Embed presentation

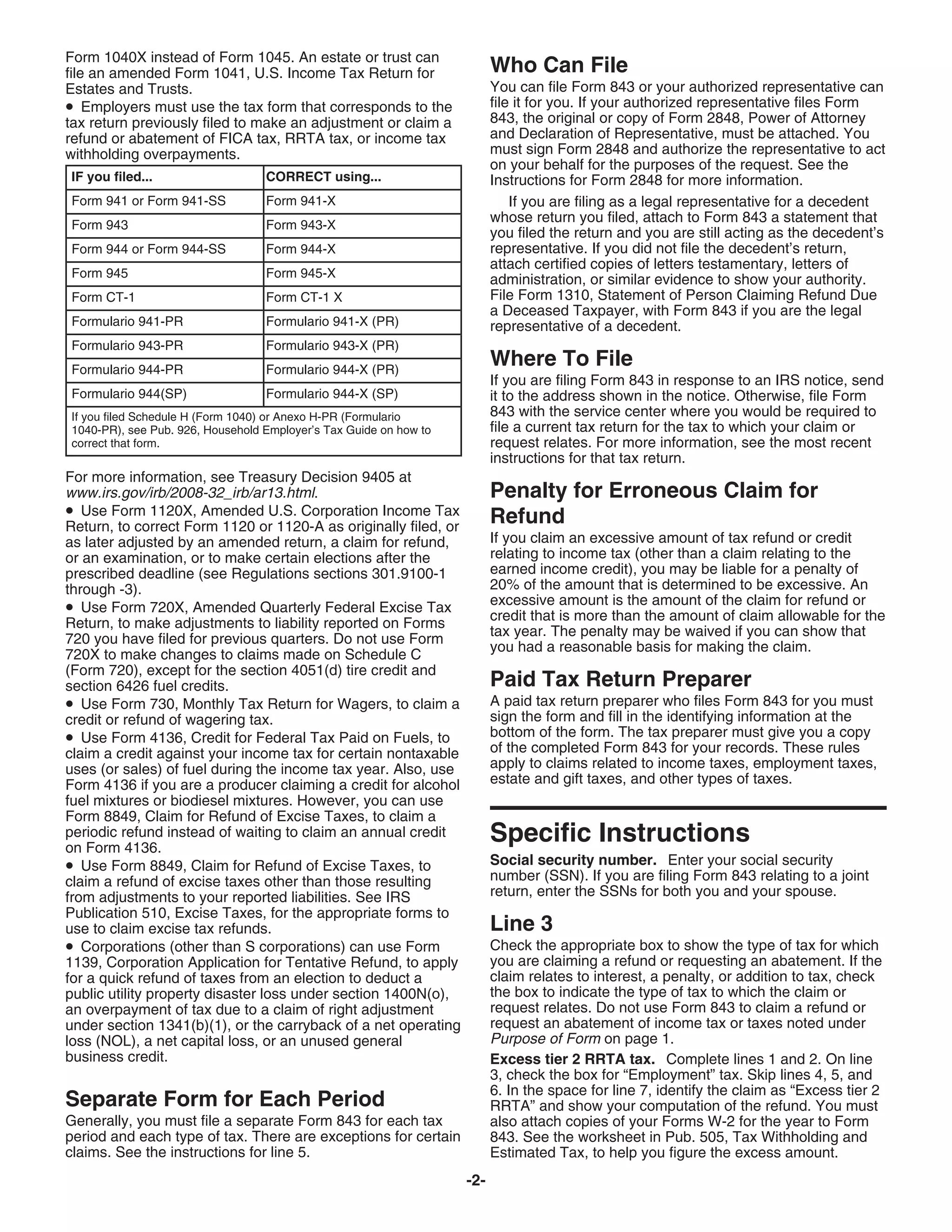

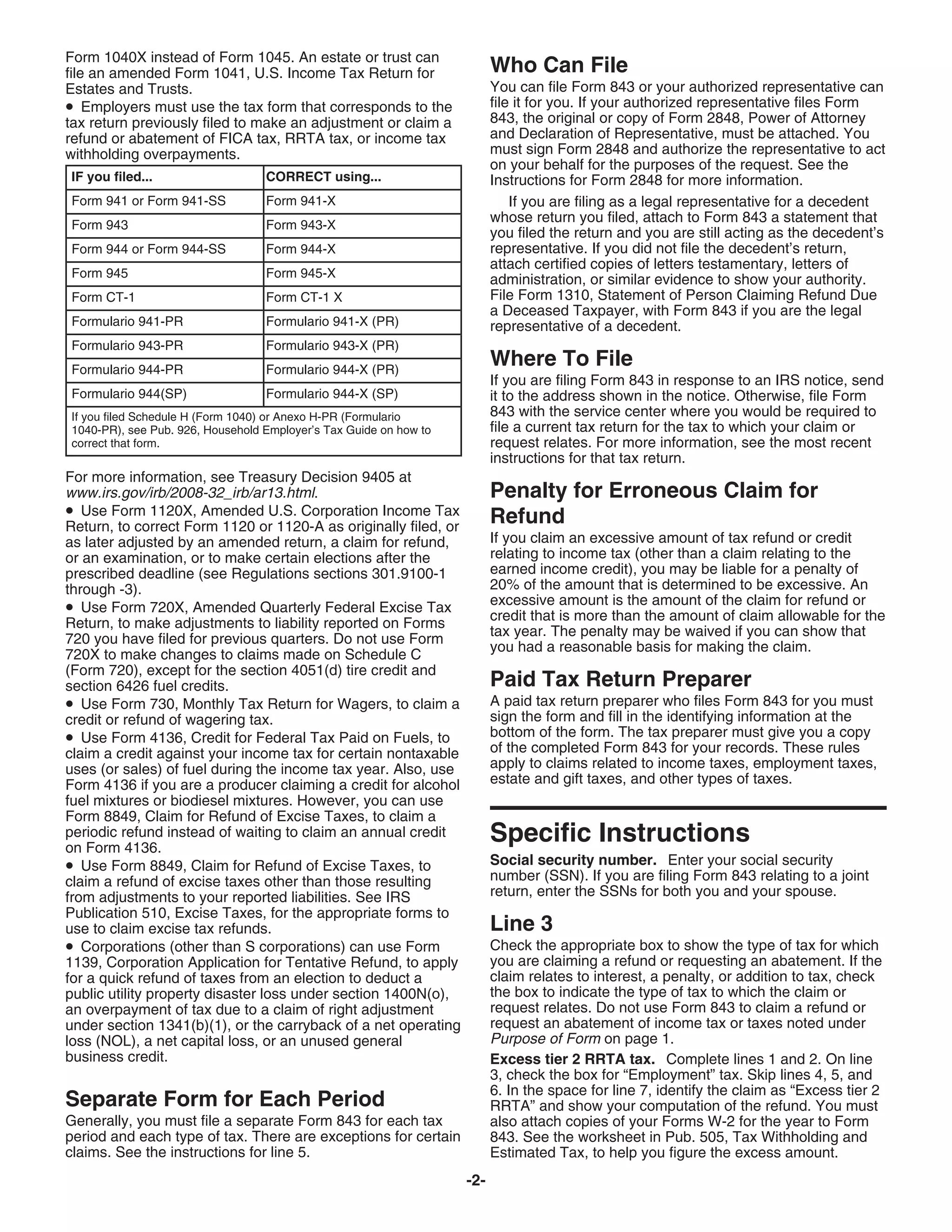

Download to read offline

This document provides instructions for completing Form 843, Claim for Refund and Request for Abatement. Key details include: - Form 843 is used to claim refunds of certain taxes, interest, penalties, and additions to tax, as well as request abatement of assessed penalties and taxes. - It cannot be used for income tax refunds, estate or gift tax abatements, or FICA, RRTA, and withholding tax adjustments by employers. Different forms are required for those purposes. - The form is submitted to the IRS center where the related tax return would normally be filed. It requires the claimant's social security number and identification of the specific tax and tax period involved