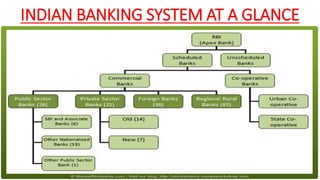

This document provides an overview of the banking system in India. It begins with a brief history of banking in India starting in the late 18th century. It then defines what a bank is and describes the major components of the Indian banking system, including the Reserve Bank of India, scheduled banks (commercial and cooperative), and non-scheduled banks. The document outlines the various types of commercial and cooperative banks and their characteristics. It also discusses some of the challenges faced by banks in India as well as their contributions to the Indian economy. The conclusion emphasizes the important role of banks in India and how financial reforms have improved the system.