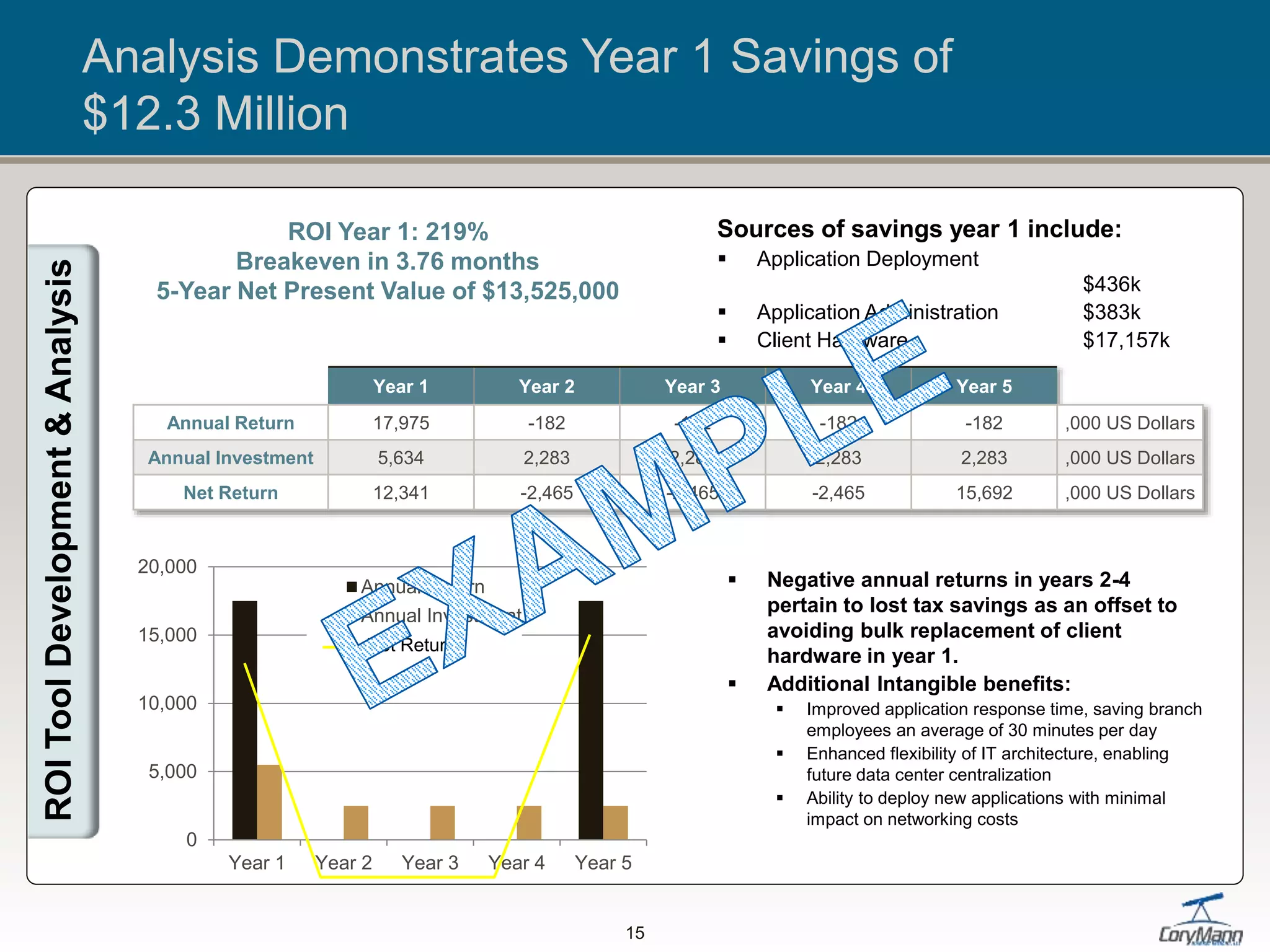

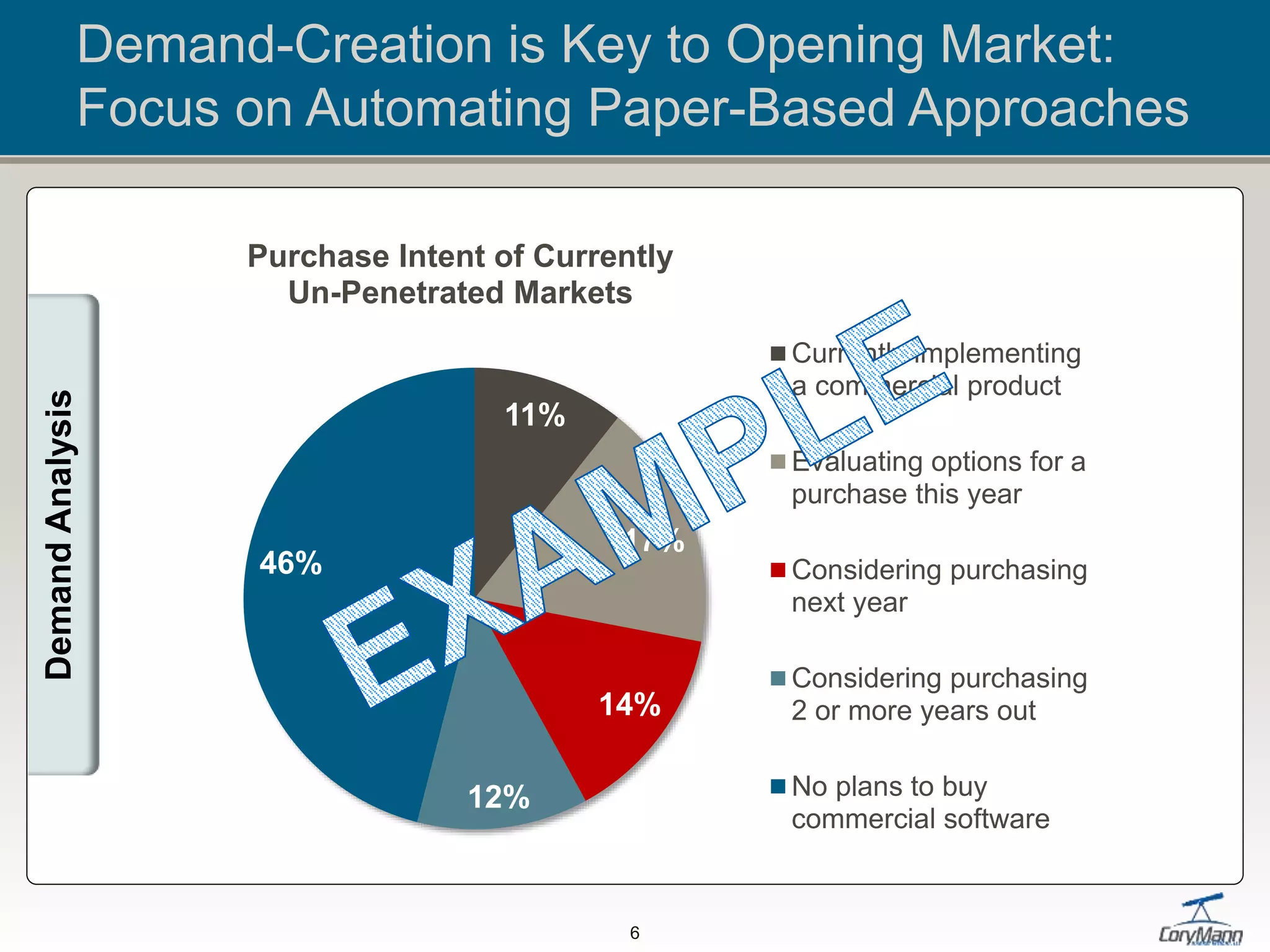

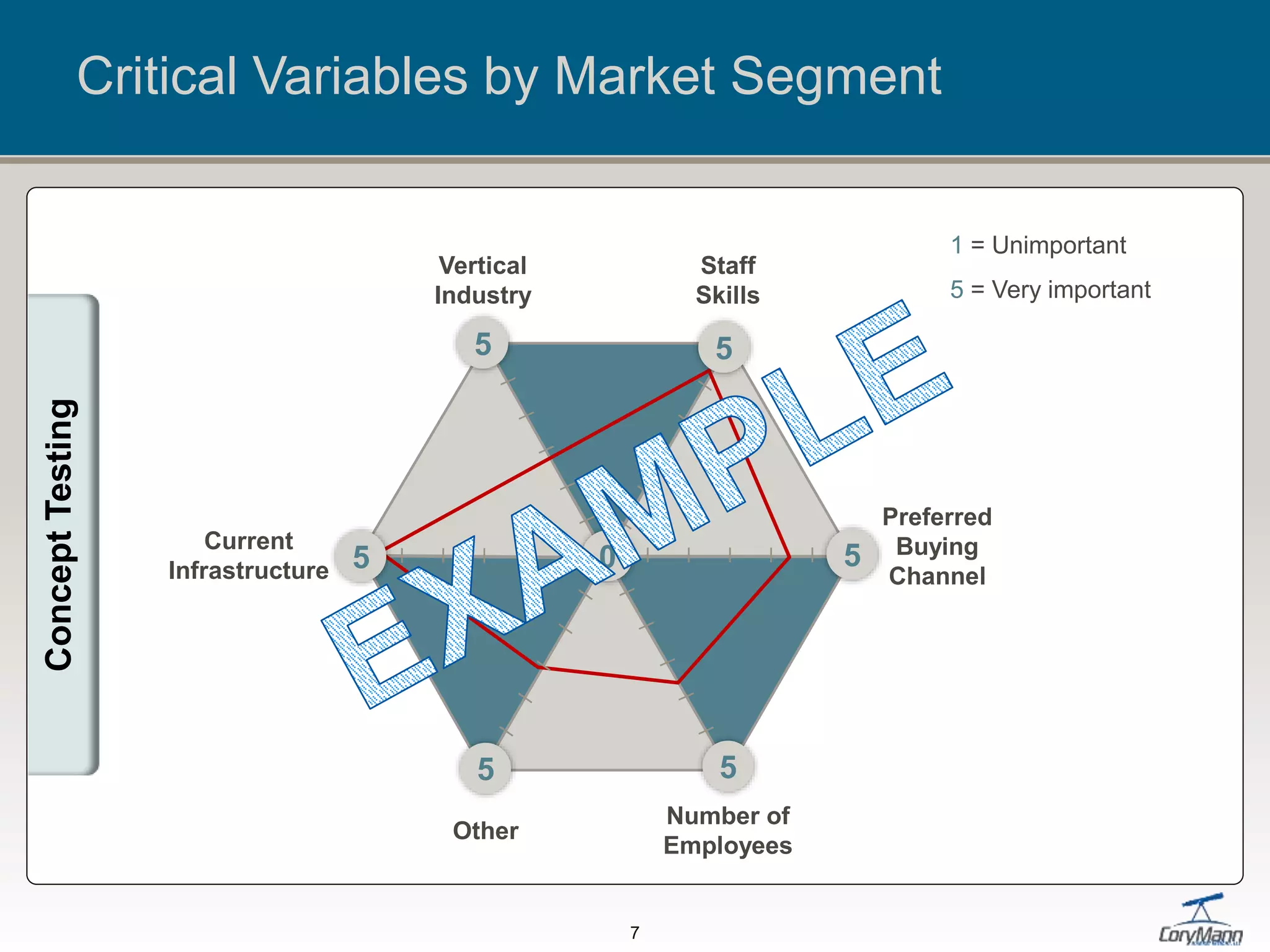

