Coal India LTD. Management Guidiance and Outlook

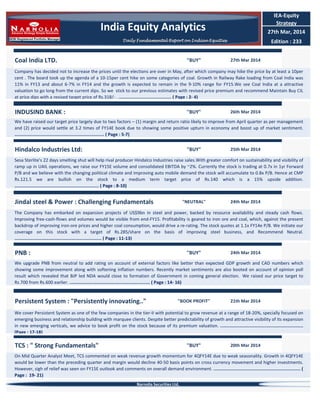

- 1. Coal India LTD. "BUY" 27th Mar 2014 Company has decided not to increase the prices until the elections are over in May, after which company may hike the price by at least a 10per cent . The board took up the agenda of a 10-15per cent hike on some categories of coal. Growth in Railway Rake loading from Coal India was 11% in FY13 and about 6-7% in FY14 and the growth is expected to remain in the 9-10% range for FY15.We see Coal India at a attractive valuation to go long from the current dips. So we stick to our previous estimates with revised price premium and recommend Maintain Buy CIL at price dips with a revised target price of Rs.318/- . ........................................ ( Page : 2- 4) IEA-Equity Strategy 27th Mar, 2014 Edition : 233 Persistent System : "Persistently innovating.." 21th Mar 2014 PNB : "BUY" 24th Mar 2014 We upgrade PNB from neutral to add rating on account of external factors like better than expected GDP growth and CAD numbers which showing some improvement along with softening inflation numbers. Recently market sentiments are also booted on account of opinion poll result which revealed that BJP led NDA would close to formation of Government in coming general election. We raised our price target to Rs.700 from Rs.600 earlier. ............................................................. ( Page : 14- 16) Jindal steel & Power : Challenging Fundamentals "NEUTRAL" 24th Mar 2014 On Mid Quarter Analyst Meet, TCS commented on weak revenue growth momentum for 4QFY14E due to weak seasonality. Growth in 4QFY14E would be lower than the preceding quarter and margin would decline 40-50 basis points on cross currency movement and higher investments. However, sigh of relief was seen on FY15E outlook and comments on overall demand environment. .................................................................. ( Page : 19- 21) Hindalco Industries Ltd: INDUSIND BANK : "BUY" 26th Mar 2014 We have raised our target price largely due to two factors – (1) margin and return ratio likely to improve from April quarter as per management and (2) price would settle at 3.2 times of FY14E book due to showing some positive upturn in economy and boost up of market sentiment. .................................................................... ( Page : 5-7) "BUY" 25th Mar 2014 Sesa Sterlite's 22 days smelting shut will help rival producer Hindalco Industries raise sales.With greater comfort on sustainability and visibility of ramp up in UAIL operations, we raise our FY15E volume and consolidated EBITDA by ~2%. Currently the stock is trading at 0.7x in 1yr Forward P/B and we believe with the changing political climate and improving auto mobile demand the stock will accumulate to 0.8x P/B. Hence at CMP Rs.121.5 we are bullish on the stock to a medium term target price of Rs.140 which is a 15% upside addition. ................................................................ ( Page : 8-10) We cover Persistent System as one of the few companies in the tier-II with potential to grow revenue at a range of 18-20%, specially focused on emerging business and relationship building with marquee clients. Despite better predictability of growth and attractive visibility of its expansion in new emerging verticals, we advice to book profit on the stock because of its premium valuation. ............................................................... (Page : 17-18) "BOOK PROFIT" TCS : " Strong Fundamentals" "BUY" 20th Mar 2014 The Company has embarked on expansion projects of US$9bn in steel and power, backed by resource availability and steady cash flows. Improving free-cash-flows and volumes would be visible from end-FY15. Profitability is geared to iron ore and coal, which, against the present backdrop of improving iron-ore prices and higher coal consumption, would drive a re-rating. The stock quotes at 1.1x FY14e P/B. We initiate our coverage on this stock with a target of Rs.285/share on the basis of improving steel business, and Recommend Neutral. .................................................................. ( Page : 11-13) Narnolia Securities Ltd, India Equity Analytics Daily Fundamental Report on Indian Equities

