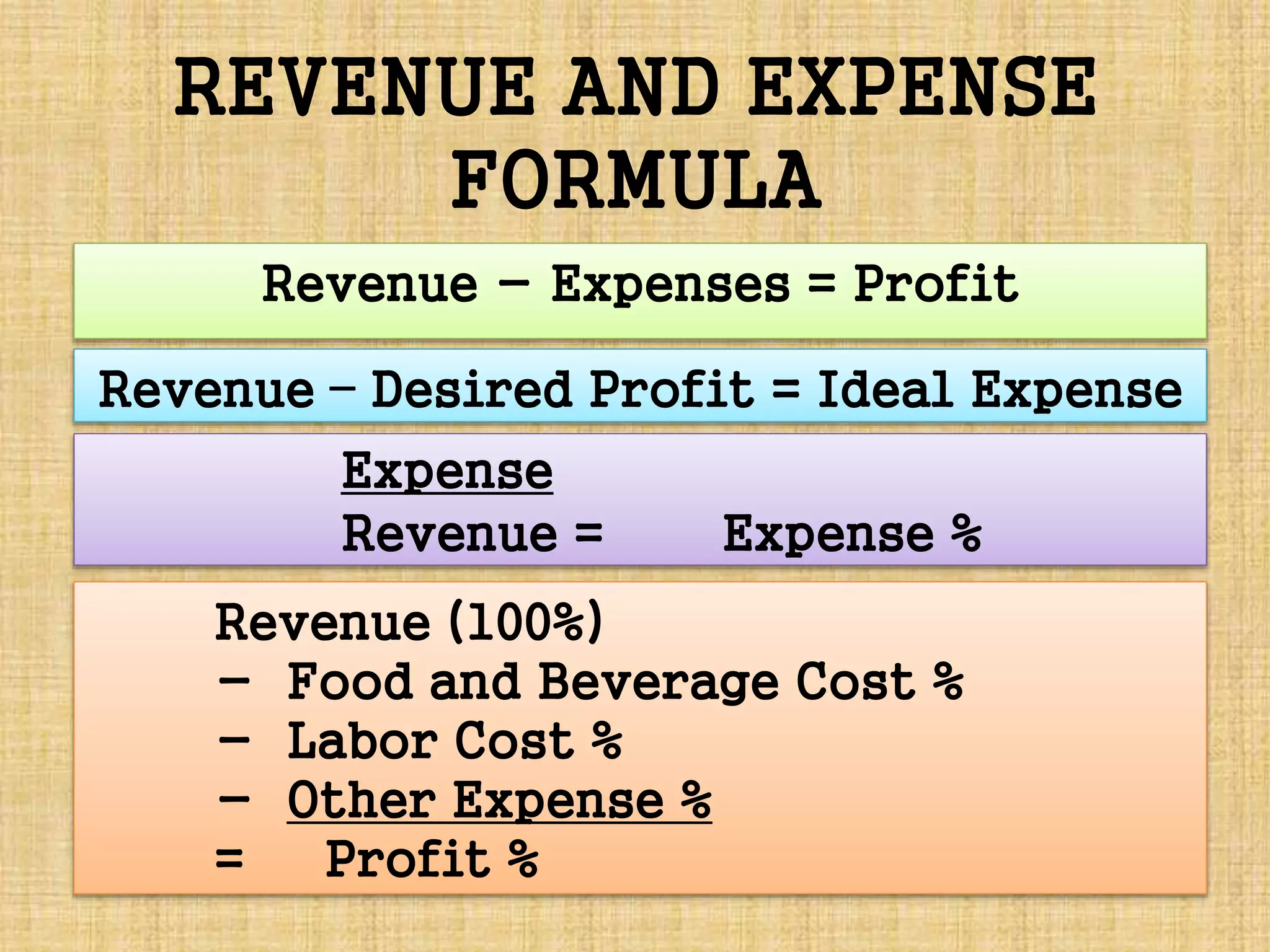

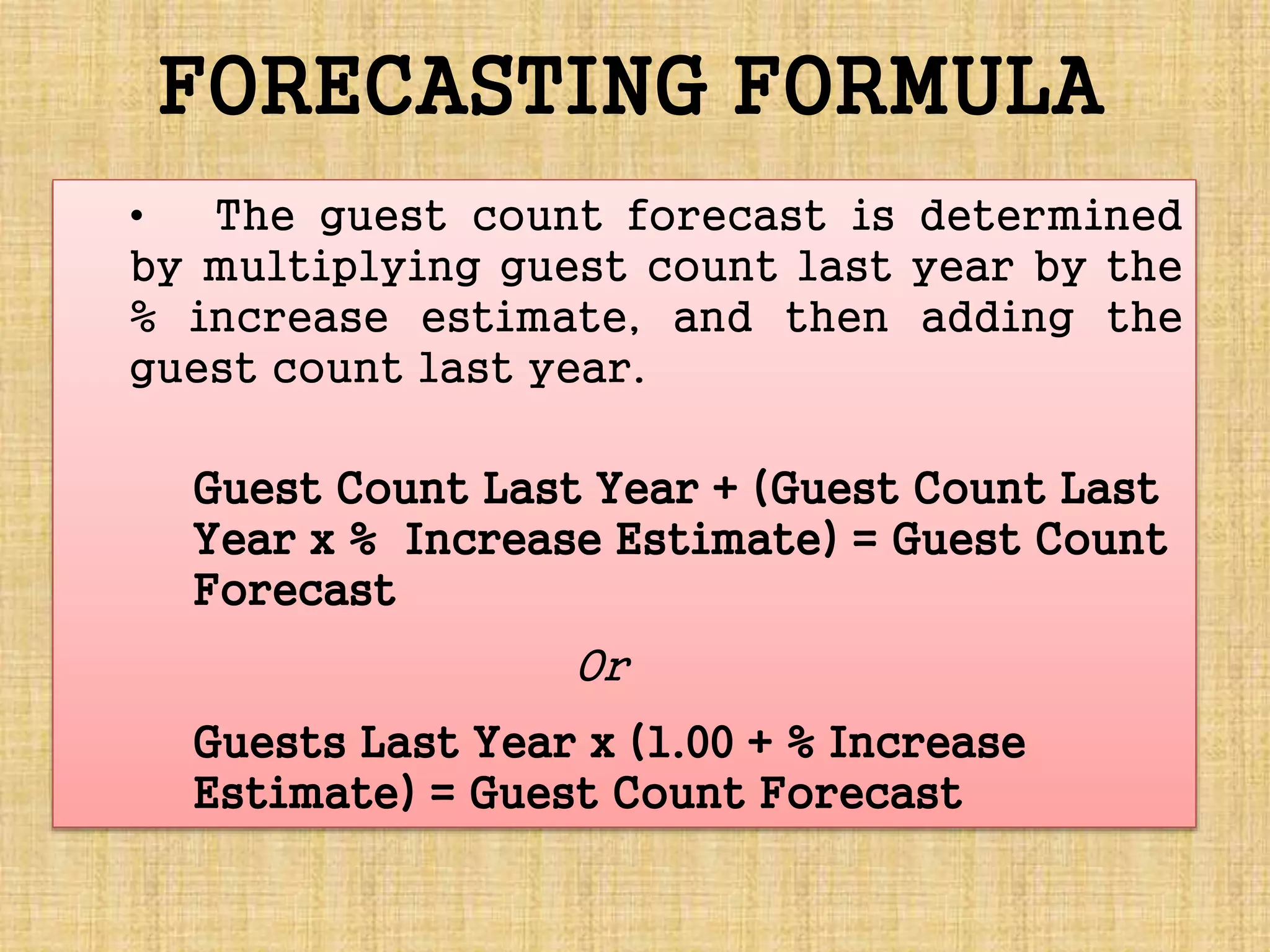

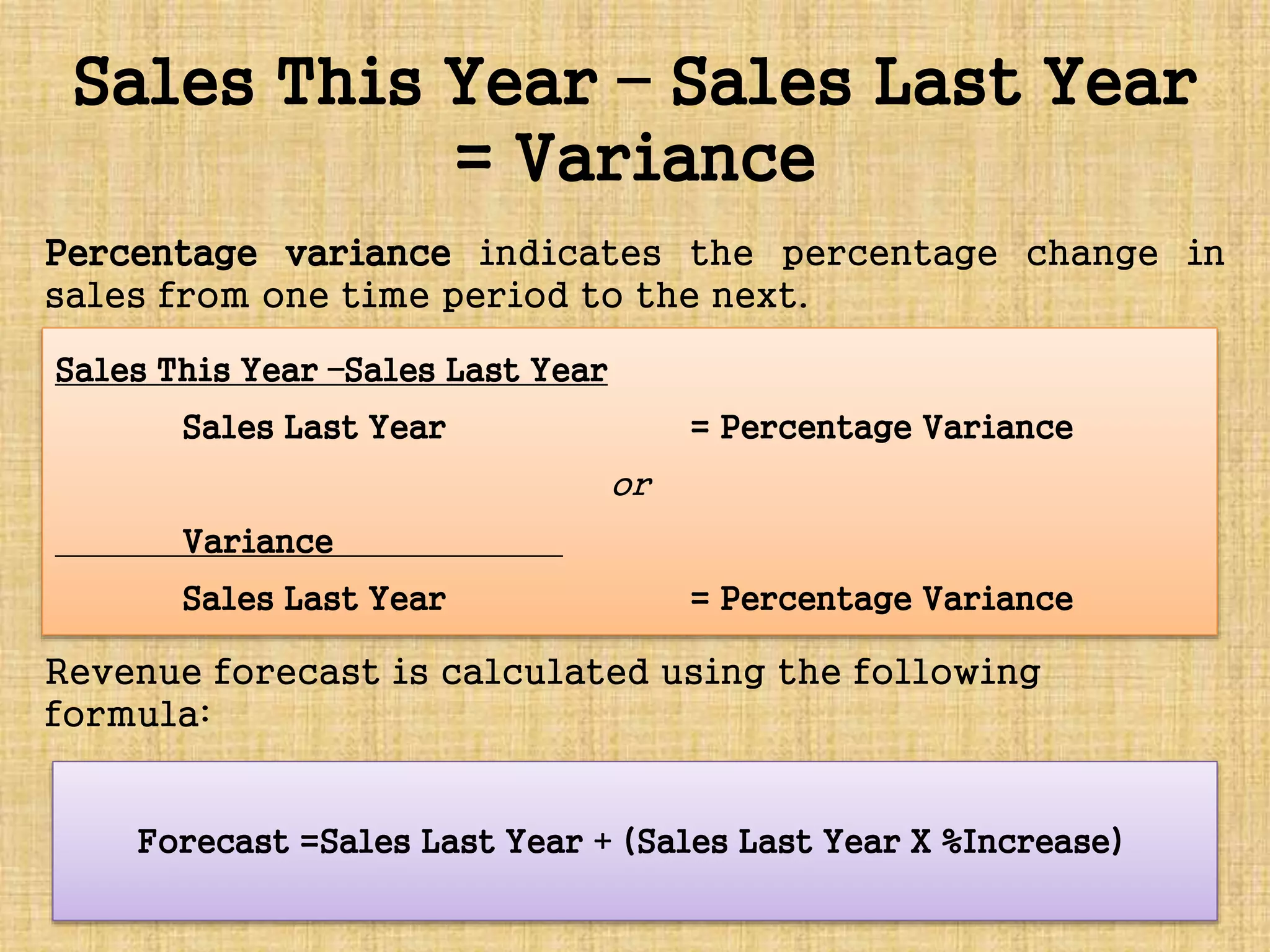

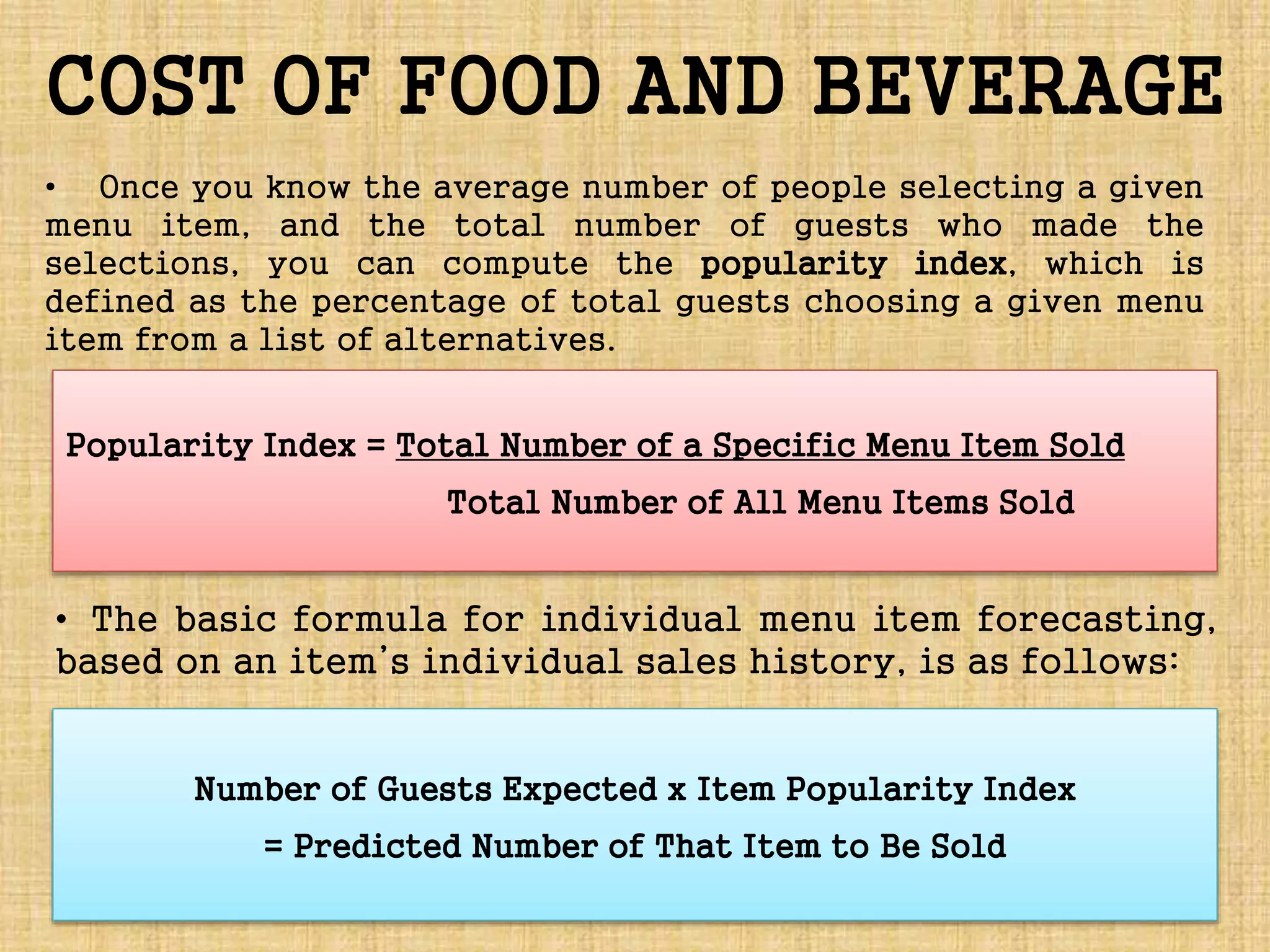

