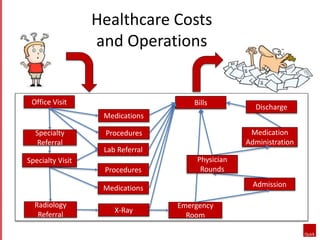

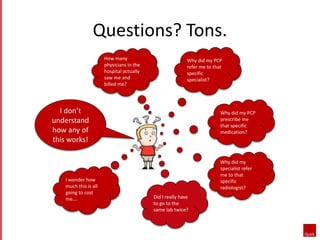

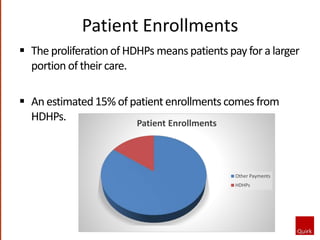

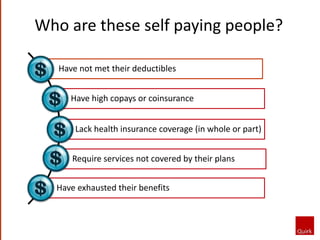

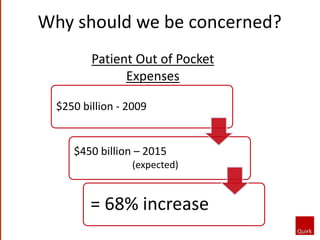

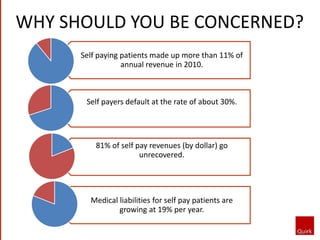

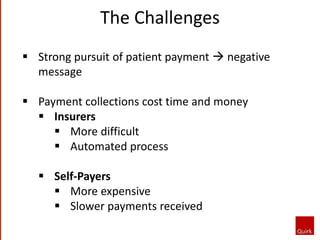

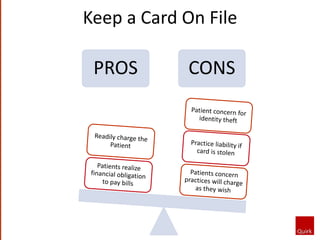

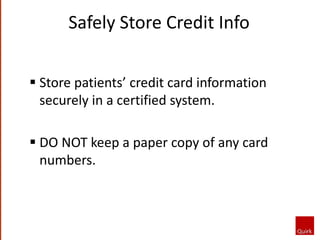

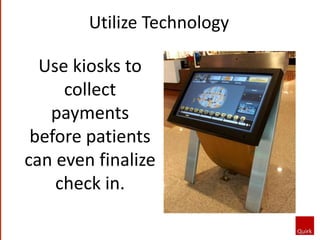

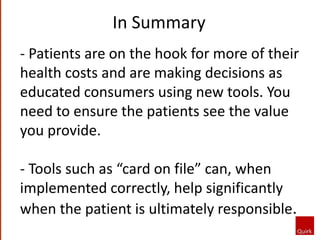

The document discusses the increasing financial responsibility of patients in healthcare due to shifts in insurance models, suggesting that healthcare providers need to adapt their payment collection strategies. It emphasizes the importance of clear communication regarding patient financial obligations, offering multiple payment options, and utilizing technologies like kiosks for payments. Furthermore, it highlights the challenges of managing self-pay collections and the need for personalized follow-up to enhance recovery rates and patient understanding.