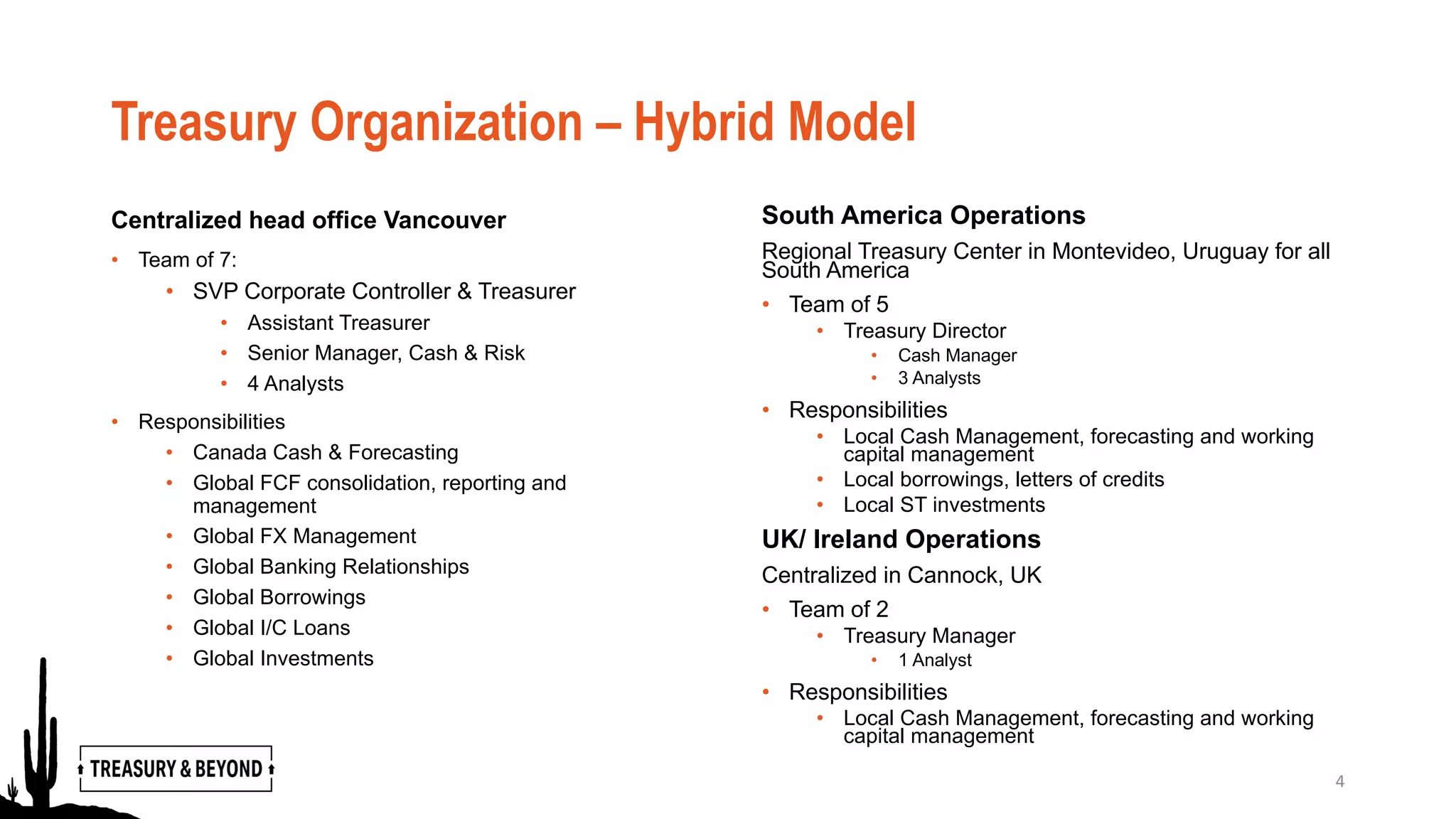

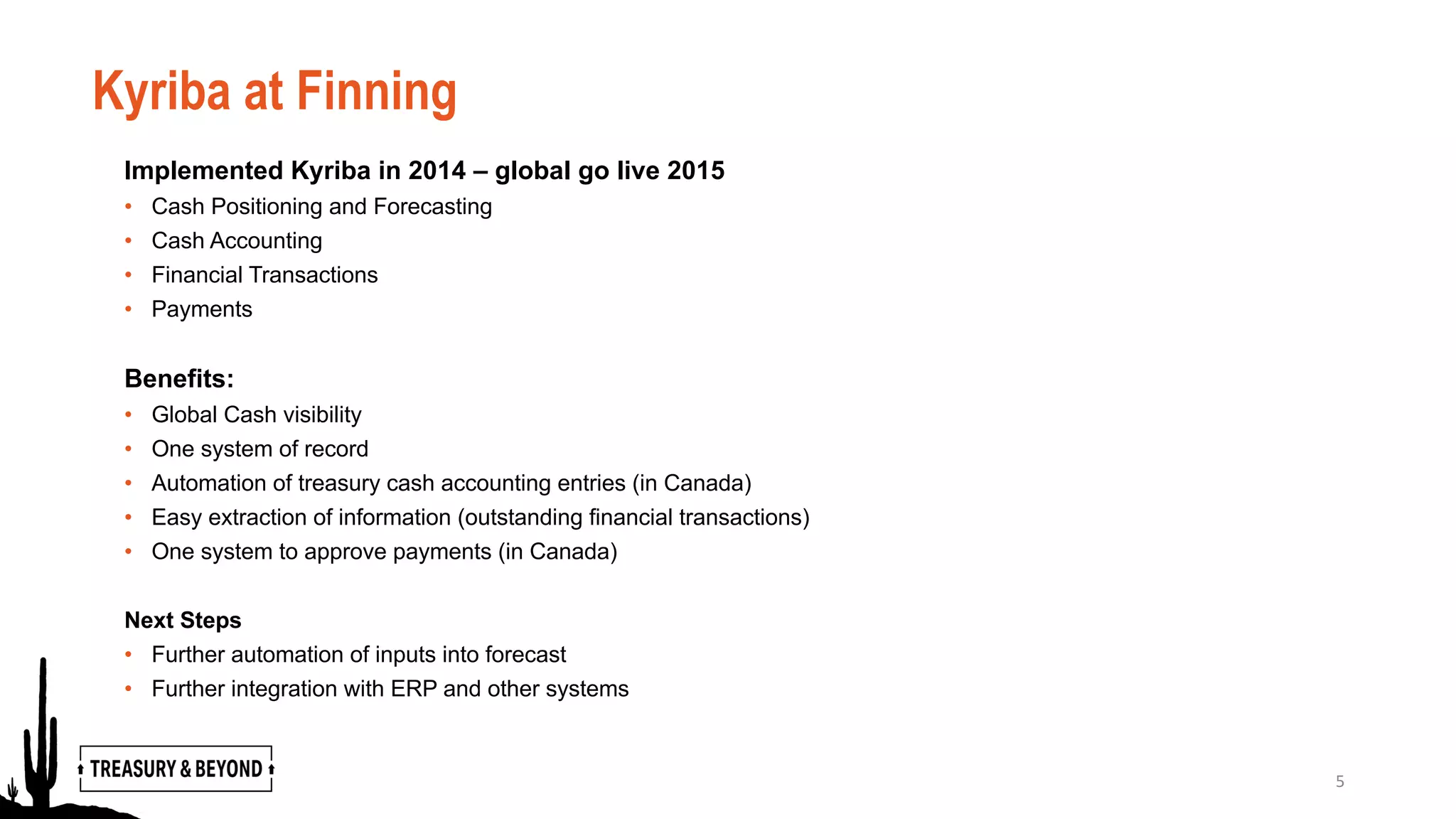

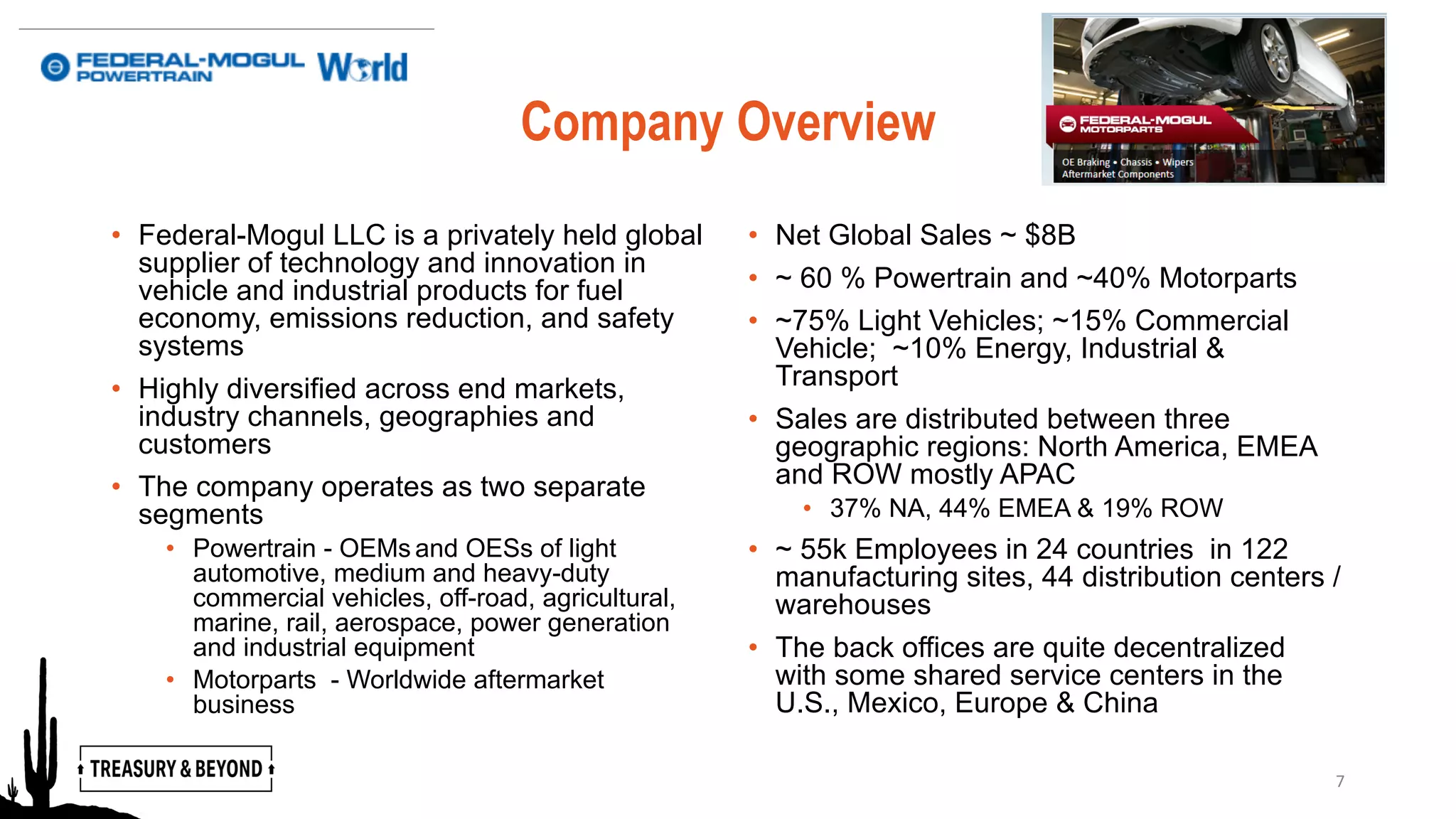

