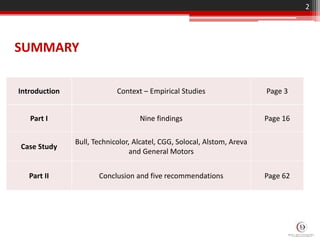

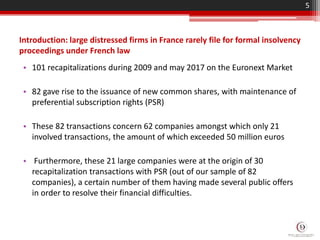

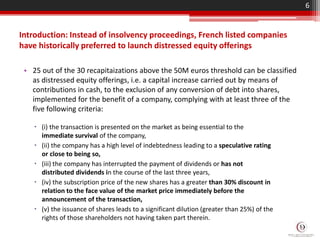

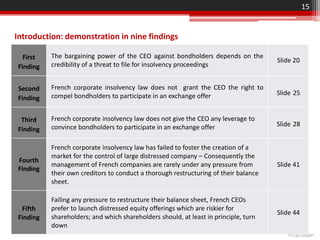

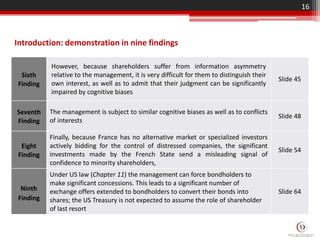

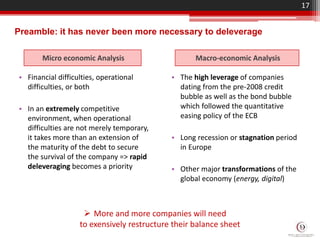

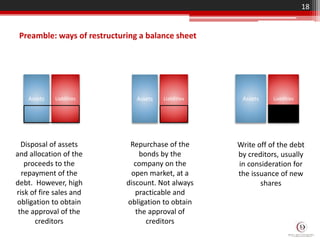

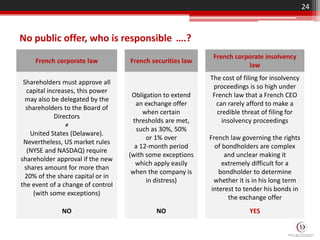

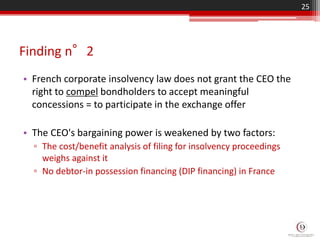

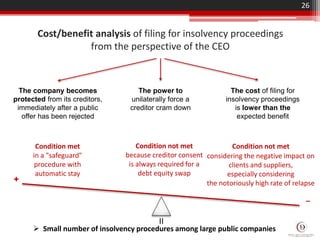

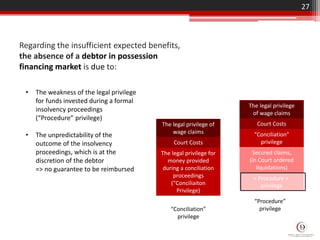

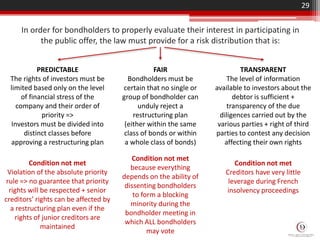

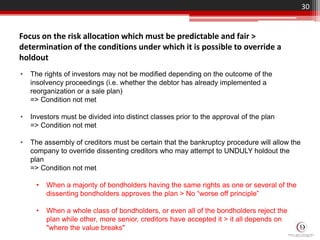

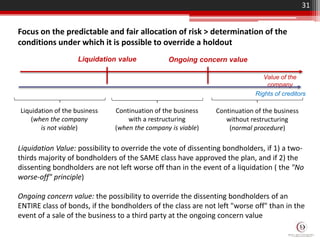

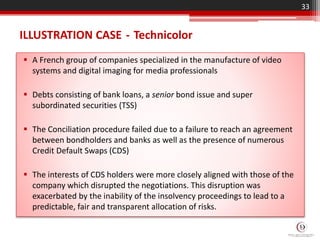

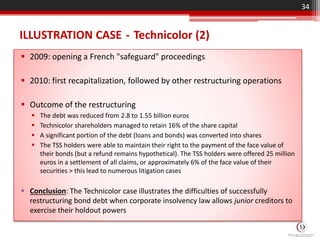

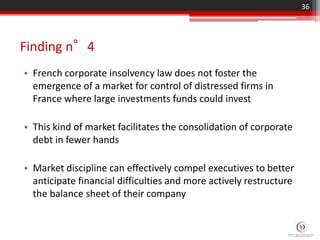

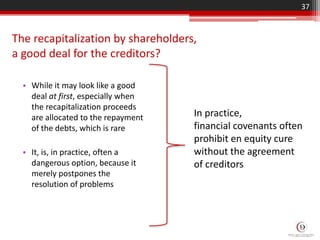

