Report

Share

Download to read offline

Recommended

This presentation by Scott Hammond, Partner, Gibson Dunn, was made during the discussion “Challenges and co-ordination of leniency programmes” held at the 127th meeting of the OECD Working Party No. 3 on Co-operation and Enforcement on 5 June 2018. More papers and presentations on the topic can be found out at oe.cd/2gt.Challenges and co-ordination of leniency programmes – HAMMOND – June 2018 OEC...

Challenges and co-ordination of leniency programmes – HAMMOND – June 2018 OEC...OECD Directorate for Financial and Enterprise Affairs

This presentation by Prof. Hwang LEE from the Korean University School of Law was made during the discussion on "Sanctions in Anti-trust cases" held at the 15th Global Forum on Competition on 2 December 2016. More papers and presentations on the topic can be found out at www.oecd.org/competition/globalforum/competition-and-sanctions-in-antitrust-cases.htmSanctions in Anti-trust cases – Prof. Hwang LEE – Korean University School of...

Sanctions in Anti-trust cases – Prof. Hwang LEE – Korean University School of...OECD Directorate for Financial and Enterprise Affairs

This presentation by the OECD Competition Division was made during the discussion on "Sanctions in Anti-trust cases" held at the 15th Global Forum on Competition on 2 December 2016. More papers and presentations on the topic can be found out at www.oecd.org/competition/globalforum/competition-and-sanctions-in-antitrust-cases.htmSanctions in Anti-trust cases – OECD Background paper – November 2016 OECD di...

Sanctions in Anti-trust cases – OECD Background paper – November 2016 OECD di...OECD Directorate for Financial and Enterprise Affairs

Recommended

This presentation by Scott Hammond, Partner, Gibson Dunn, was made during the discussion “Challenges and co-ordination of leniency programmes” held at the 127th meeting of the OECD Working Party No. 3 on Co-operation and Enforcement on 5 June 2018. More papers and presentations on the topic can be found out at oe.cd/2gt.Challenges and co-ordination of leniency programmes – HAMMOND – June 2018 OEC...

Challenges and co-ordination of leniency programmes – HAMMOND – June 2018 OEC...OECD Directorate for Financial and Enterprise Affairs

This presentation by Prof. Hwang LEE from the Korean University School of Law was made during the discussion on "Sanctions in Anti-trust cases" held at the 15th Global Forum on Competition on 2 December 2016. More papers and presentations on the topic can be found out at www.oecd.org/competition/globalforum/competition-and-sanctions-in-antitrust-cases.htmSanctions in Anti-trust cases – Prof. Hwang LEE – Korean University School of...

Sanctions in Anti-trust cases – Prof. Hwang LEE – Korean University School of...OECD Directorate for Financial and Enterprise Affairs

This presentation by the OECD Competition Division was made during the discussion on "Sanctions in Anti-trust cases" held at the 15th Global Forum on Competition on 2 December 2016. More papers and presentations on the topic can be found out at www.oecd.org/competition/globalforum/competition-and-sanctions-in-antitrust-cases.htmSanctions in Anti-trust cases – OECD Background paper – November 2016 OECD di...

Sanctions in Anti-trust cases – OECD Background paper – November 2016 OECD di...OECD Directorate for Financial and Enterprise Affairs

This note by Rosa M. Abrantes-Metz, Practice Co-Leader, Global Antitrust & Competition, Brattle, was prepared for the discussion “Competition and Payment Card Interchange Fees” held at the 19th meeting of the OECD-IDB Latin American and Caribbean Competition Forum on 22 September 2021. More papers and presentations on the topic can be found out at oe.cd/laccf.Competition and Payment Card Interchange Fees– Rosa Abrantes-Metz – OECD-IDB ...

Competition and Payment Card Interchange Fees– Rosa Abrantes-Metz – OECD-IDB ...OECD Directorate for Financial and Enterprise Affairs

This presentation by Mark Simpson, Partner, Norton Rose Fulbright, was made during the discussion “Blockchain and Competition” held at the 129th meeting of the OECD Competition Committee on 8 June 2018. More papers and presentations on the topic can be found out at oe.cd/2gx.Blockchain and Competition – SIMPSON – June 2018 OECD discussion

Blockchain and Competition – SIMPSON – June 2018 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Jocelyn Martel, Professor ESSEC, was made during the discussion “Barriers to exit” held at the 132nd meeting of the OECD Competition Committee on 4 December 2019. More papers and presentations on the topic can be found at oe.cd/bte.Barriers to Exit – MARTEL – December 2019 OECD discussion

Barriers to Exit – MARTEL – December 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Müge Adalet McGowan, Senior Economist, Economics Department, OECD, was made during the discussion “Barriers to exit” held at the 132nd meeting of the OECD Competition Committee on 4 December 2019. More papers and presentations on the topic can be found at oe.cd/bte.

