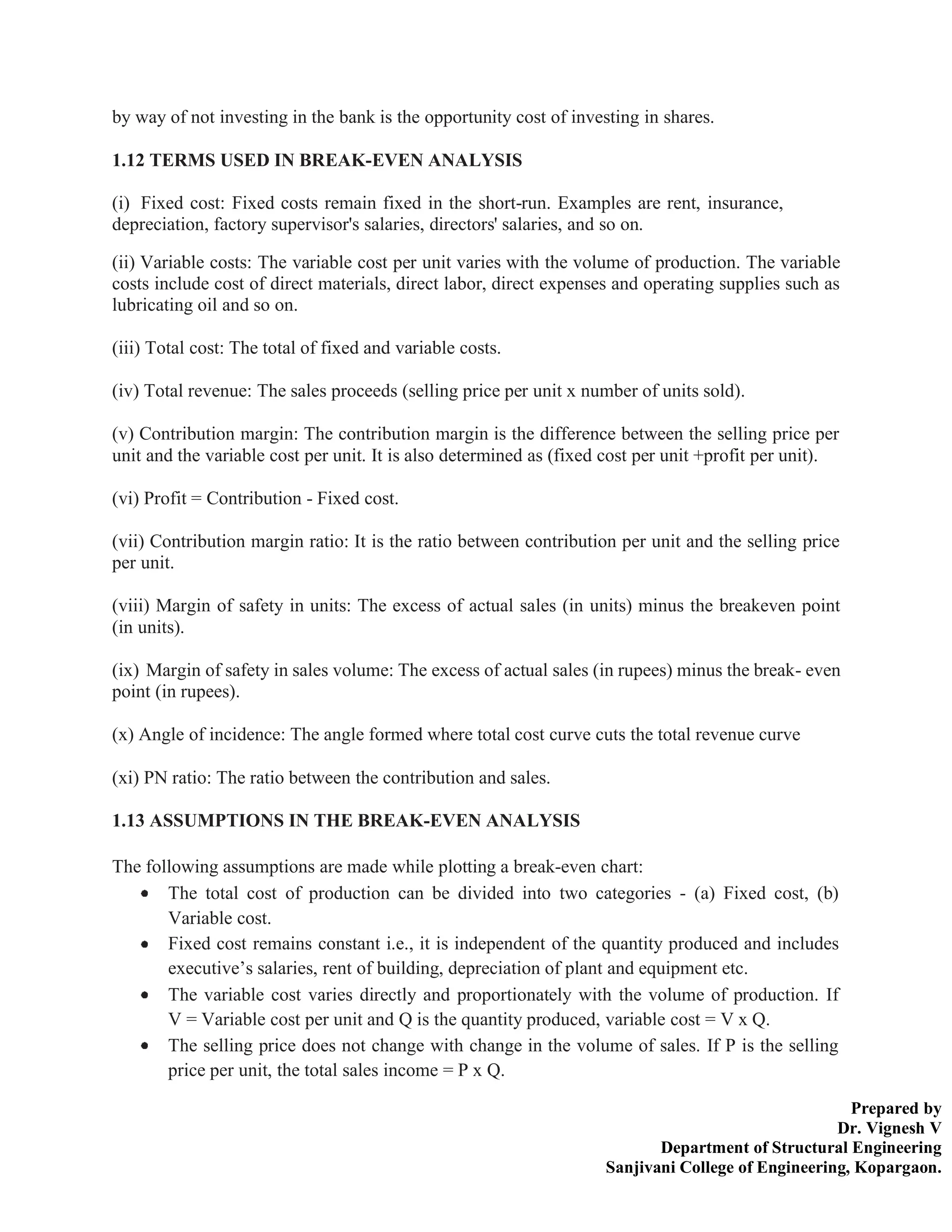

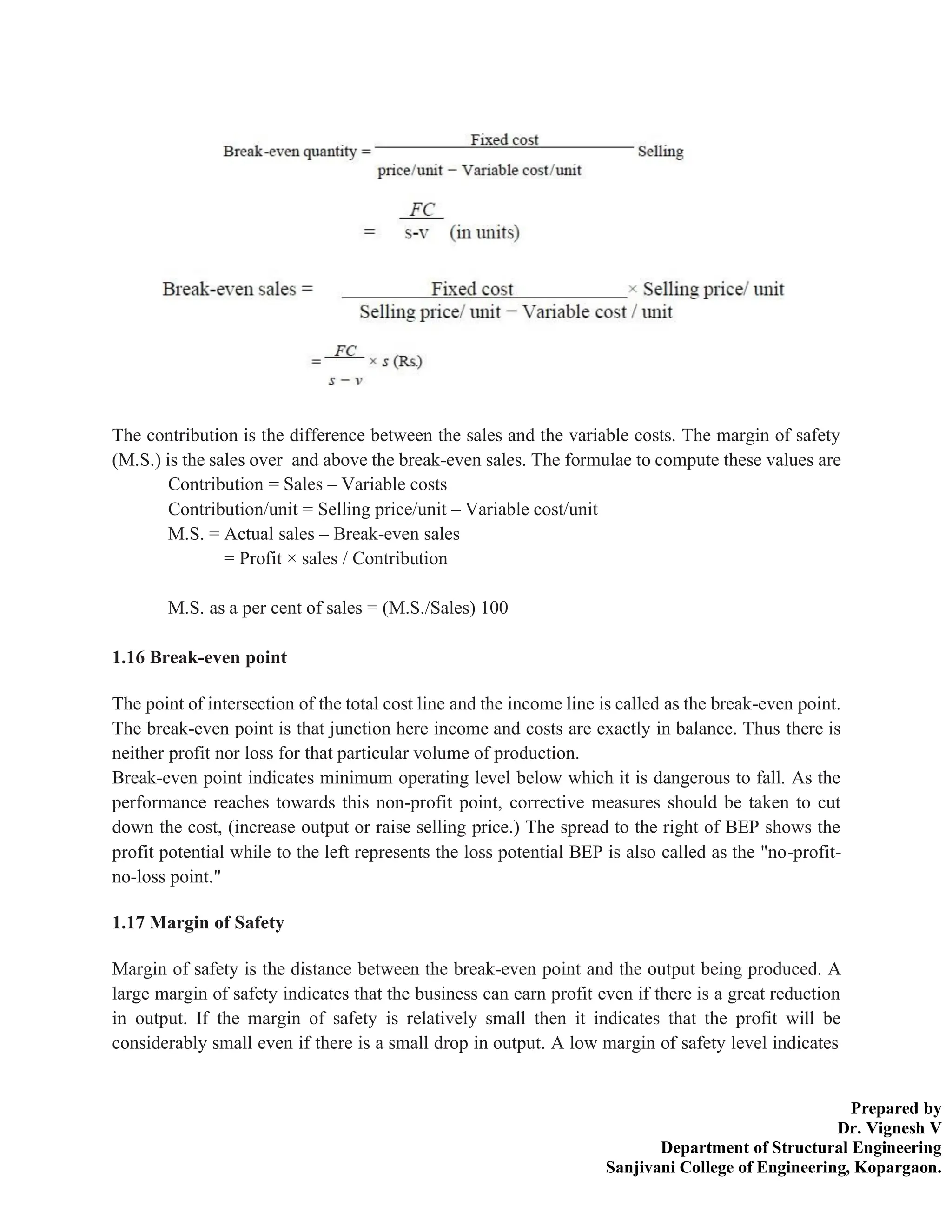

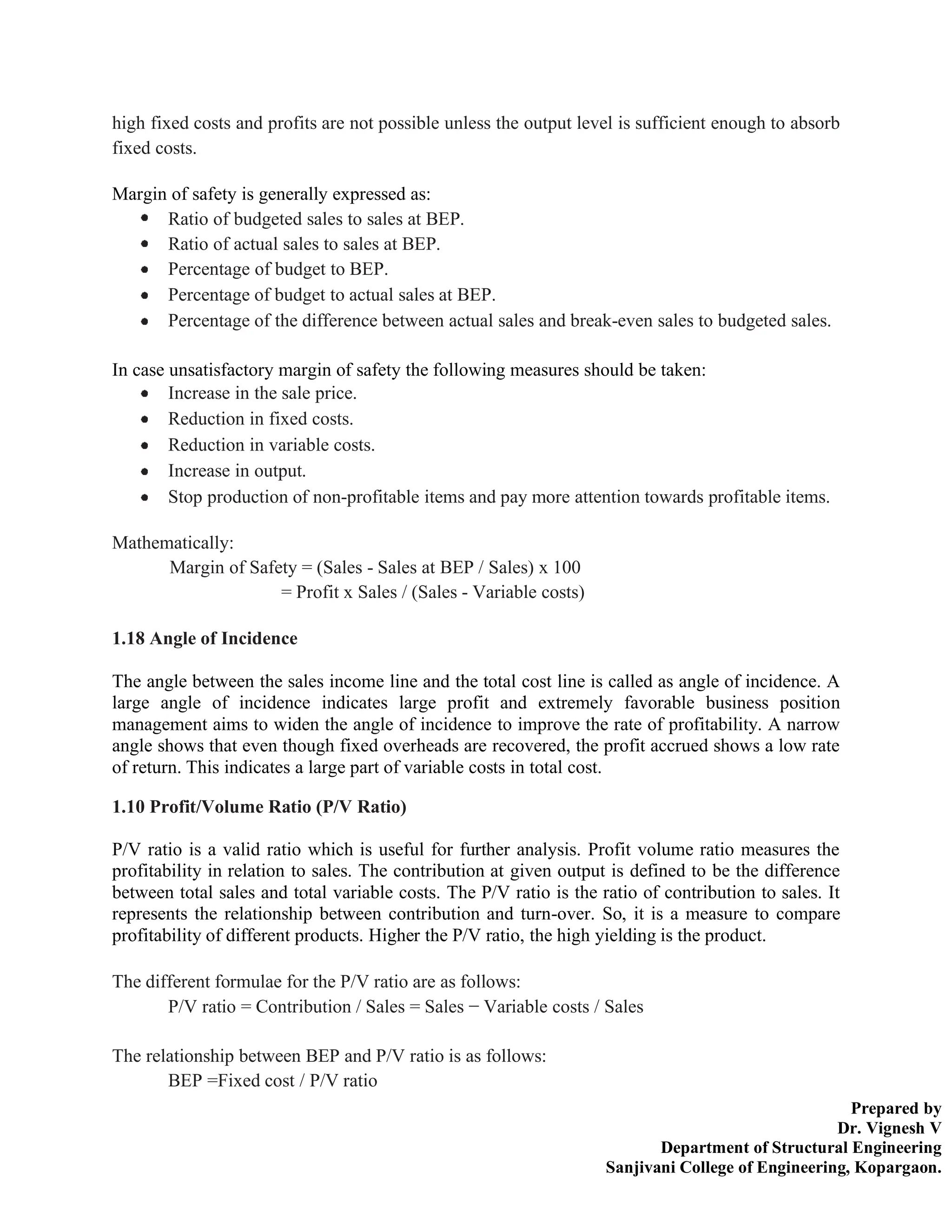

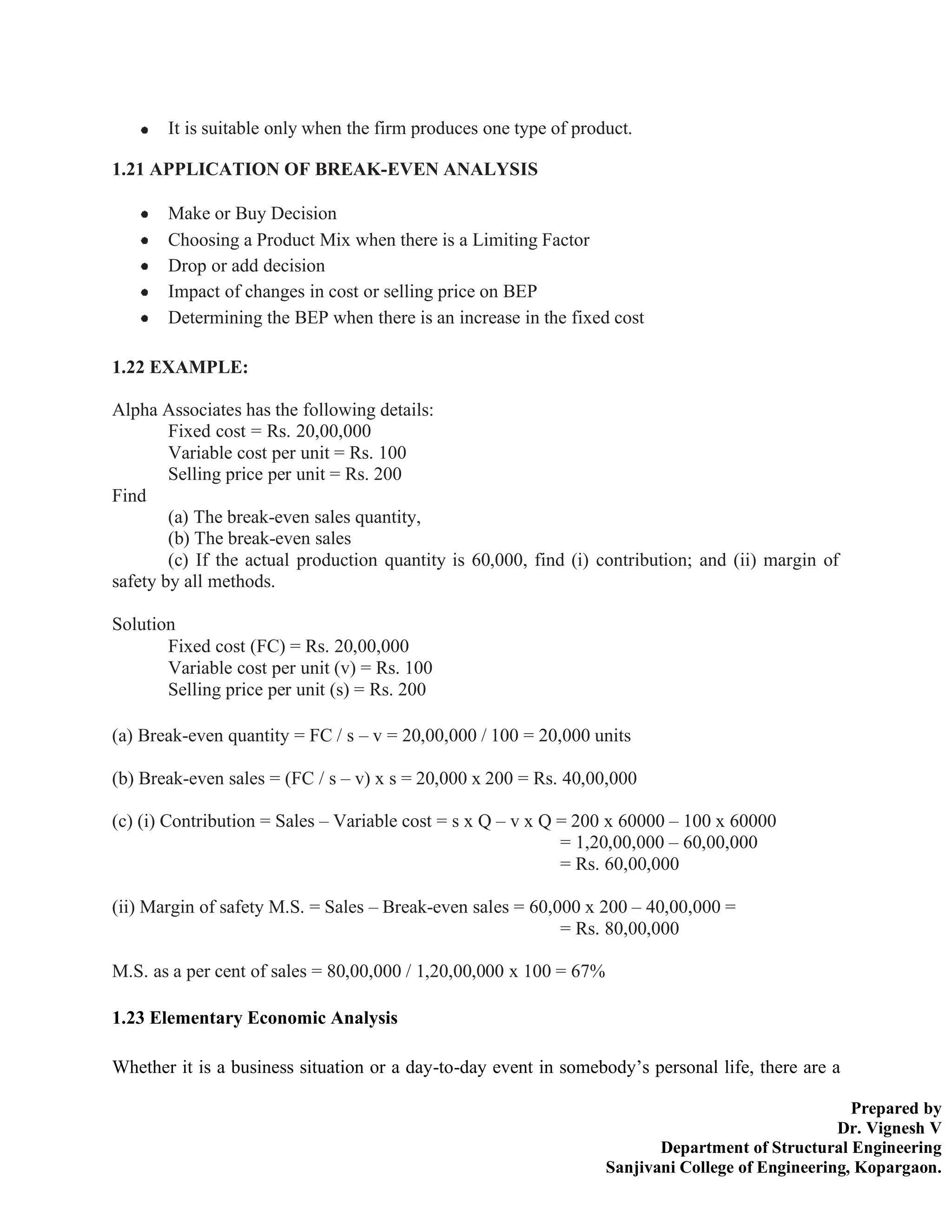

