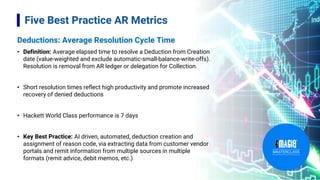

This document outlines five best practice AR metrics that companies should track: 1) Average days to complete a new credit review, 2) Average days delinquent, 3) Auto-cash hit rate, 4) Average resolution cycle time for deductions, and 5) Credit to cash process cost as a percentage of revenue. It discusses each metric in detail and provides best practice examples for achieving world-class performance. The document also describes how recurring reporting should focus on these key metrics to provide insight while minimizing reporting time and cost, while separate analytics reports are needed for deeper data analyses to identify process flaws and improvement opportunities.