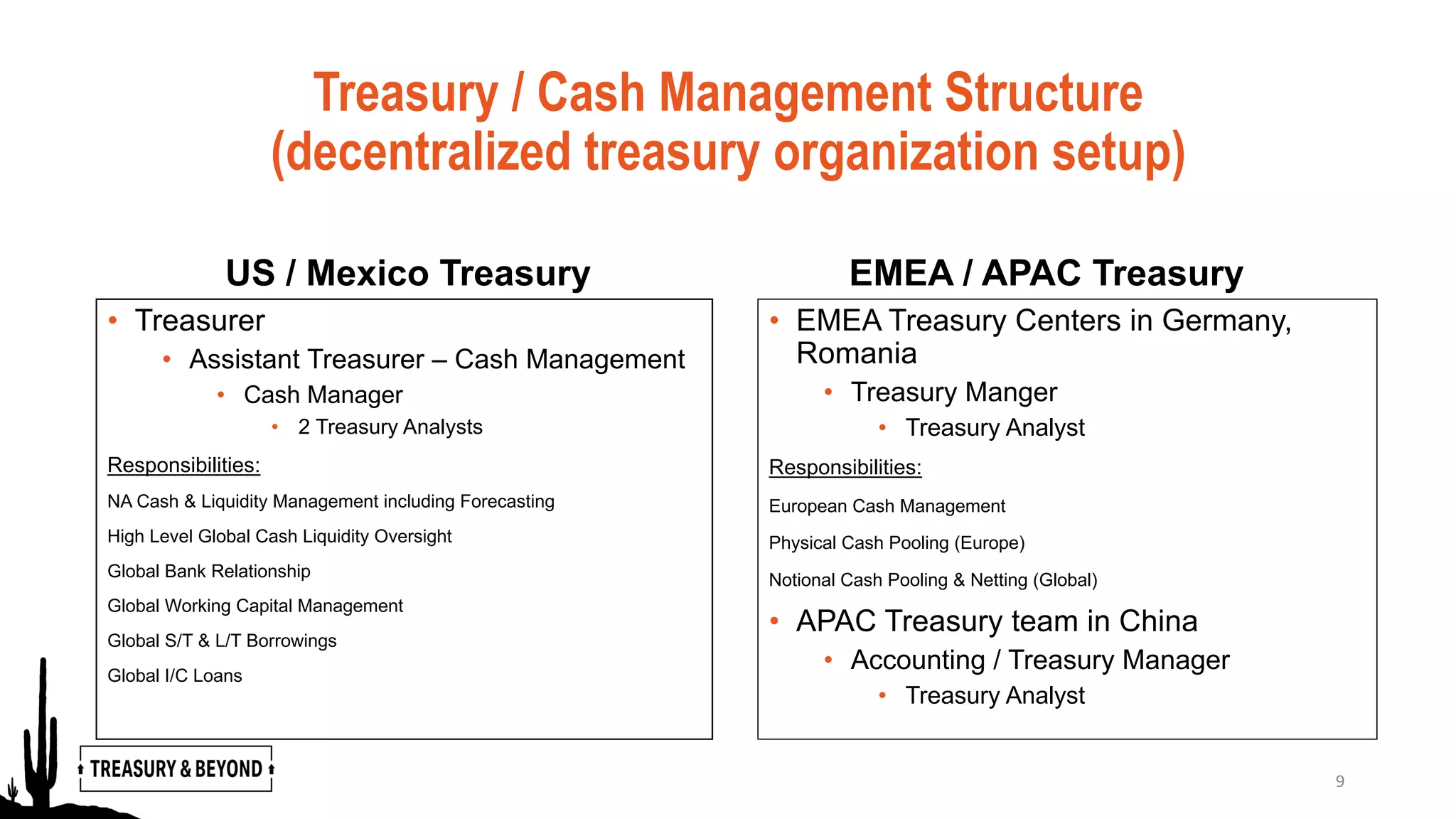

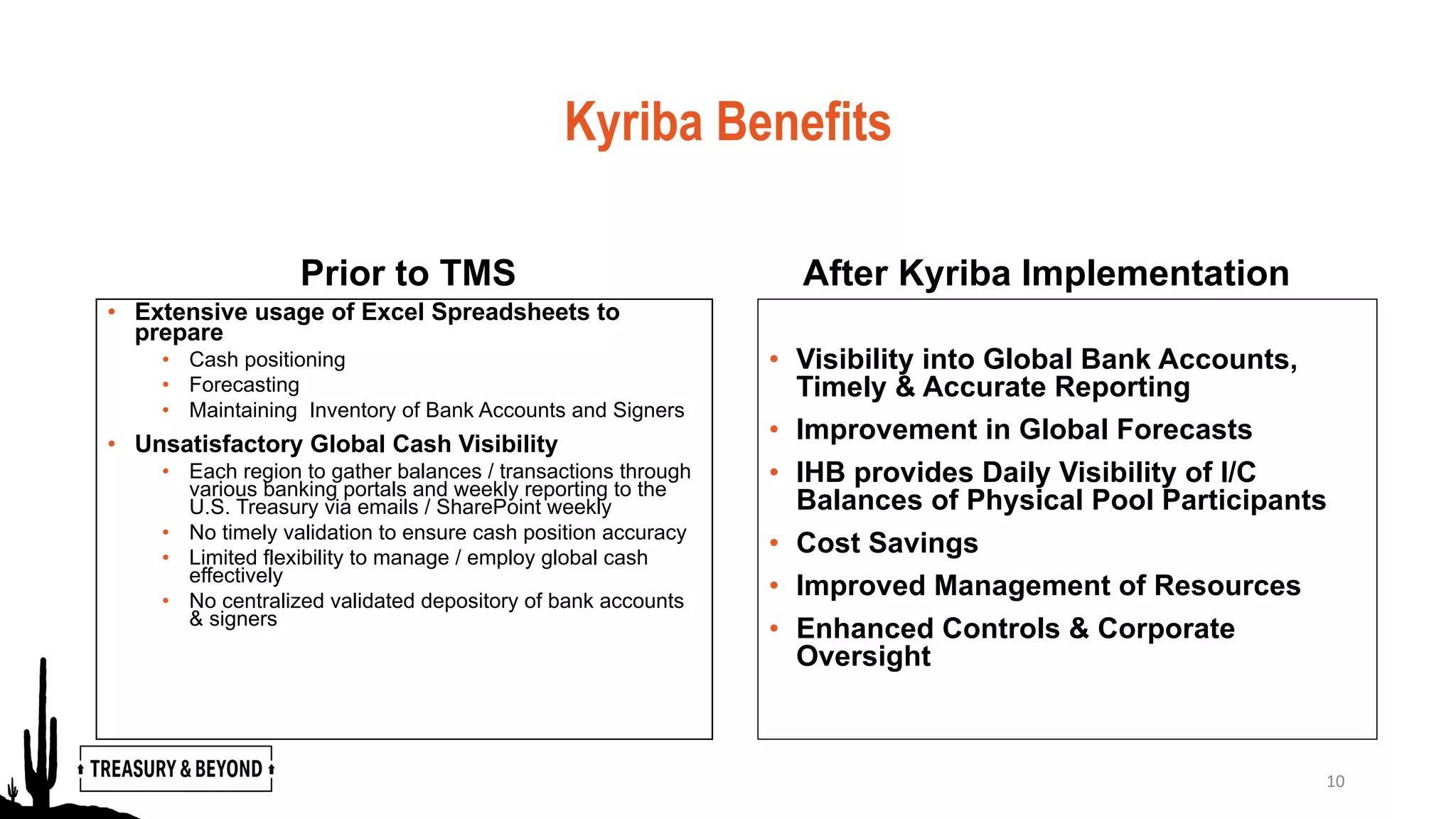