- 2. Coal India LTD. Management Guidiance 280 318 307 13% 4% Issue with NTPC to sort out by end of FY14 533278 176226 17622 E-auction Volume Growth 6601 1M 1yr YTD Absolute -1.3 -21.2 -21.4 Rel. to Nifty 2.8 8.8 8.6 Expenditure Font 3QFY14 2QFY14 1QFY14 Promoters 90.0 90.0 90.0 FII 5.5 5.5 5.4 DII 2.4 2.3 2.3 Others 2.1 2.2 2.4 Rescheduling Date of hearing stands a key concern Realization gain on Revised Coal Price Financials : Q3FY14 Y-o-Y % Q-o-Q % Q3FY13 Q2FY14 Net Revenue 16928 -2.3 9.8 17325 15411 EBITDA 4104 -4.3 46.9 4288 2794 Depriciation 442 5.2 -10.7 420 495 Interest Cost 10 0.0 25.6 10 8 Tax 1930 4.9 36.6 1839 1412 PAT 3894 -11.4 27.6 4395 3052 (In Crs) 2 Market Data BSE Code COALINDIA Average Daily Volume (Nos.) On the expenditure side contractual expenses increased ~20% to Rs.154/ton from Rs.128/ton in Q2FY14.Powerfuel cost and other expenses per ton remained flat, while cost of project per ton decreased to Rs149/ton from Rs.206/ton in the previous quarter. Realization of Coal India showed little uptick like 2% to Rs.1445/ton. Management is fairly confident to achieve 25-30 MT (Million Tonnes) of growth in production for FY15. Of the production growth, 12-15 MT to come from Mahanadi Coal fields, 12 MT to come from South Eastern Coal fields and the balance from rest of the subsidiaries primarily Western Coal Fields.FY15 Coal offtake target to be 507 MT. NTPC has been regular in clearing payments so far, except for some payments held up due to Grade quality issues. Receivables from NTPC were at Rs 3295 crore as of end of Dec 2013. By end of FY14 management hopes to sort out the NTPC payment issue.Total receivables as of end of Dec 2013 stand at Rs.10457 crores; out of which Rs.8476 crore is undisputed and balance is disputed. E-auction volumes during the quarter ended Dec 2013 went up to 15.14 MT from 10.48 MT during the corresponding previous quarter. For the nine-month period ended Dec 2013, E-auction volumes went up to 41.26 MT from 35.61 MT compared to the corresponding previous period.Wherever transport and loading facility issues due to low railway rake availability are being faced by subsidiaries then those subsidiaries are advised by the management to go for e-auctions. NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) 372/238 Nifty Please refer to the Disclaimers at the end of this Report. Stock Performance-% Share Holding Pattern-% 1 yr Forward P/B Source - Comapany/EastWind Research Competition Appellate Tribunal stays Rs 1,773 Crore fine on CIL, and will decide on the matter on next hearing 16th April 2014 (Rescheduled from 11th Feb 2014). Meanwhile, Coal India Ltd is likely to get additional revenue of Rs 2,119 Crore in this fiscal on account of revision in dry fuel prices.Though the incremental revenue is a positive sign but it fails to change our previous valuation. Number from the sampling exercise taken by a third-party check for the full year (FY14) may come by Mar 2014. Also results for quarter ended Mar 2014 may see some provisioning for such low grade quality coal. Upside Change from Previous Result Update CMP Target Price Previous Target Price "Buy" 27th Mar 14 Narnolia Securities Ltd,

- 3. FY11 FY12 FY13 FY14E 50234 62415 68303 69960 7573 5123 6556 8372 1755 2013 2333 2591 4580 4901 5802 6049 20481 26705 27943 28943 40390 40857 50219 53705 9843 21558 18084 16255 1673 1969 1813 1860 79 54 45 34 5595 6484 7623 7310 10868 20588 17356 17921 33 51 36 40 3 PAT ROE % Source - Comapany/EastWind Research Source - Comapany/EastWind Research We see Coal India at a attractive valuation to go long from the current dips. So we stick to our previous estimates with revised price premium and recommend Maintain Buy CIL at price dips with a revised target price of Rs.318/- .Which is ~13% upside from the current level. Company has decided not to increase the prices until the elections are over in May, after which company may hike the price by at least a 10per cent . The board took up the agenda of a 10-15per cent hike on some categories of coal. Coal India has decided to add 25,000 workmen over the next five years while three times as many workmen employed by the state run miner are scheduled to retire during this period, a move that is expected to double its productivity per employee and reduce cost of production by about 10 per cent. Source - Comapany/EastWind Research Source - Comapany/EastWind Research Source - Comapany/EastWind Research contractual expenses Employee benefit Expence Expenditure EBITDA Depriciation Tax Interest Cost P/L PERFORMANCE Coal India LTD. Rs. 600-700 crore benefit/savings to be seen on a full year basis for FY14 and beyond due to rationalization of loading and crushing charges.Currently 46-47 MT of ground stock available; 10 MT liquidation of ground stock possible by end of FY14. Source - Comapany/EastWind Research Net Revenue from Operation Cost Of Projects & Contractual Power and fuel Earlier we suggested, if earnings falls, then price might go beyond 256, but p/b level may be maintained , else we assume that since the company is a good dividend paying company with Roe above 30% we assume p/b should remain above 3. Curently the stock is trading at 3.4x at one year forward price to book but looking at the earnings and dividend yield we believe the stock will trade at most common 3.8x level. View & Outlook Growth in Railway Rake loading from Coal India was 11% in FY13 and about 6-7% in FY14 and the growth is expected to remain in the 9-10% range for FY15 Narnolia Securities Ltd,