Barriers to Exit – ADALET MCGOWAN – December 2019 OECD discussion

Barriers to Exit – ADALET MCGOWAN – December 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

Allowing trading of energy efficiency credits could have numerous benefits for a national energy efficiency resource standard (EERS) – most importantly, it could reduce the cost of compliance with the policy by increasing competition and facilitating the implementation of the lowest cost and highest value energy efficiency measures available.Deal or No Deal? Pros and Cons of Trading Under an Energy Efficiency Resource...

Deal or No Deal? Pros and Cons of Trading Under an Energy Efficiency Resource...Alliance To Save Energy

This presentation by Xavier VIVES, IESE School of Business, was made during the discussion “Digital disruption in financial markets” held at the 131st meeting of the OECD Competition Committee on 5 June 2019. More papers and presentations on the topic can be found out at oe.cd/ddfm.Digital disruption in financial markets – VIVES – June 2019 OECD discussion

Digital disruption in financial markets – VIVES – June 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

Presented by Melesse Minale at the 4th Annual East Africa Finance Summit.

Access to finance is one of the main bottlenecks to business and financial inclusion is very low

Promoting Access to Finance Through Financial Sector Development, Melesse Minale

Promoting Access to Finance Through Financial Sector Development, Melesse MinaleThe i-Capital Africa Institute

This presentation by Janos BARBERIS, Senior Research Fellow at the Asian Institute of International Financial Law, was made during the discussion “Digital disruption in financial markets” held at the 131st meeting of the OECD Competition Committee on 5 June 2019. More papers and presentations on the topic can be found out at oe.cd/ddfm.Digital disruption in financial markets – BARBERIS – June 2019 OECD discussion

Digital disruption in financial markets – BARBERIS – June 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Ajinkya M Tulpule, Senior Legal Counsel, Ferrero, was made during the discussion “Blockchain and Competition” held at the 129th meeting of the OECD Competition Committee on 8 June 2018. More papers and presentations on the topic can be found out at oe.cd/2gx.Blockchain and Competition – TULPULE – June 2018 OECD discussion

Blockchain and Competition – TULPULE – June 2018 OECD discussionOECD Directorate for Financial and Enterprise Affairs

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...William J. Harrington

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...William J. Harrington

More Related Content

What's hot

This note by Rosa M. Abrantes-Metz, Practice Co-Leader, Global Antitrust & Competition, Brattle, was prepared for the discussion “Competition and Payment Card Interchange Fees” held at the 19th meeting of the OECD-IDB Latin American and Caribbean Competition Forum on 22 September 2021. More papers and presentations on the topic can be found out at oe.cd/laccf.Competition and Payment Card Interchange Fees– Rosa Abrantes-Metz – OECD-IDB ...

Competition and Payment Card Interchange Fees– Rosa Abrantes-Metz – OECD-IDB ...OECD Directorate for Financial and Enterprise Affairs

This presentation by Mark Simpson, Partner, Norton Rose Fulbright, was made during the discussion “Blockchain and Competition” held at the 129th meeting of the OECD Competition Committee on 8 June 2018. More papers and presentations on the topic can be found out at oe.cd/2gx.Blockchain and Competition – SIMPSON – June 2018 OECD discussion

Blockchain and Competition – SIMPSON – June 2018 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Jocelyn Martel, Professor ESSEC, was made during the discussion “Barriers to exit” held at the 132nd meeting of the OECD Competition Committee on 4 December 2019. More papers and presentations on the topic can be found at oe.cd/bte.Barriers to Exit – MARTEL – December 2019 OECD discussion

Barriers to Exit – MARTEL – December 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Müge Adalet McGowan, Senior Economist, Economics Department, OECD, was made during the discussion “Barriers to exit” held at the 132nd meeting of the OECD Competition Committee on 4 December 2019. More papers and presentations on the topic can be found at oe.cd/bte.

