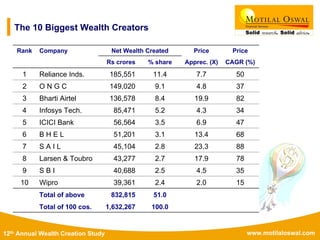

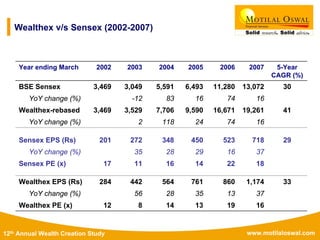

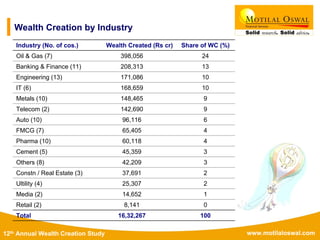

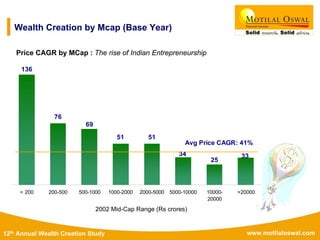

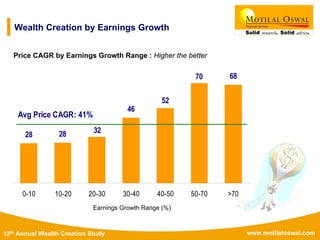

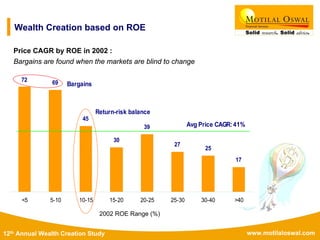

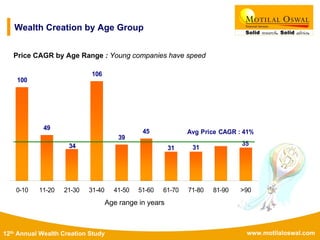

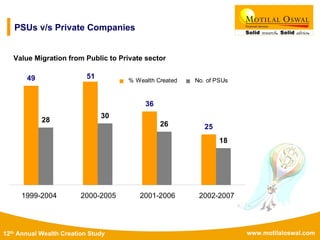

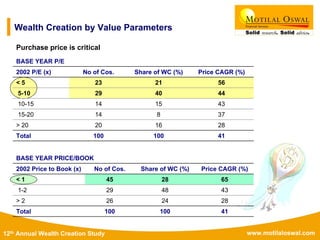

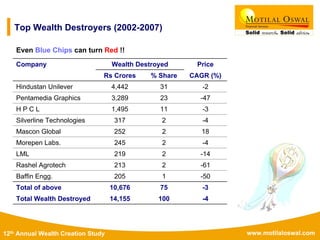

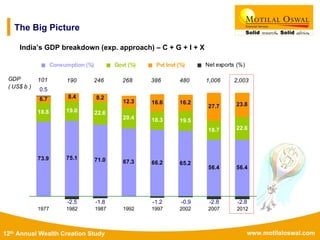

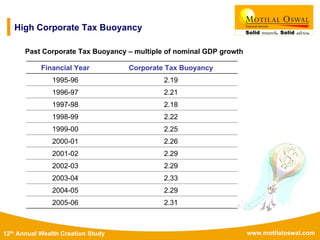

The document presents the 12th Annual Wealth Creation Study for the period 2002-2007, detailing the wealth generated by Indian companies and sectors during that time. It identifies the top wealth creators, fastest wealth creators, and the impact of various indicators such as price-to-earnings ratio and industry sectors on wealth creation. Additionally, it highlights key trends in India's economic growth, including a significant shift from public to private sector wealth creation.