- 4. FY10 FY11 FY12 FY13 6316 6316 6316 6316 20956 26998 34137 42156 27273 33314 40453 48472 343 1334 1305 1078 1620 33 0 0 2545 22461 28271 31144 772 645 829 837 1404 12387 15595 20447 5443 8490 9785 12385 0 779 759 712 12035 12065 12681 12754 2211 2057 1848 3496 610 845 1017 1181 4402 5586 6071 5618 2169 3419 5663 10480 39078 45806 58203 62236 8066 11180 13478 16189 17921 21646 24688 25479 FY10 FY11 FY12 FY13 10727 12819 16323 15948 -131 -3822 3565 -6839 10596 8997 19888 9109 950 697 -10410 -1833 2163 2911 -7382 -7852 13708 12606 2095 -575 FY10 FY11 FY12 FY13 0.0 5.7 5.5 4.0 0.0 17.3 32.6 27.5 4.9 22.8 29.2 52.7 1.7 4.3 4.3 4.2 1.0 3.7 3.1 2.8 4 EPS Debtor to Turnover% Creditors to Turnover% Trading At : Changes In Working Capital Net Cash From Operation Cash From Investment Cash from Finance Net Cash Flow during year Trade receivables Inventories to Turnover% CASH FLOWS Cash from Operation Short-term loans and advances Total Assets RATIOS P/B B/S PERFORMANCE Share capital Reserve & Surplus Total equity Long-term borrowings Short-term borrowings Long-term provisions Cash and bank balances Tangible assets Capital work-in-progress Long-term loans and advances Inventories Coal India LTD. Trade payables Short-term provisions Total liabilities Intangibles Narnolia Securities Ltd,

- 5. INDUSIND BANK 486 540 428 11 26 1M 1yr YTD Absolute 22.7 20.5 20.5 Rel.to Nifty 17.1 4.8 4.8 Current 24QFY1 4 3QFY1 3Promoters 15.2 15.2 15.3 FII 41.1 39.9 42.3 DII 7.2 7.4 7.0 Others 36.4 37.5 35.4 Financials Rs, Cr 2011 2012 2013 2014E 2015E NII 1376 1704 2233 2787 4053 Total Income 2090 2716 3596 4562 5827 PPP 1082 1373 1839 2452 2972 Net Profit 577 803 1061 1320 1633 EPS 12.4 17.2 20.3 25.3 31.1 5 CMP Margin expansion on the lower cost of fund and change in portfolio composition Margin expansion would be come from whole sale deposits and CASA front as per management. Indusind bank funding profile constitute about 35% of wholesale fund which is lower is cost and bank had raised $300 bn in form of foreign currency deposits which has cost around 3.5% while regular deposits cost fall around 6.5 to 7%. Further bank advance composition has switched in favour of corporate book in the wake of possible slowdown in commercial vehicle segment in retail book. Bank’s CASA improved from 31.8% in 2QFY14 to 32.2% in 3QFY14 led by SA growth of 50% YoY and 8% QoQ. Bank opened 13 branches in December quarter and another 40 branches are under process of various stages which are to be opened by March 2014. Aggressive branch expansion would be CASA accretion and deposits cost would be soften. Management expects NIM to remain steady with upward basis. Mkt Capital (Rs Cr) Target Price Change from Previous( Rs) INDUSIND Bank Vs Nifty Share Holding Pattern-% 1.26 lakhs Nifty 6589 Please refer to the Disclaimers at the end of this Report. (Source: Company/Eastwind) Indusind bank has outperformed Nifty by 16% in last one month and Bank Nifty by 6%. We believe this has been on the back of possible margin expansion as per management and market sentiments. Margin could be expanded on the back of lower cost of fund led by wholesale deposits, FCRN deposits fund, CASA accretion and shift loan book in fovour of corporate book due to slowdown in commercial segment in retail portfolio. Further we observe that there is about 80% correlation between price of HDFC bank and Indusind bank and their current price ratio (HDFC Bank to Indusind Bank) moved in range of 1.7 to 1.4 in five year time frame (Presently at 1.52). HDFC bank is close to 4 times of book but Indusind bank still has potential to move up (presently trading at 2.8 times of book versus 3.2 times in historical band). Our target price ratio would be 1.4 which implies expected HDFC price target of Rs.760 (4 times of book) and Indusind bank price target of Rs.540 (3.2 times of FY14E book). Stock Performance 52wk Range H/L 531/318 BSE Code 532187 NSE Symbol INDUSINDBK Average Daily Volume 25535 We have raised our target price largely due to two factors – (1) margin and return ratio likely to improve from April quarter as per management and (2) price would settle at 3.2 times of FY14E book due to showing some positive upturn in economy and boost up of market sentiment. Result update BUY Previous Target Price Upside Market Data "BUY" 26th March 2014 Narnolia Securities Ltd,

