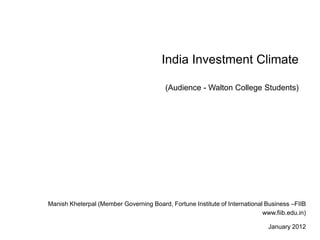

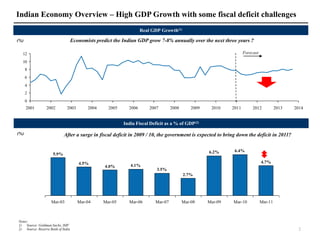

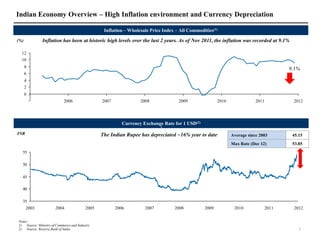

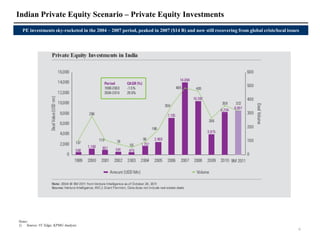

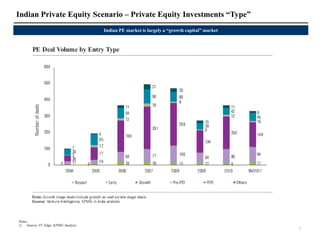

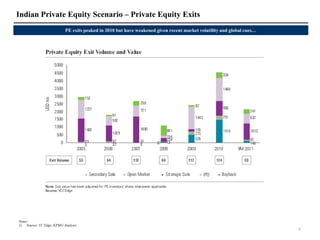

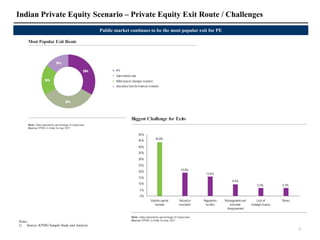

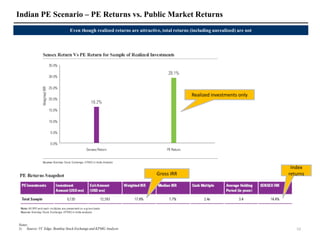

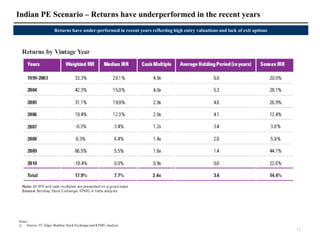

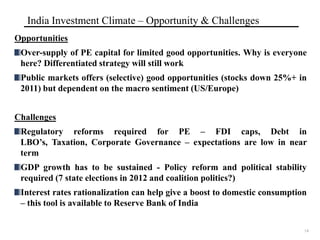

The Indian economy has experienced high GDP growth of around 7-8% annually over the past decade. However, high inflation and a large fiscal deficit present challenges. Private equity investments peaked in 2007 but have weakened in recent years due to market volatility and a lack of exit options. While India provides many opportunities for growth capital investments, regulatory reforms are still needed to further improve the investment climate. Overall, sustained GDP growth, policy reforms, and political stability will be important for India to realize its full economic potential.