Barriers to Exit – ADALET MCGOWAN – December 2019 OECD discussion

Barriers to Exit – ADALET MCGOWAN – December 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

Allowing trading of energy efficiency credits could have numerous benefits for a national energy efficiency resource standard (EERS) – most importantly, it could reduce the cost of compliance with the policy by increasing competition and facilitating the implementation of the lowest cost and highest value energy efficiency measures available.Deal or No Deal? Pros and Cons of Trading Under an Energy Efficiency Resource...

Deal or No Deal? Pros and Cons of Trading Under an Energy Efficiency Resource...Alliance To Save Energy

This presentation by Xavier VIVES, IESE School of Business, was made during the discussion “Digital disruption in financial markets” held at the 131st meeting of the OECD Competition Committee on 5 June 2019. More papers and presentations on the topic can be found out at oe.cd/ddfm.Digital disruption in financial markets – VIVES – June 2019 OECD discussion

Digital disruption in financial markets – VIVES – June 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

Presented by Melesse Minale at the 4th Annual East Africa Finance Summit.

Access to finance is one of the main bottlenecks to business and financial inclusion is very low

Promoting Access to Finance Through Financial Sector Development, Melesse Minale

Promoting Access to Finance Through Financial Sector Development, Melesse MinaleThe i-Capital Africa Institute

This presentation by Janos BARBERIS, Senior Research Fellow at the Asian Institute of International Financial Law, was made during the discussion “Digital disruption in financial markets” held at the 131st meeting of the OECD Competition Committee on 5 June 2019. More papers and presentations on the topic can be found out at oe.cd/ddfm.Digital disruption in financial markets – BARBERIS – June 2019 OECD discussion

Digital disruption in financial markets – BARBERIS – June 2019 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Ajinkya M Tulpule, Senior Legal Counsel, Ferrero, was made during the discussion “Blockchain and Competition” held at the 129th meeting of the OECD Competition Committee on 8 June 2018. More papers and presentations on the topic can be found out at oe.cd/2gx.Blockchain and Competition – TULPULE – June 2018 OECD discussion

Blockchain and Competition – TULPULE – June 2018 OECD discussionOECD Directorate for Financial and Enterprise Affairs

What's hot (20)

Euro Shorts 11.12.15 including Financial transaction tax update and BaFin tig...

Euro Shorts 11.12.15 including Financial transaction tax update and BaFin tig...

Competition and Payment Card Interchange Fees– Rosa Abrantes-Metz – OECD-IDB ...

Competition and Payment Card Interchange Fees– Rosa Abrantes-Metz – OECD-IDB ...

American Conference Institute: Delivering Financial Services to Underserved &...

American Conference Institute: Delivering Financial Services to Underserved &...

Blockchain and Competition – SIMPSON – June 2018 OECD discussion

Blockchain and Competition – SIMPSON – June 2018 OECD discussion

Barriers to Exit – MARTEL – December 2019 OECD discussion

Barriers to Exit – MARTEL – December 2019 OECD discussion

Barriers to Exit – ADALET MCGOWAN – December 2019 OECD discussion

Barriers to Exit – ADALET MCGOWAN – December 2019 OECD discussion

Deal or No Deal? Pros and Cons of Trading Under an Energy Efficiency Resource...

Deal or No Deal? Pros and Cons of Trading Under an Energy Efficiency Resource...

Financial crime hot topics: DPA's and Correspondent Banking

Financial crime hot topics: DPA's and Correspondent Banking

Digital disruption in financial markets – VIVES – June 2019 OECD discussion

Digital disruption in financial markets – VIVES – June 2019 OECD discussion

Promoting Access to Finance Through Financial Sector Development, Melesse Minale

Promoting Access to Finance Through Financial Sector Development, Melesse Minale

Edward Corcoran: The UK experience with digital currencies

Edward Corcoran: The UK experience with digital currencies

Digital disruption in financial markets – BARBERIS – June 2019 OECD discussion

Digital disruption in financial markets – BARBERIS – June 2019 OECD discussion

Blockchain and Competition – TULPULE – June 2018 OECD discussion

Blockchain and Competition – TULPULE – June 2018 OECD discussion

Similar to ISDA Opinions for Basel Capital Regulatory Relief

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...William J. Harrington

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...William J. Harrington

Similar to ISDA Opinions for Basel Capital Regulatory Relief (20)

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...

External Meeting for Proposed Rule 79 FR 59898 (May 12, 2015 with William J. ...

