This document summarizes a presentation on organizational reconnaissance and intelligence given by Arik Johnson and JP Ratajczak. Some key points discussed include:

- The need for intelligence to evolve in response to new threats rather than strategy driving intelligence.

- The concept of "stochasm" as the difference between what is known and unknown in intelligence.

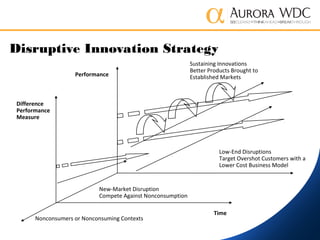

- Three trends driving business evolution: human capital/collaboration, governance/risk oversight, and business model disruption.

- Porter's five forces model and different competitive strategies like guerrilla, flanking, offensive, and defensive.

- The importance of understanding non-customers and looking beyond the current business for disruptive innovation opportunities.

![Era of Asymmetric Interpretation [Reconnaissance]

Asymmetric Interpretation Depends on Both Decisive & Incisive Sensing

Incisive

Scanning for Trends, there may be

no Decision made

Historical Patterns & Anomalies

Implications for the Reader

Bottom-Up Exposition

Driven by Trends

Product is Observation/Commentary

Emergent & Skeptical

Open Source

Decisive

Frame of Reference is the

Decision

Compares Options & Outcomes

Recommendations & Trust

Top-Down Imposition

Driven by Issues

Product is Decision/Action

Factual & Hypothetical

Confidential & Proprietary](https://image.slidesharecdn.com/20140715iafieeriepa2-140715105729-phpapp02/85/Intelligence-Organizational-Reconnaissance-16-320.jpg)