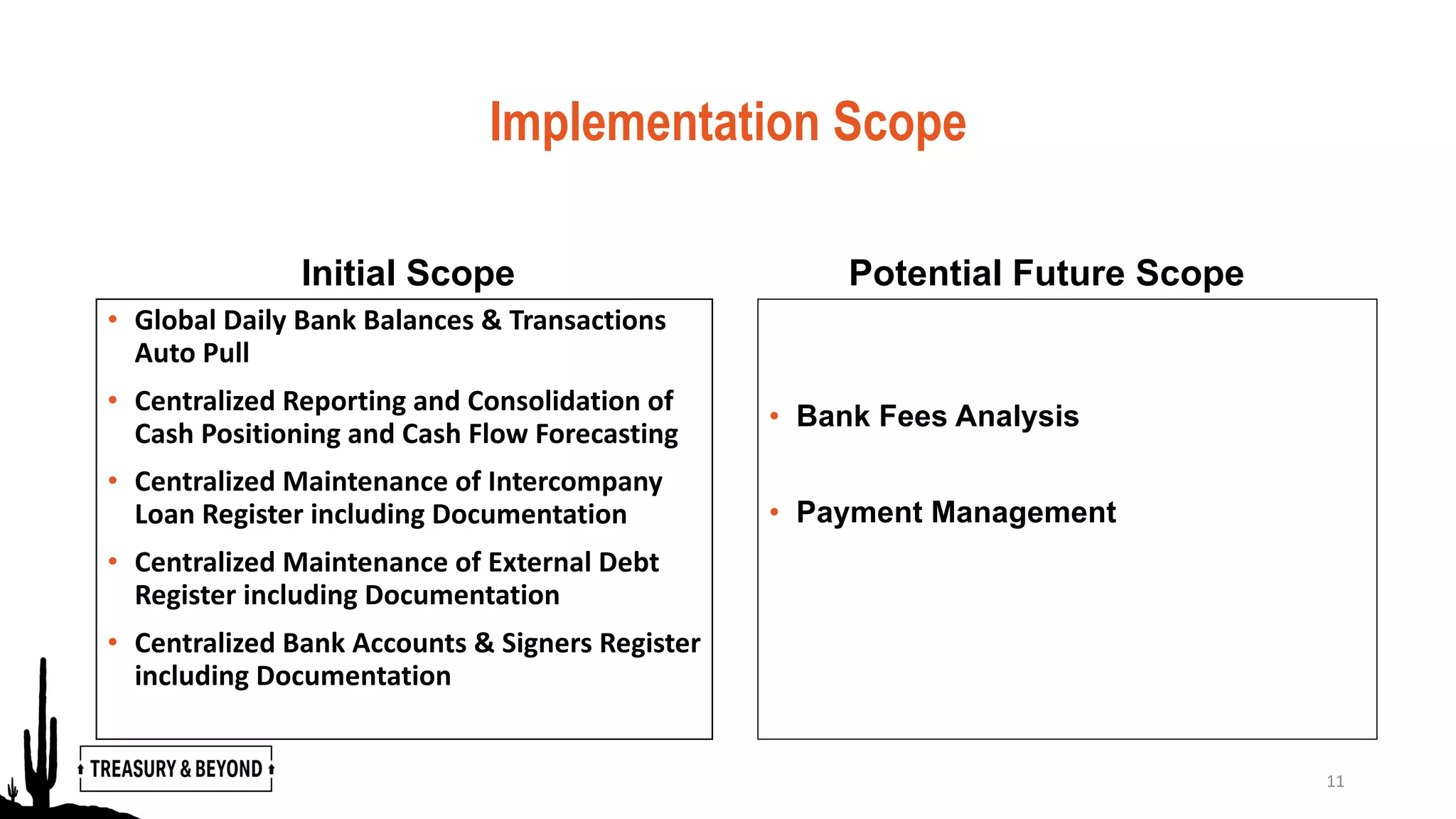

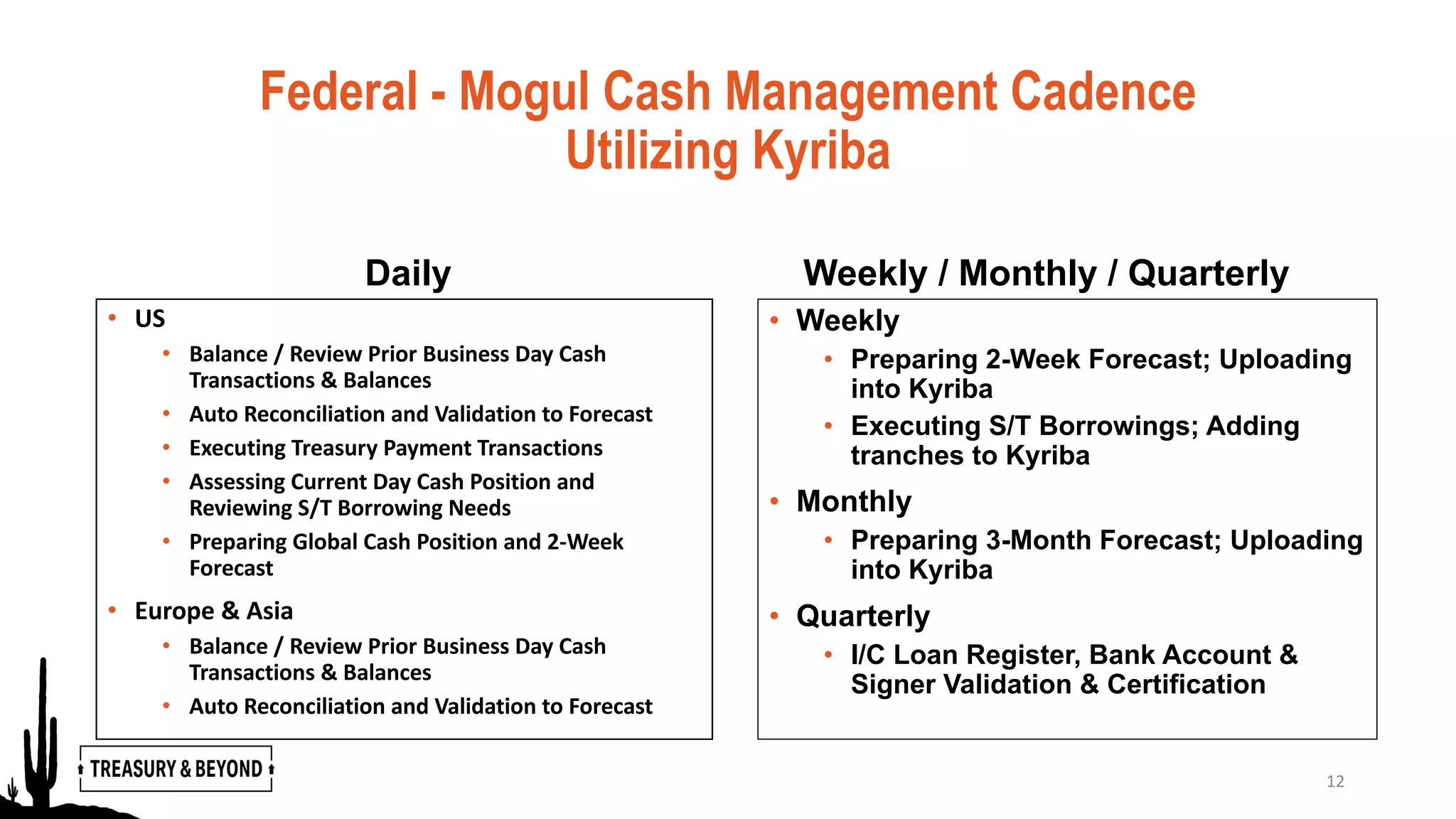

Finning is the largest Caterpillar dealer globally, generating ~6 billion CAD in annual revenues across various industries, with a diverse operational presence. The company employs a hybrid treasury management model, utilizing Kyriba for cash management and forecasting, enhancing global visibility and automation. Federal-Mogul LLC operates as a decentralized global supplier with ~8 billion in net sales, leveraging a treasury organization that optimizes cash management across various geographic regions.