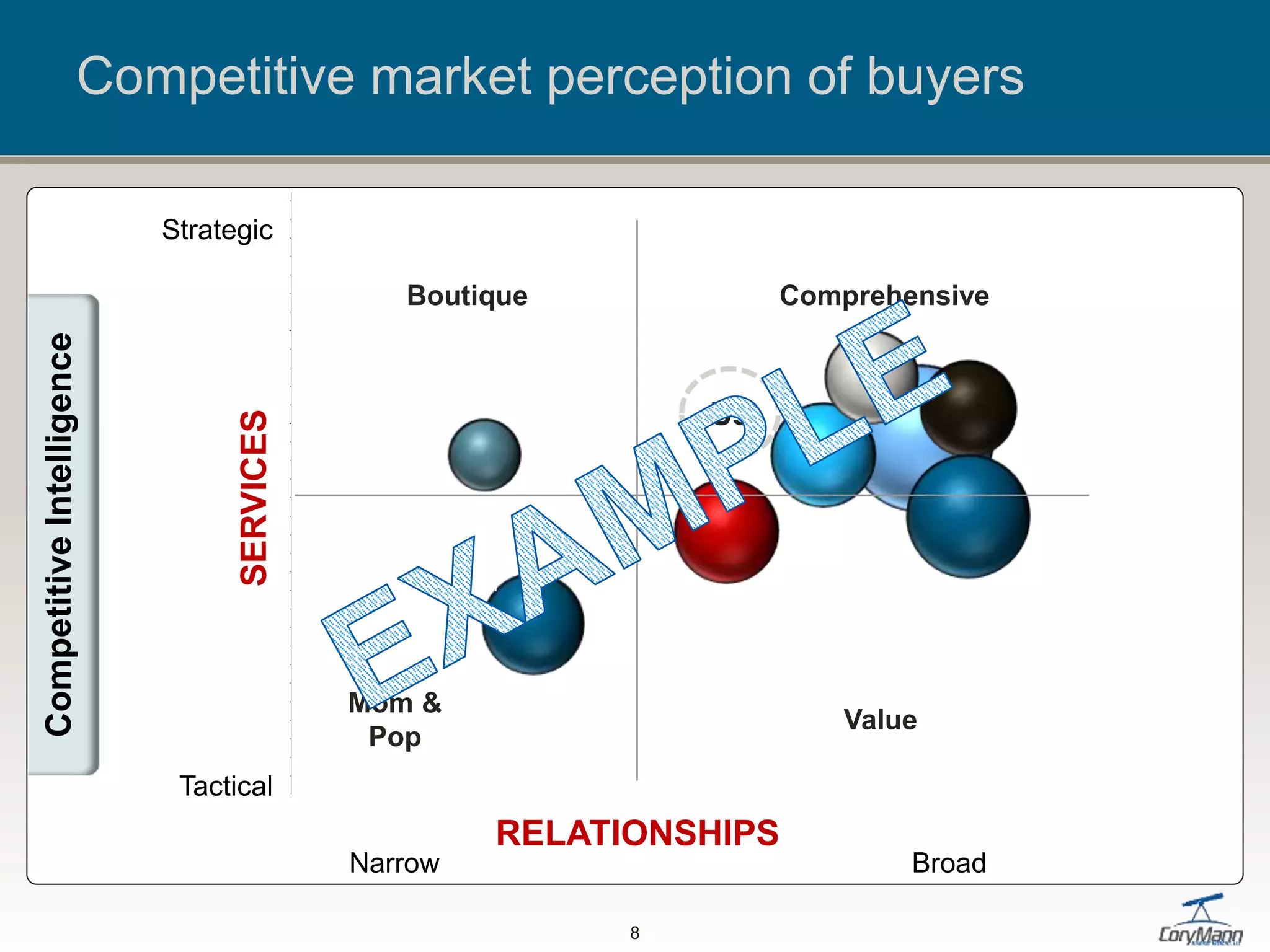

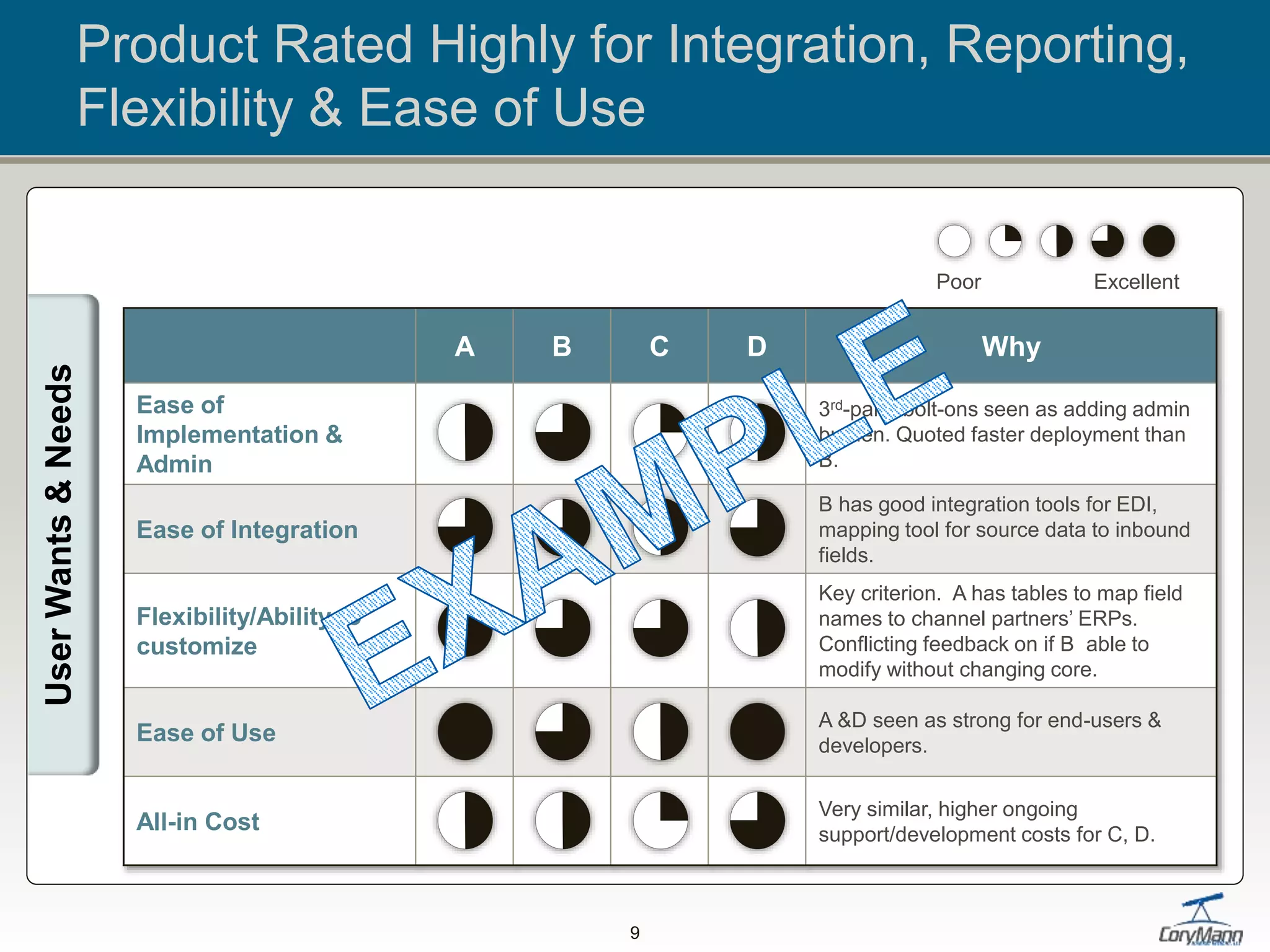

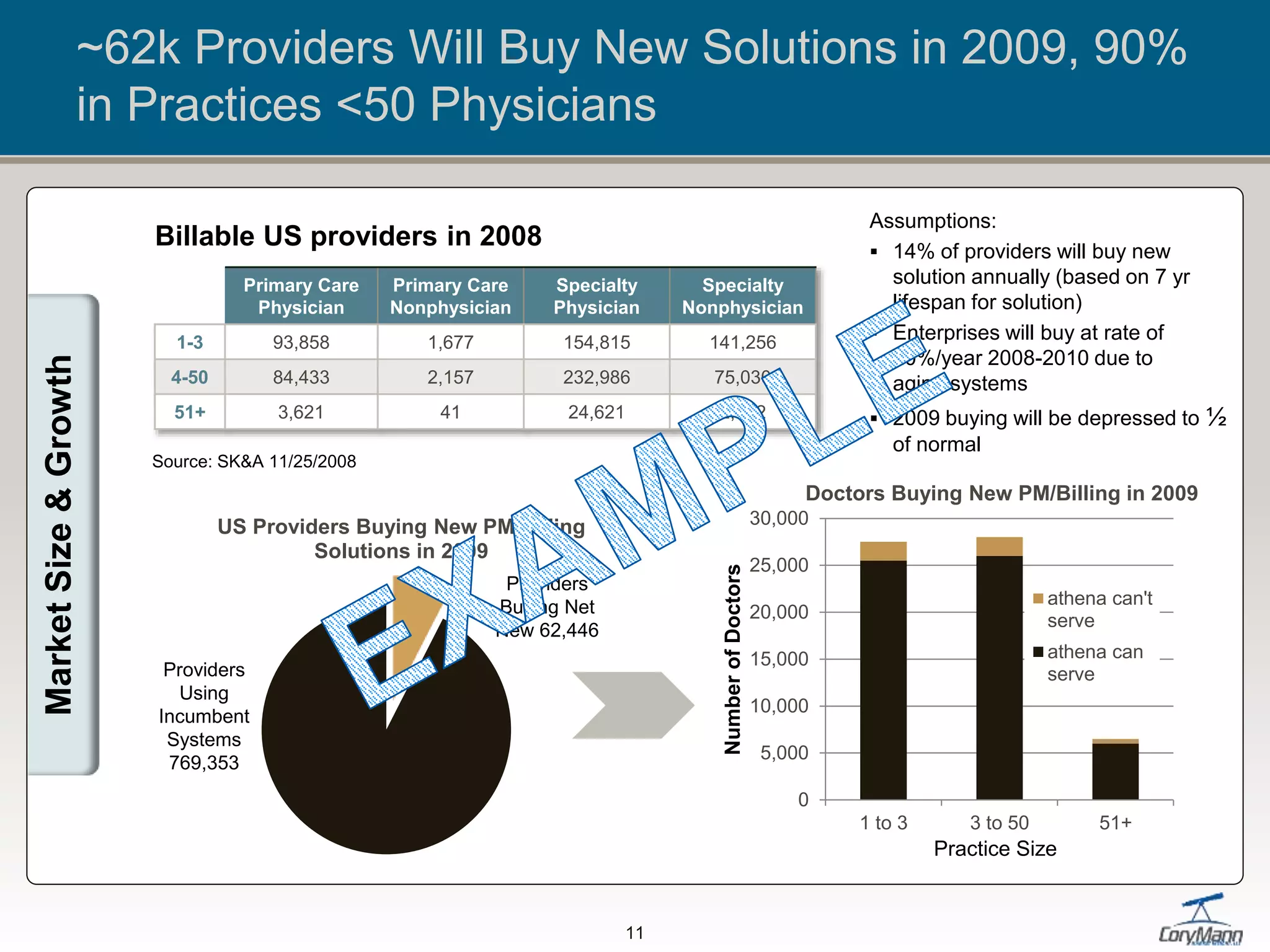

