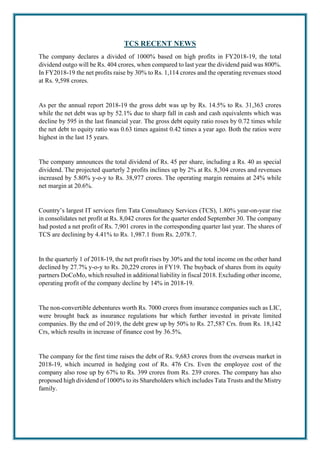

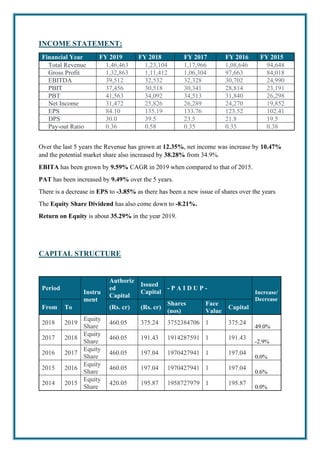

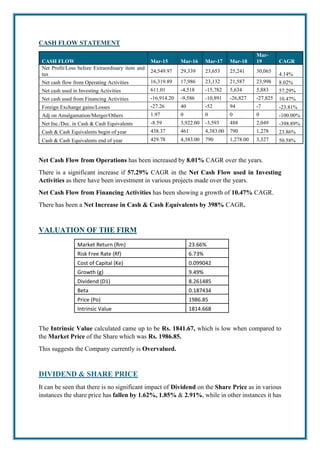

Tata Consultancy Services (TCS) is a leading global IT services company that has grown significantly over the past 50 years. It has over 420,000 employees serving clients in 50 countries. While TCS has increased its revenues and profits in recent years, it has also substantially increased its debt levels. Based on the company's financial performance and market valuation, the current share price of TCS appears to be overvalued relative to its intrinsic value.