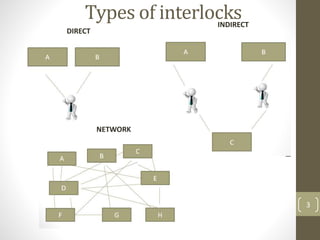

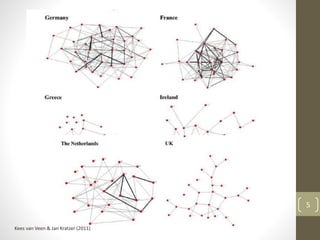

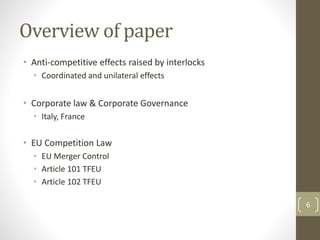

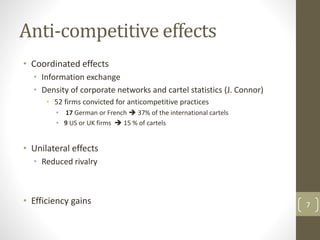

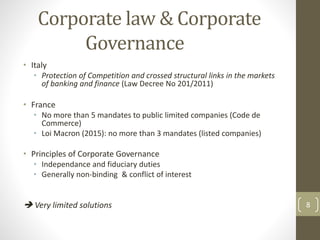

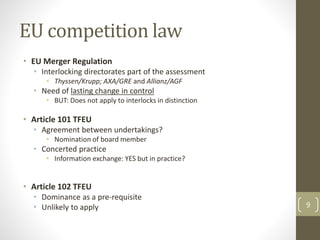

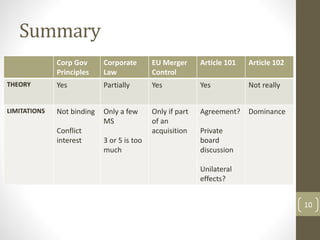

The document discusses the implications of interlocking directorates in Europe and their anti-competitive risks within corporate governance and law. It compares practices in the EU to those in the US, highlighting gaps in enforcement and the need for stricter regulations to address these competition issues. Key aspects include the limited effectiveness of current corporate governance principles and the impact of interlocks on competition and corporate networks.