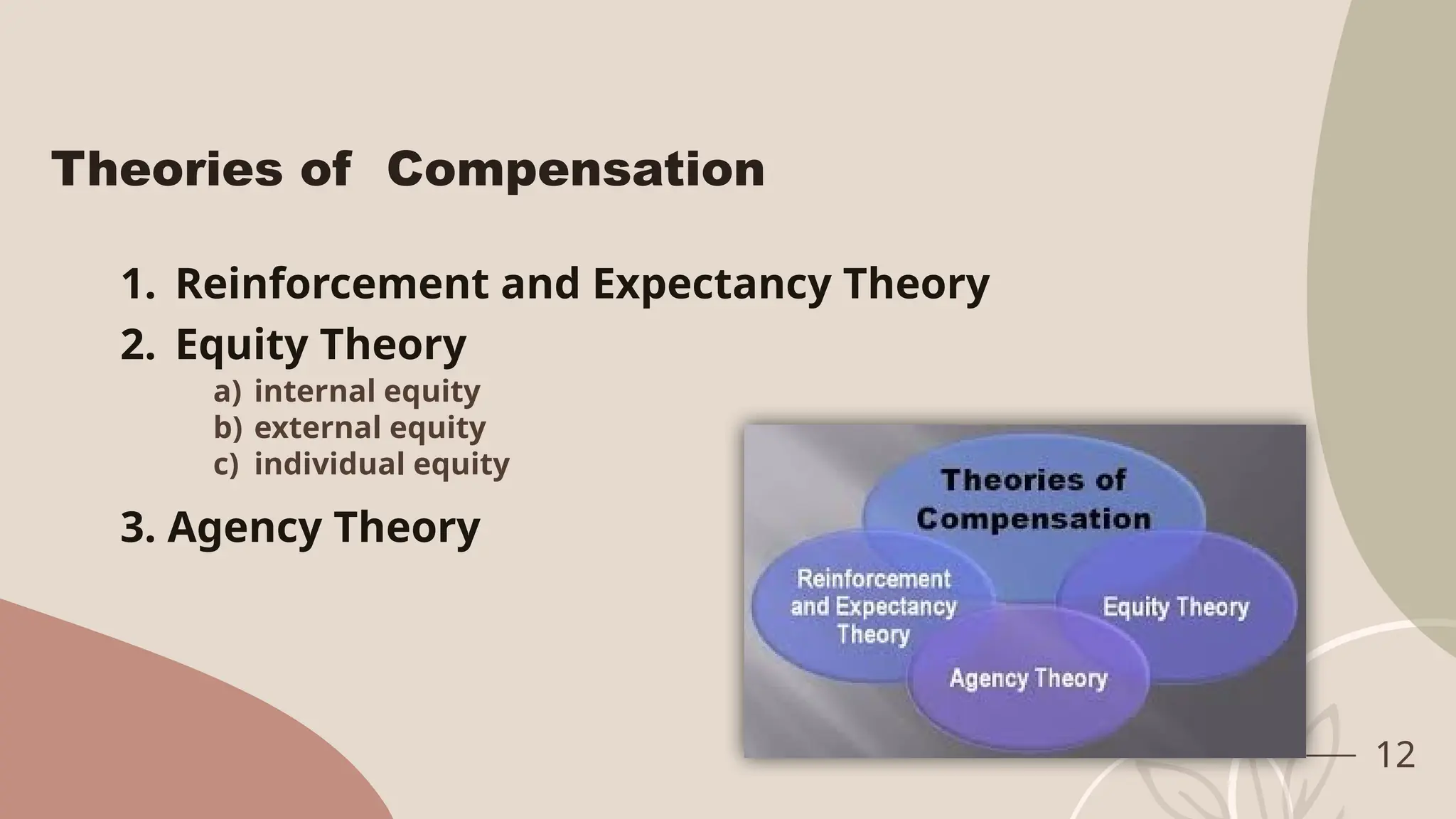

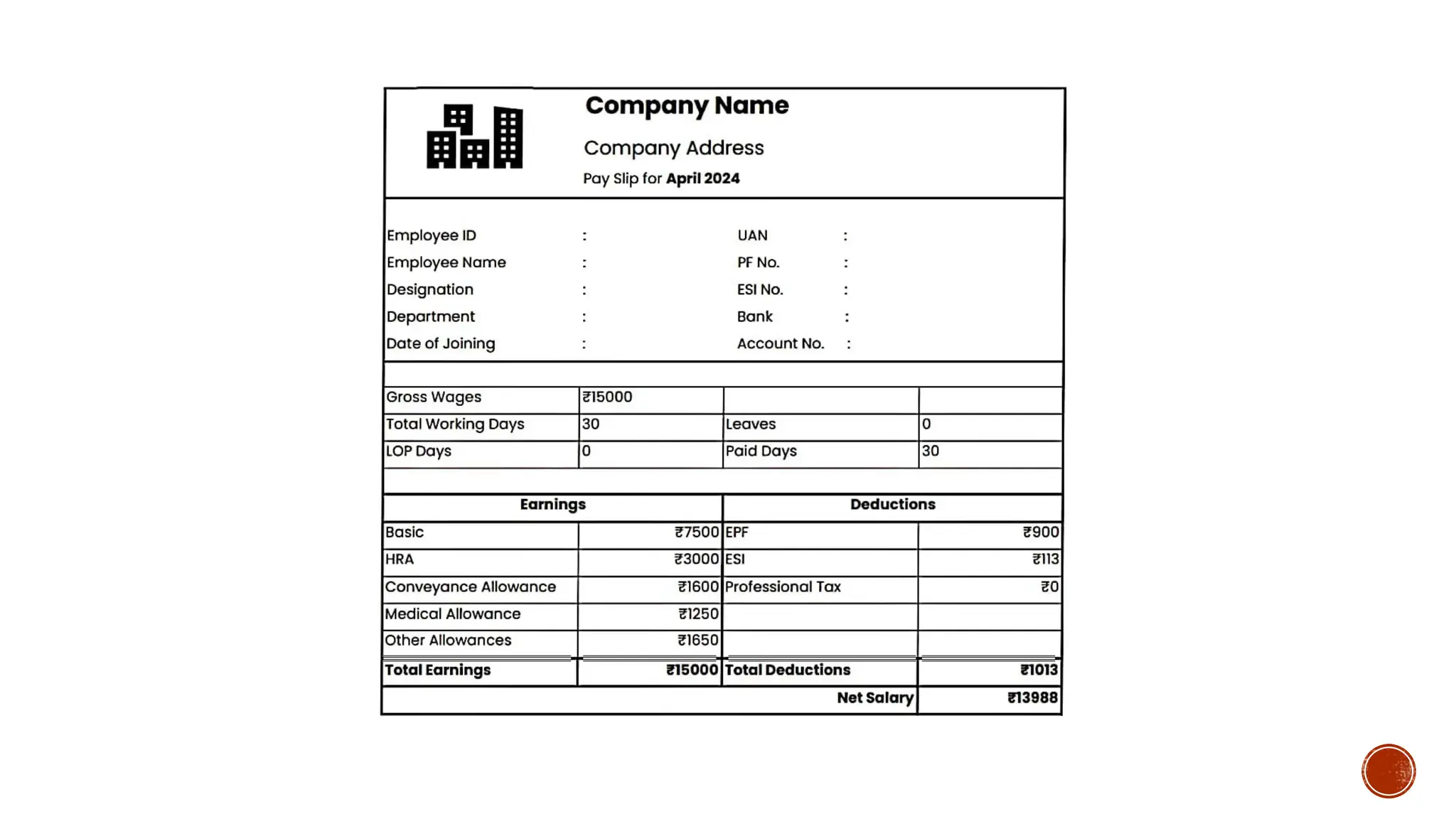

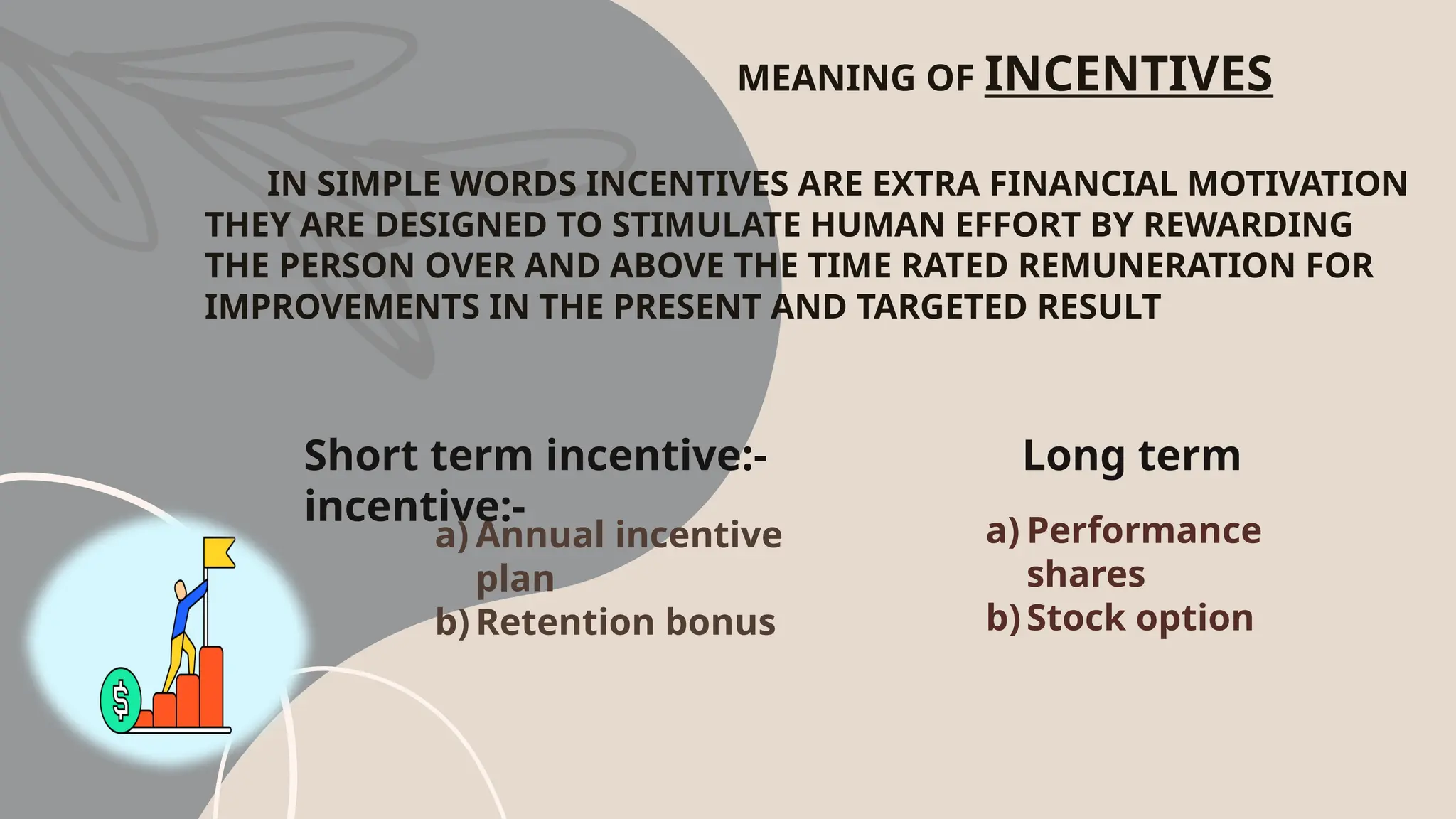

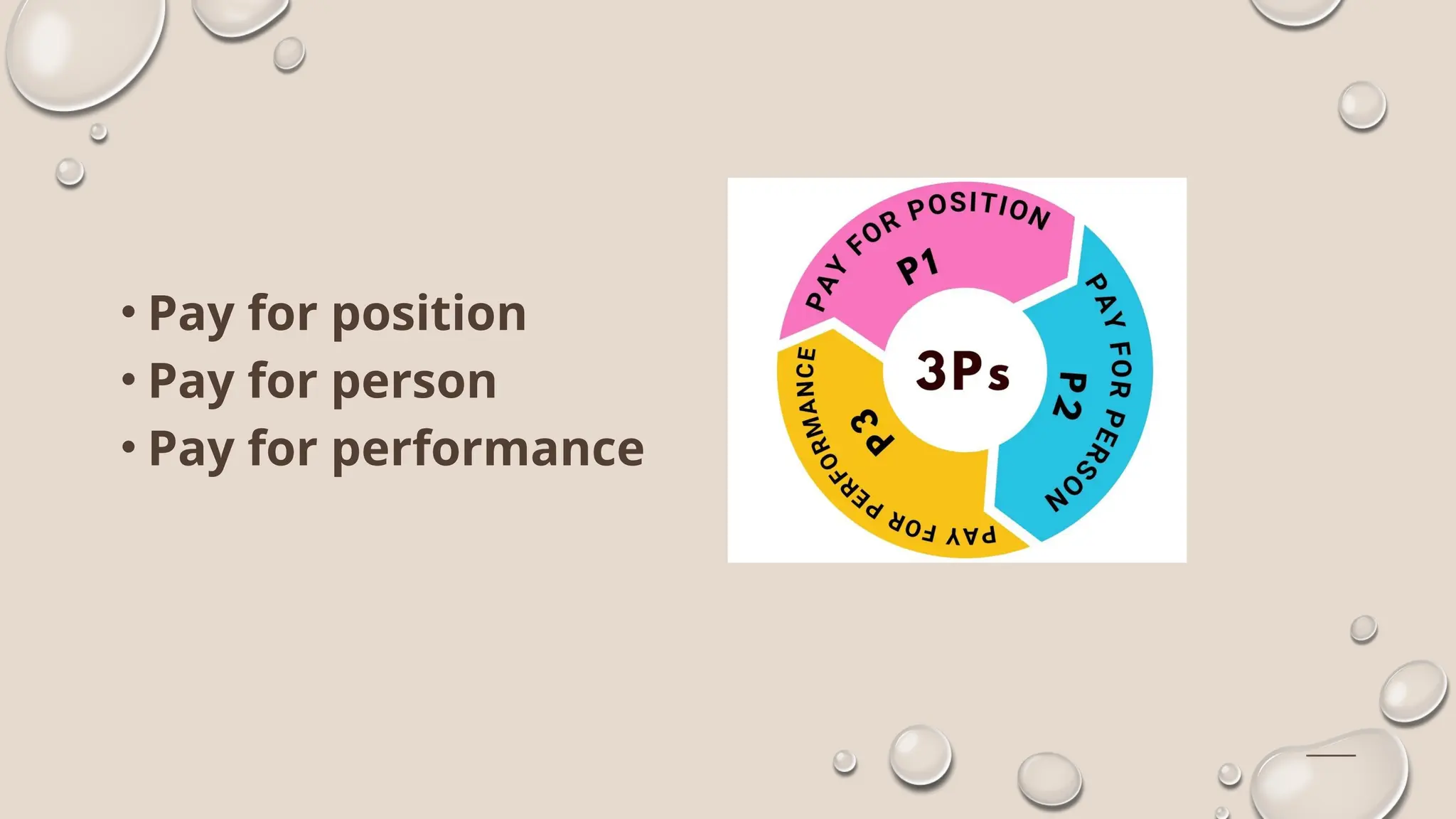

The document provides an overview of compensation management, detailing various forms of compensation such as salary, bonuses, allowances, and non-monetary rewards. It emphasizes the objectives of compensation for both employees and employers, as well as the principles guiding effective compensation strategies. Additionally, it covers compensation structures, the importance of social security, retirement planning, and the role of compensation in attracting and retaining talent within organizations.