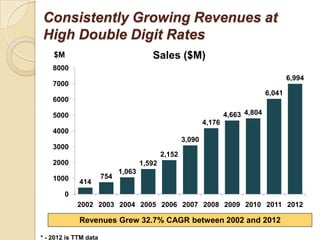

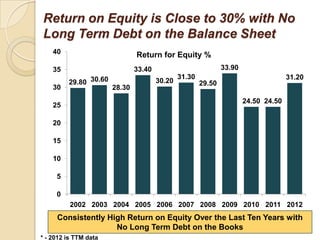

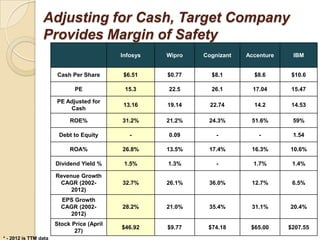

Infosys has consistently grown revenues and EPS at high double digit rates between 2002 and 2012, with revenues growing at a 32.7% CAGR and EPS growing at 28.2% CAGR. Infosys has also maintained a high return on equity of around 30% with no long term debt. Despite this strong financial performance, Infosys is currently trading at a discount to its peers Wipro and Cognizant based on its price-to-earnings ratio when adjusted for its higher cash balance per share.