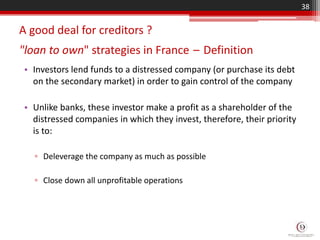

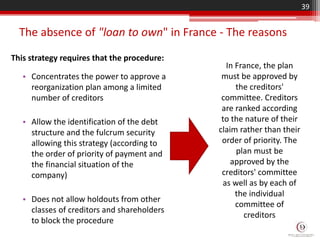

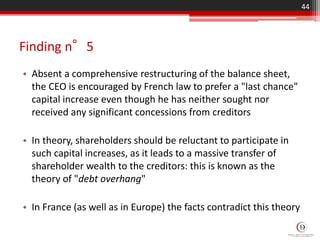

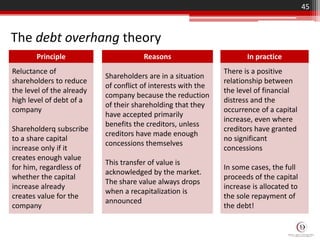

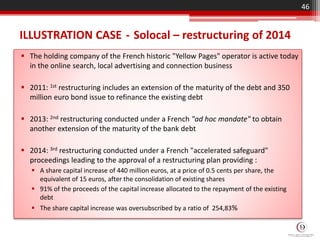

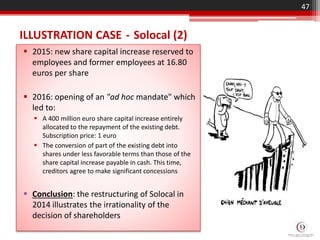

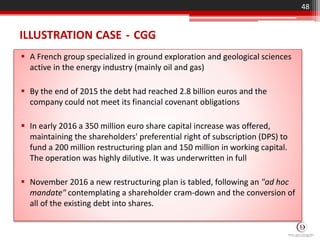

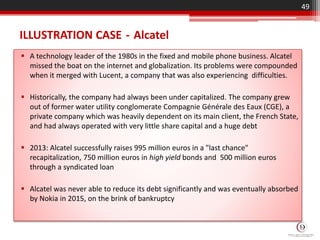

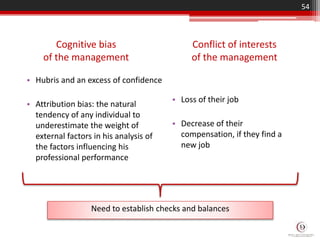

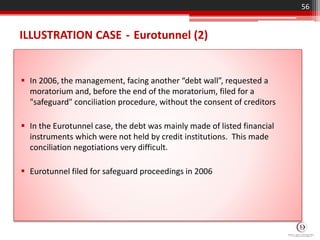

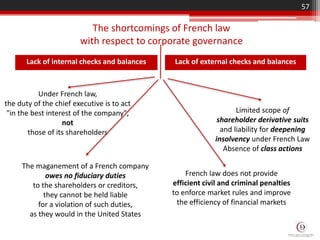

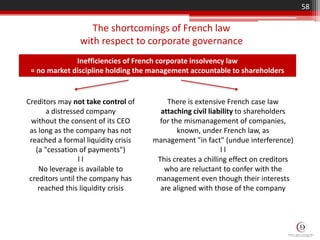

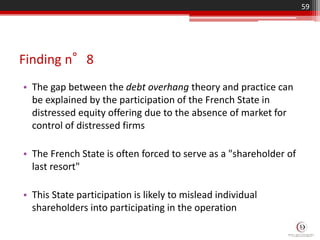

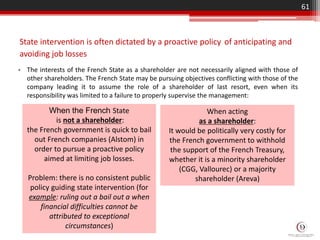

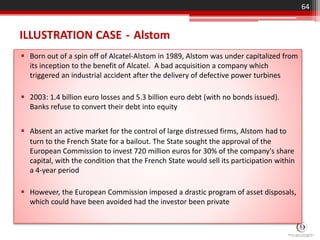

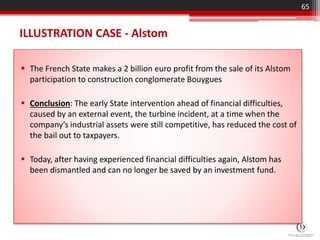

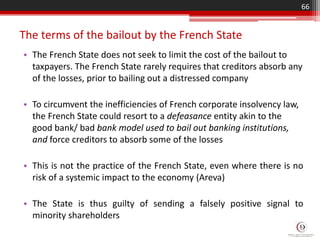

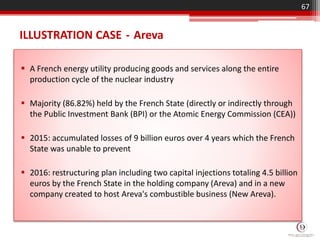