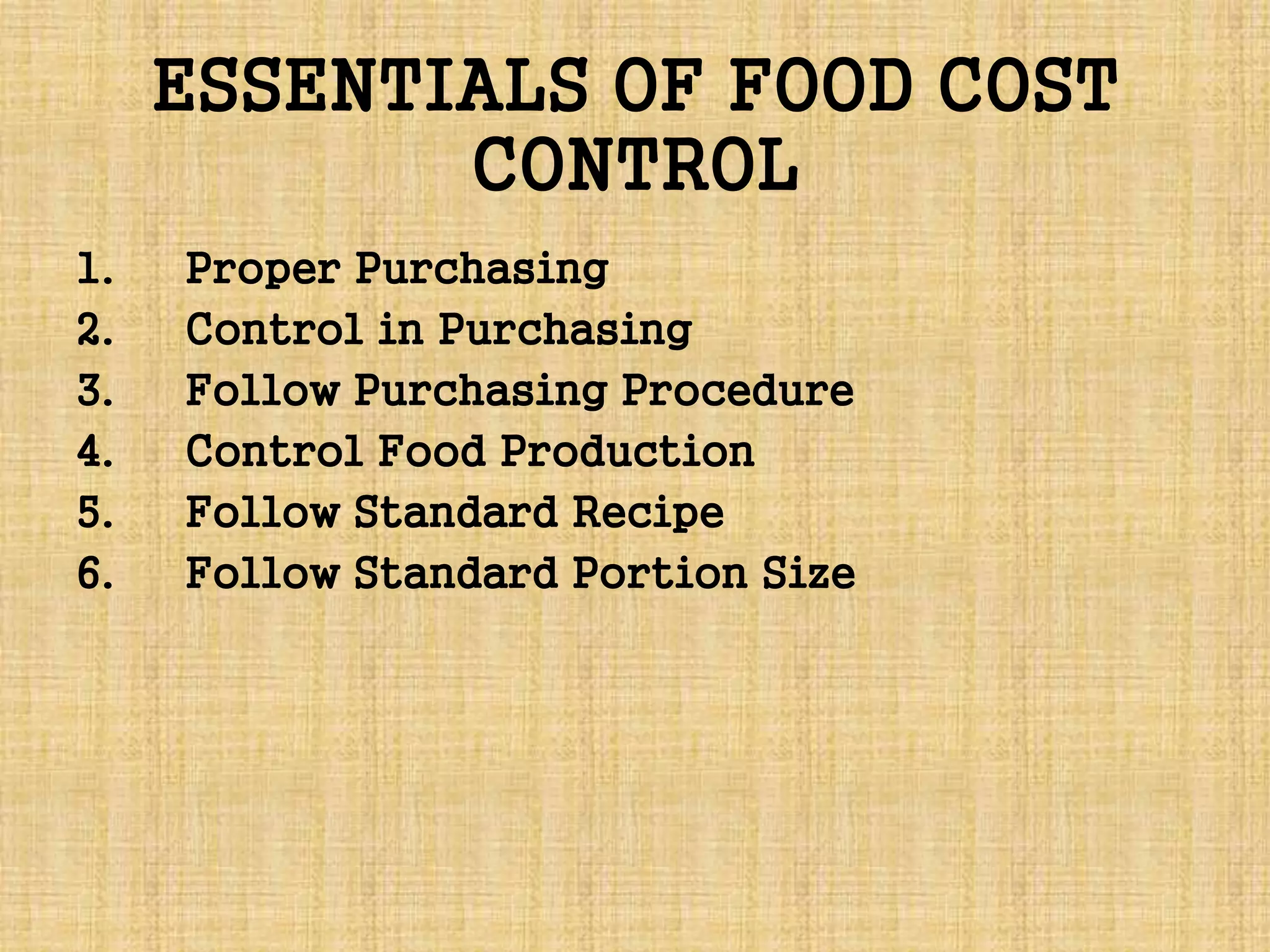

This document outlines key concepts around food and beverage cost control for hospitality managers. It discusses the manager's main roles of communication, cost/expense control, revenue enhancement, and forecasting. It then covers introducing cost control, including defining costs, types of costs, and control techniques. Specific techniques covered include establishing standards, procedures, training, budgets, and ensuring proper purchasing, production, recipes and portion sizes to control food costs. The overall goal of cost control is to help ensure profitability through regulating expenses.