This document provides information about a project report submitted for an MBA program. It includes a title page, declaration, preface, acknowledgements, executive summary, and the beginnings of chapters 1 and 2 on the company profile. The project focuses on understanding the role of finance management at Fortune Park Hotel, an ITC Ltd. property, and ERP implementation. It describes conducting the study at Fortune Park Hotel to understand the finance department's functions and activities. The company profile section gives an overview of ITC Ltd. and its Fortune Hotels subsidiary, including their missions and the Indian hotel industry characteristics.

![33 | P a g e

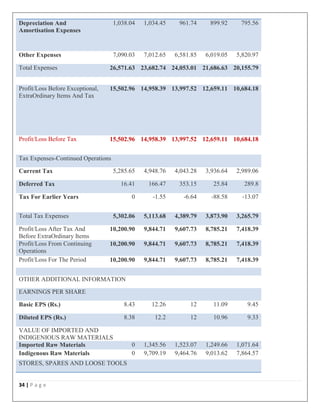

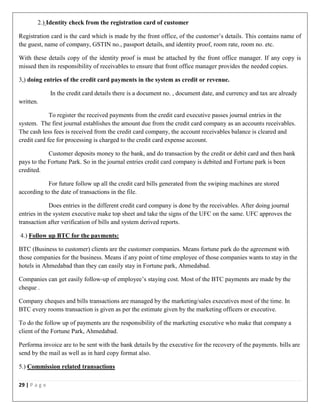

Profit & Loss account of ITC

------------------- in Rs. Cr. -------------------

Mar 17 16-Mar 15-Mar 14-Mar 13-Mar

12 mths 12 mths 12 mths 12 mths 12 mths

INCOME

Revenue From Operations

[Gross]

55,001.69 51,582.45 49,964.82 46,712.62 41,809.82

Less: Excise/Sevice Tax/Other

Levies

15,359.78 15,107.18 13,881.61 13,830.06 12,204.24

Revenue From Operations [Net] 39,641.91 36,475.27 36,083.21 32,882.56 29,605.58

Other Operating Revenues 446.77 362.12 424.19 356.04 295.69

Total Operating Revenues 40,088.68 36,837.39 36,507.40 33,238.60 29,901.27

Other Income 1,985.91 1,803.74 1,543.13 1,107.14 938.7

Total Revenue 42,074.59 38,641.13 38,050.53 34,345.74 30,839.97

EXPENSES

Cost Of Materials Consumed 11,765.56 11,054.75 10,987.83 10,263.28 8,936.21

Purchase Of Stock-In Trade 3,566.57 2,590.08 3,898.66 3,021.47 3,375.92

Changes In Inventories Of

FG,WIP And Stock-In Trade

644.17 58.17 -214.53 -128.41 -246.35

Employee Benefit Expenses 2,444.31 1,883.51 1,780.04 1,608.37 1,387.01

Finance Costs 22.95 49.13 57.42 2.95 86.47](https://image.slidesharecdn.com/internshipitchotel-170917111429/85/Internship-itc-hotel-33-320.jpg)