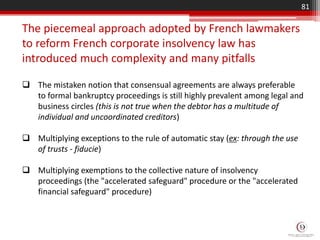

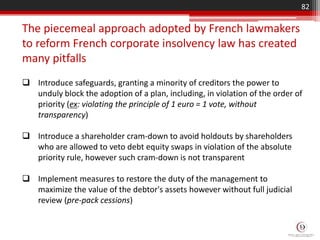

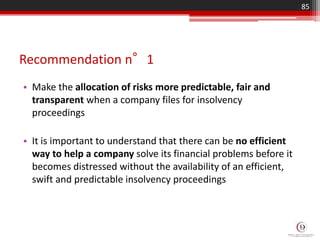

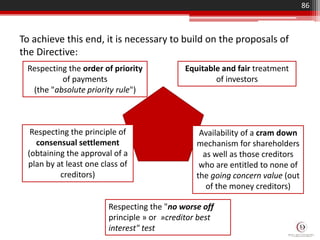

The document analyzes the inefficiencies of French corporate insolvency law, particularly the preference of large distressed firms to engage in distressed equity offerings instead of formal insolvency proceedings. It highlights the significant risks involved for shareholders in these recapitalizations, the limited bargaining power of CEOs with bondholders, and the French state's role as a 'shareholder of last resort.' The analysis comprises case studies and empirical findings that underscore the need for reform in the legal framework governing corporate debt and insolvency in France.