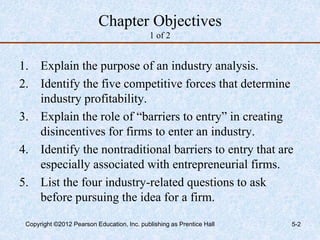

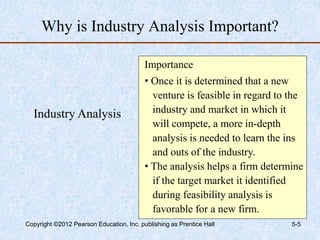

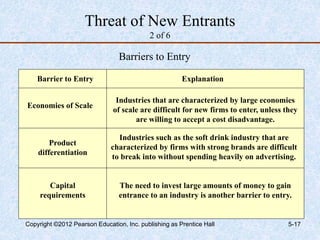

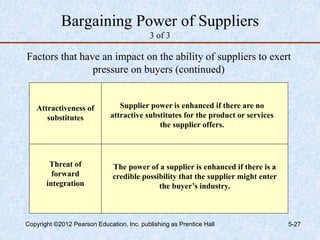

Chapter 5 discusses industry and competitor analysis, emphasizing the importance of understanding industry potential and the competitive forces that influence profitability. It identifies five key competitive forces that affect the entry of new firms and outlines barriers to entry, both traditional and nontraditional. Additionally, the chapter covers how to conduct competitor analysis and ethical methods for gathering competitive intelligence.