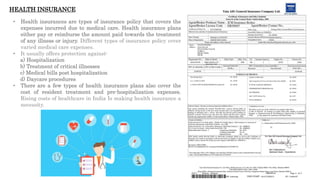

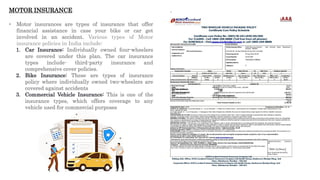

This document provides an overview of different types of insurance available in India. It discusses general insurance such as health, motor, home, fire, and travel insurance. It also outlines various life insurance options like term life, whole life, endowment plans, and pension plans. For each type of insurance, the document describes the key components and coverage provided. It provides details on health, motor, home, travel, and fire insurance policies. Finally, it briefly discusses the purpose and process of registering a sale deed for property transactions.