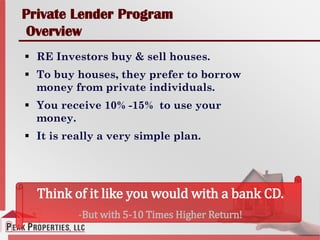

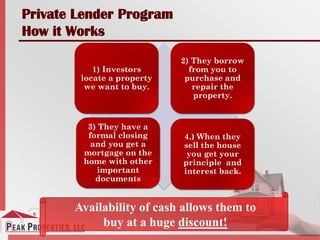

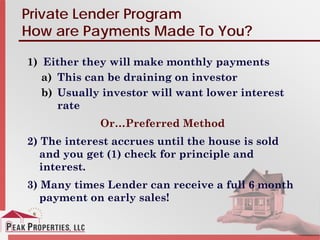

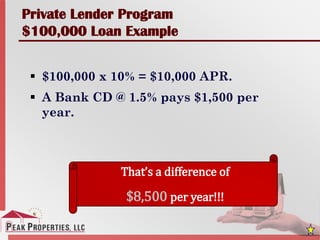

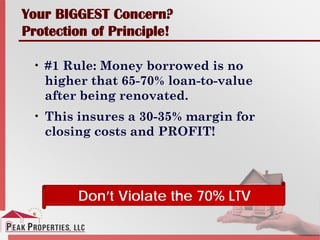

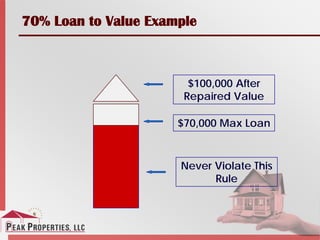

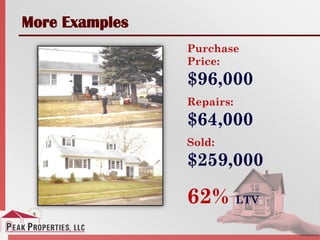

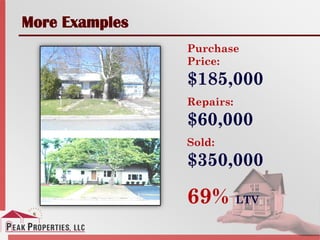

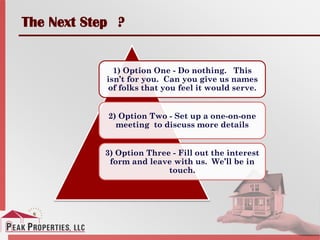

Peak Properties is a real estate investment firm that offers private lending opportunities for investors to earn high returns of 10-15% by lending money to the firm. The firm buys distressed homes, renovates them, and quickly resells them for profits. Investors are secured by first mortgages on the properties and their money is used to fund purchases and repairs. The loans are short term, usually 4-6 months, and investors receive their principal and interest back when the homes are sold. The presentation provides examples of past deals and touts the safety and passive nature of these investment opportunities.