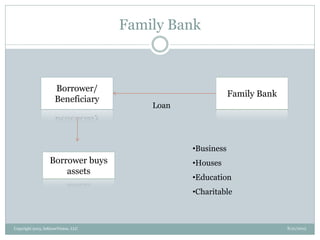

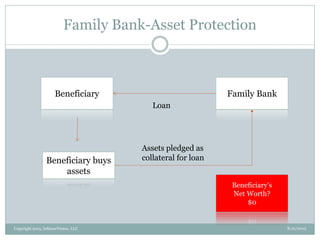

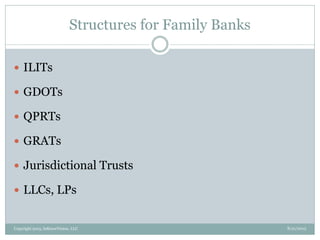

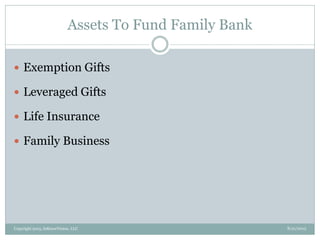

The document discusses the concept and advantages of family banks, emphasizing their role in wealth management and intergenerational legacy planning. It outlines essential steps for establishing a family bank, including clear vision, participation processes, loan management, and communication strategies. Additionally, it highlights common pitfalls to avoid and the potential benefits for family members, including opportunities for entrepreneurship and asset protection.