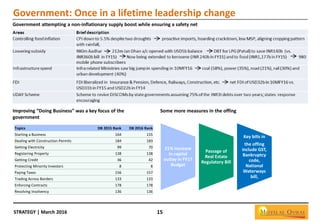

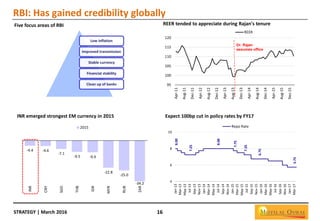

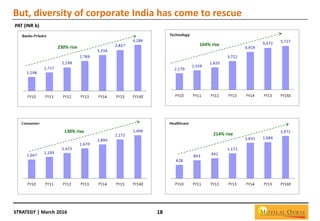

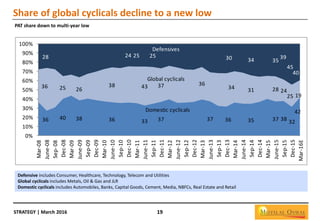

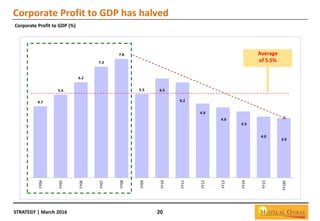

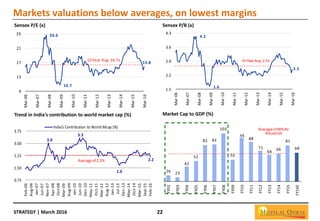

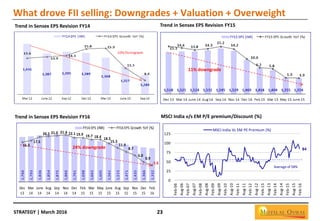

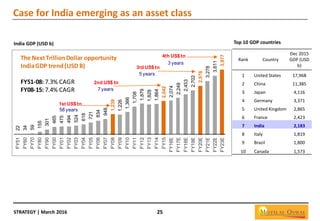

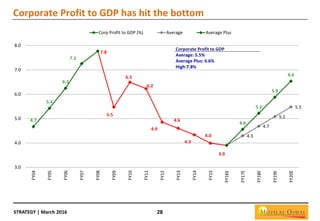

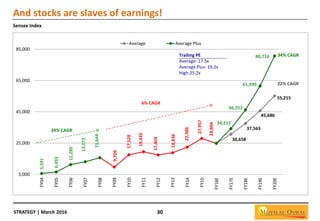

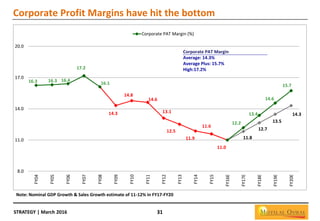

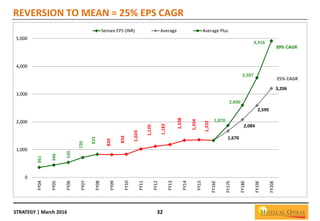

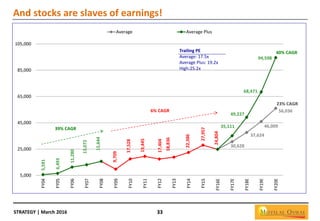

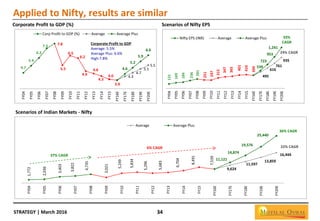

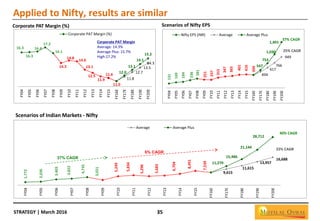

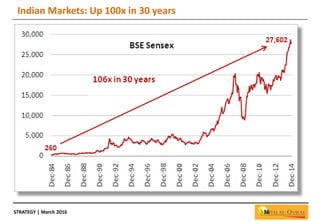

This document discusses whether it is better to take a "time-in" approach or attempt to time the market when investing in Indian equities. It notes that corporate profits in India have halved as a percentage of GDP and profitability has declined significantly for cyclical sectors. However, defensive sectors have seen rising profits. The document argues that India's macroeconomic fundamentals have improved, with lower inflation, fiscal deficits, and a stronger currency and reserves. It believes the worst is behind for Indian corporates and valuations are reasonable, suggesting the best is yet to come for Indian equities with a long-term "time-in" approach.