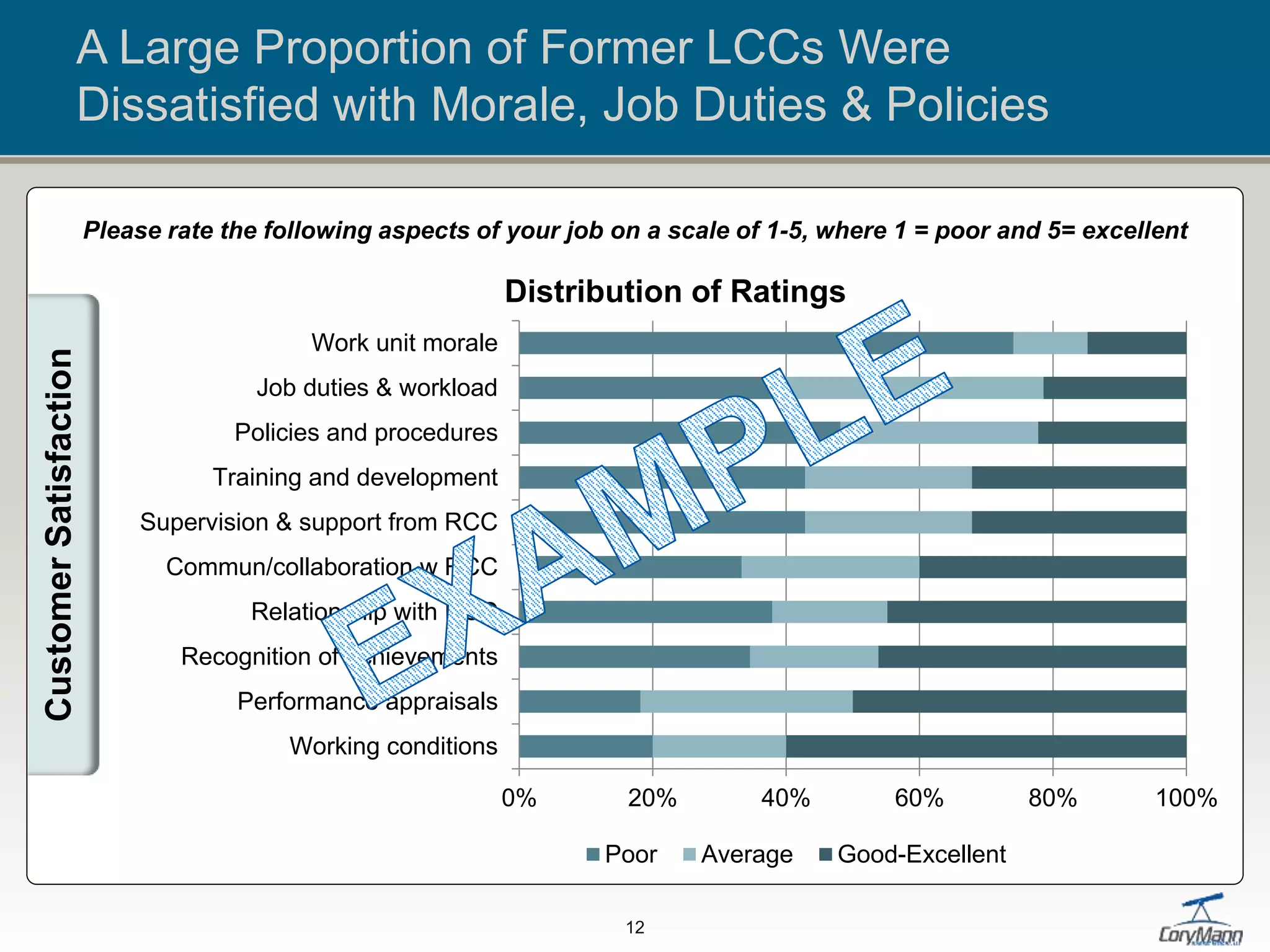

The document discusses insights gained from market research and client interactions that highlight the importance of usability and onboarding in reducing churn, alongside positioning video-based services effectively. It outlines strategies for demand creation, concept testing, and competitive intelligence, along with the identification of distinct market segments. Additionally, it includes details about various services offered, client feedback on existing products, and an analysis of investment returns, including significant cost savings from enhanced application deployment and administration.