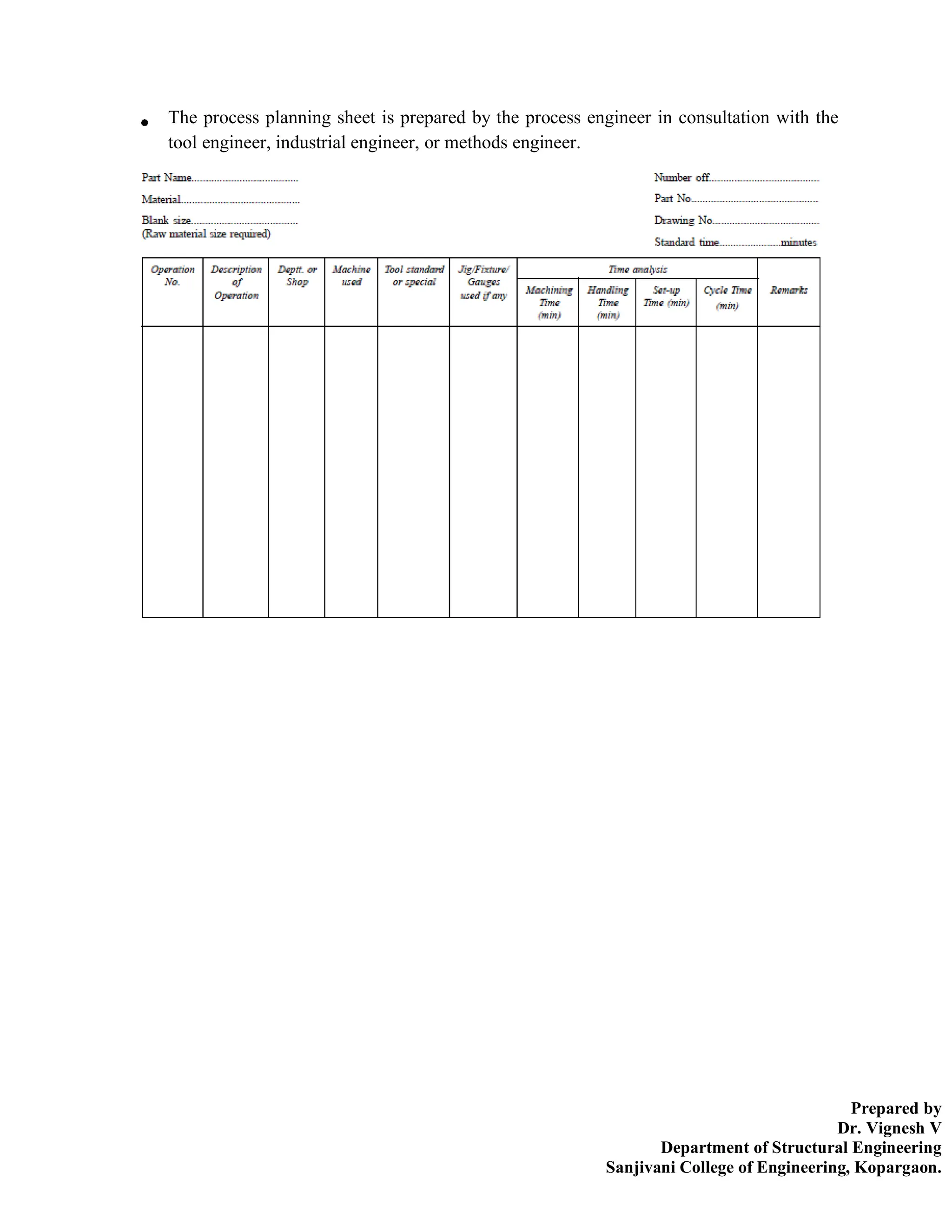

The document provides an overview of engineering economics and its relevance to business organizations, detailing the flow of an economy, laws of supply and demand, and the concept of economic efficiency. It discusses various economic components such as costs, break-even analysis, and decision-making methods aimed at minimizing costs and maximizing benefits. Key elements surrounding production costs, including direct and indirect costs, are examined to illustrate their impact on pricing and overall economic efficiency.