Collateral Management and Market Developments - Whitepaper

Collateral Management and Market Developments - Whitepaper

Mind the Gaps: AML and Fraud Global Benchmark Survey

Mind the Gaps: AML and Fraud Global Benchmark Survey

Response to FCA crowdfunding consultation simon deane-johns - final

Response to FCA crowdfunding consultation simon deane-johns - final

The real cost of KYC & AML compliance for the financial sector - Ondato

The real cost of KYC & AML compliance for the financial sector - Ondato

The real cost of KYC & AML compliance for the financial sector - Ondato.pdf

The real cost of KYC & AML compliance for the financial sector - Ondato.pdf

Fintech and market structure in financial services: Market developments and p...

Fintech and market structure in financial services: Market developments and p...

Legal shorts 25.07.14 including AIFM partnership tax changes and FCA update o...

Legal shorts 25.07.14 including AIFM partnership tax changes and FCA update o...

Monday November 19 2012 - Top 10 Risk Management News

Monday November 19 2012 - Top 10 Risk Management News

P101018 Penelitian Crypto Untuk Ekonomi Negara FSB

P101018 Penelitian Crypto Untuk Ekonomi Negara FSB

ISDA Opinions for Basel Capital Regulatory Relief

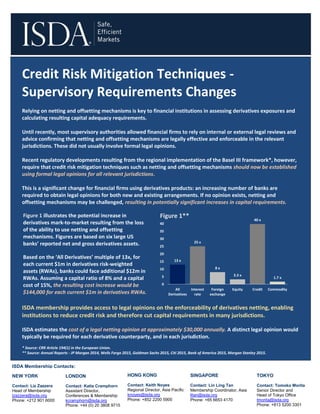

- 1. Credit Risk Mitigation Techniques - Supervisory Requirements Changes Relying on netting and offsetting mechanisms is key to financial institutions in assessing derivatives exposures and calculating resulting capital adequacy requirements. Until recently, most supervisory authorities allowed financial firms to rely on internal or external legal reviews and advice confirming that netting and offsetting mechanisms are legally effective and enforceable in the relevant jurisdictions. These did not usually involve formal legal opinions. Recent regulatory developments resulting from the regional implementation of the Basel III framework*, however, require that credit risk mitigation techniques such as netting and offsetting mechanisms should now be established using formal legal opinions for all relevant jurisdictions. This is a significant change for financial firms using derivatives products: an increasing number of banks are required to obtain legal opinions for both new and existing arrangements. If no opinion exists, netting and offsetting mechanisms may be challenged, resulting in potentially significant increases in capital requirements. ISDA membership provides access to legal opinions on the enforceability of derivatives netting, enabling institutions to reduce credit risk and therefore cut capital requirements in many jurisdictions. ISDA estimates the cost of a legal netting opinion at approximately $30,000 annually. A distinct legal opinion would typically be required for each derivative counterparty, and in each jurisdiction. * Source: CRR Article 194(1) in the European Union. ** Source: Annual Reports - JP Morgan 2014, Wells Fargo 2015, Goldman Sachs 2015, Citi 2015, Bank of America 2015, Morgan Stanley 2015. 13 x 25 x 8 x 3.3 x 40 x 1.7 x 0 5 10 15 20 25 30 35 40 All Derivatives Interest rate Foreign exchange Equity Credit Commodity Figure 1 illustrates the potential increase in derivatives mark-to-market resulting from the loss of the ability to use netting and offsetting mechanisms. Figures are based on six large US banks’ reported net and gross derivatives assets. Based on the ‘All Derivatives’ multiple of 13x, for each current $1m in derivatives risk-weighted assets (RWAs), banks could face additional $12m in RWAs. Assuming a capital ratio of 8% and a capital cost of 15%, the resulting cost increase would be $144,000 for each current $1m in derivatives RWAs. Figure 1** SINGAPORE Contact: Lin Ling Tan Membership Coordinator, Asia lltan@isda.org Phone: +65 6653 4170 HONG KONG Contact: Keith Noyes Regional Director, Asia Pacific knoyes@isda.org Phone: +852 2200 5900 ISDA Membership Contacts: NEW YORK Contact: Liz Zazzera Head of Membership lzazzera@isda.org Phone: +212 901 6000 LONDON Contact: Katie Cramphorn Assistant Director, Conferences & Membership kcramphorn@isda.org Phone: +44 (0) 20 3808 9715 TOKYO Contact: Tomoko Morita Senior Director and Head of Tokyo Office tmorita@isda.org Phone: +813 5200 3301