![“Marketo is very good about monitoring the community.

Employees often step in to help.”

— Drew, Marketo Customer, <50 FTE

“Has a large online community and makes sure you are

involved in a local user group.”

— Cathy, Marketo Partner, <50 FTE, service provider

Attack (real customer complaints)

Inflexible Reporting

“When we tried to get the system to show

us the create date…Marketo couldn't do

it. In salesforce.com, I would simply run a

report with Create Date, Lead Source =

Website, and Lead Source

Name... Marketo was unable to break

down the data along those dimensions.”

(Marketo Customer, Blog Post 12/11)

Poor Analytics

“Marketo is designed for looking at the

behavior of individual leads…not for

analyzing the behavior of groups of leads.”

(Marketo Customer, Blog Post 3/12)

Difficult to Work With

Consistent complaints about pushy sales

reps, uncooperative support, too much

effort needed to get information. (Marketo

Customer, Blog Post, 3/12, among others)

Defend (real sales reps’ attacks)

“Marketo is purely market automation, this is

not what Client does well.” (Chip, Marketo

Sales Rep)

We combine lead gen with nurturing and

automation for a more complete solution

than Marketo (which is solely focused on

automation).

Client doesn’t do nurturing, scoring, tracking

well” (Chip, Marketo Sales Rep)

Our segment/list approach to nurturing and

scoring is based on behavior, actions, and

data collected through forms, CRM, etc. It’s

more flexible and robust than Marketo.

Marketo’s difference: pace of innovation –

every year 1 major release. Each one is looked

at as a competitive advantage. [Ex: Crowd

Factory, first to move to B2C social media]

(Chip, Marketo Sales Rep)

We are continually shipping new features.

Just check out our blog.

Marquis

Customers

“Really easy. All object oriented.”

— Mari, Marketo Partner, <50 FTE, consultant

Product

Screenshot

Marketo Dashboard Funnel

Top Features

Positioned by their

reps during sales calls

1. Convenient Pre-built

campaigns

2. Complete third-party

Integration

3. Intricate marketing

system

4. Elaborate lead

scoring system

5. “IT Free”

“Marketo drives [leads] through [the] sales function. HubSpot

drives [leads] to [the] company.”

— Matt, Marketo Employee

Battle Marketo with Flexibility & Complete Solution

from Top of Funnel

Prepared in collaboration with Explorics. www.explorics.com

13

Attack&Defend](https://image.slidesharecdn.com/introtocorymannmarketinsight20182-181022203351/75/Intro-to-Cory-Mann-s-User-Customer-Market-Insight-Practice-13-2048.jpg)

![Jeff

VP EE

Benefits

Pamela

Parks &

Resorts

Tom

Operations

Barbara

Strategy

Deloitte

Jeff Was Final Decision-Maker; Barbara Highly

Influential, Then Tom

Decision influencers included:

Deloitte: Input in the beginning of process. Encouraged

Client to invite Client to bid

Tom : Facilitated RFP process. Ran previous program with

Payer/Client partnership. Now rolling out new

Payer program.

Barbara: Strategy, long term focused. Open to best-in-class

solution. Her team developed RFP.

Pamela: Medical Director, Client Resorts, represented 80%

of employee population

14

“My team designed the RFP, but

Tom facilitated the project to get

a new vendor. This would

normally be my role…Due to

lack of bandwidth, Tom took on

the role running the integrated

medical management stream.”

– Barbara

“is consensus-

driven…He [Jeff]

influenced the final

decision. He is

oriented towards

bundling of vendors.

Some of us felt best-

in-class was the way

to go.”

– Barbara

Win/Loss](https://image.slidesharecdn.com/introtocorymannmarketinsight20182-181022203351/75/Intro-to-Cory-Mann-s-User-Customer-Market-Insight-Practice-14-2048.jpg)