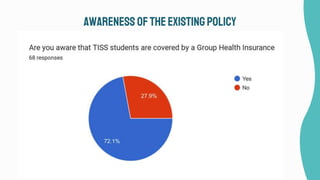

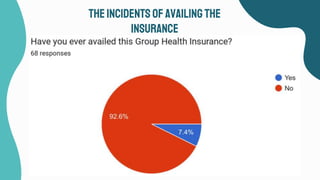

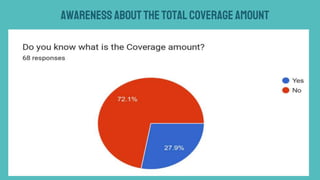

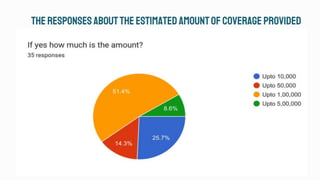

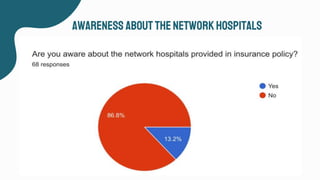

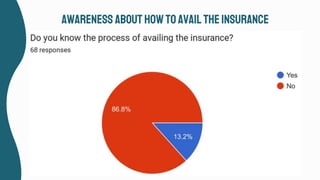

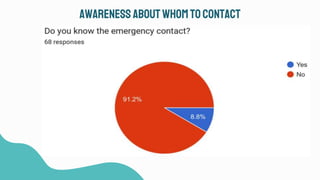

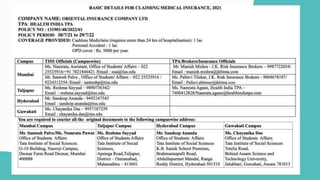

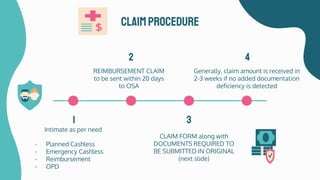

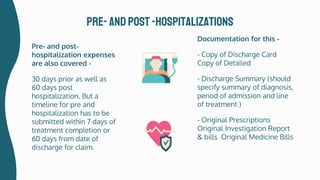

This document summarizes the key details of the group insurance policy provided to students at TISS. It finds that while 73% of students are aware of the insurance, only 7.5% have utilized it. The policy is provided by Oriental Insurance Company with a coverage of Rs. 1 lakh for hospitalization and Rs. 5000 for OPD expenses. Claims can be filed either as cashless at network hospitals or reimbursement at non-network ones. The OSA noted that most students are unaware of the full scope of coverage available under the policy.