- 6. 6 INDUSIND BANK Please refer to the Disclaimers at the end of this Report. Trading significantly discount than HDFC Bank despite of almost lending profit Historically it has been observed that Indusind Bank one year forward price to book move in the range of 2.5 to 3.2 times. Recently bank’s price has appreciated but still below of 3 times of book. Further we also observe that price ratio of HDFC Bank and Indusind bank move in the range of 1.7 to 1.4 and their correlation in one year price is about 78%. HDFC Bank is now very close to 4 times of book (one year forward P/BV justifies as it has been historically observed) but Indusind bank is still to reach at 3.2 times of book. Therefore chances of price appreciation in Indusind bank are higher than HDFC Bank and said price ratio of both banks would be justified. We compare this bank with HDFC Bank is due to both banks have about almost same percentage in retail lending profile. Historical Price Band HDFC Bank and Indusind Bank Price Ratio Narnolia Securities Ltd,

- 7. 7 INDUSIND BANK Financials & Assuptions Source: Eastwind/Company Please refer to the Disclaimers at the end of this Report. Narnolia Securities Ltd, Income Statement 2011 2012 2013 2014E 2015 Interest Income 3589 5359 6983 8308 10419 Interest Expense 2213 3655 4750 5521 6367 NII 1376 1704 2233 2787 4053 Change (%) Non Interest Income 714 1012 1363 1775 1775 Total Income 2090 2716 3596 4562 5827 Change (%) Operating Expenses 1008 1343 1756 2110 2855 Pre Provision Profits 1082 1373 1839 2452 2972 Change (%) Provisions 504 180 263 455 535 PBT 577 1193 1576 1997 2437 PAT 577 803 1061 1320 1633 Change (%) Balance Sheet 2011 2012 2013 2014E 2015E Deposits( Rs Cr) 34365 42362 54117 62234 74681 Change (%) 23 28 15 20 of which CASA Dep 9331 11563 15867 20537 22404 Change (%) 24 37 29 9 Borrowings( Rs Cr) 5525 8682 9460 15559 18670 Investments( Rs Cr) 13551 14572 19654 23338 28005 Loans( Rs Cr) 26166 35064 44321 54071 67589 Change (%) 34 26 22 25 Ratio 2011 2012 2013 2014E 2015E Avg. Yield on loans 10.8 12.0 12.7 0.0 12.5 Avg. Yield on Investments 5.4 7.4 6.5 6.6 6.5 Avg. Cost of Deposit 5.3 7.3 8.8 8.9 8.5 Avg. Cost of Borrowimgs 7.0 6.7 7.6 7.5 7.5 Valuation 2011 2012 2013 2014E 2015E Book Value 87 101 146 171 195 CMP 264 321 405 405 405 P/BV 3.0 3.2 2.8 2.4 2.1

- 8. Hindalco Industries Ltd. 122 1- 140 132 15% NA 2- 500440 25497 17848 6284 1M 1yr YTD A. Captive bauxite is only 21km away from the refinery Absolute 24.7 38.1 30.6 B. Low reactive silica content which reduces caustic soda consumption Rel. to Nifty 18.3 21.2 16.1 C. D. 3QFY14 2QFY14 1QFY14 Promoters 37.0 37.0 37.0 FII 26.9 24.9 24.8 DII 13.3 14.4 14.3 Others 22.9 23.7 23.9 Financials : Q3FY14 Y-o-Y % Q-o-Q % Q3FY13 Q2FY14 Net Revenue 7273 5.8 15.4 6872 6305 EBITDA 629 8.1 16.5 582 540 PAT 344 -20.6 -3.7 434 357 EBIDTA % 9% 2.1 1.0 8% 9% NPM % 5% -25.0 -16.5 6% 6% . (In Crs) 8 Expansions ready to deliver… With the change in political climate, we believe there will be demand from domestic aluminium and copper consumer. Currently copper is going through a three month low,we expect it to be better after election. Key reasons for this low cost UAIL plant include: Novelis Business: Copper producer Sesa Sterlite Ltd will shut its smelter for 22 days starting April 26, for maintenance purpose. It produces 30,000 tons of refined copper per month and exports half of that to China. It will help rival producer Hindalco Industries raise sales. And also for Hindalco the copper realization is stable with the previous quarter, so it will be additional sales if orders executes. Ongoing Positive thrusts: The Q3FY14 financial results still do not include Mahan, Utkal and Aditya projects. All three projects have started production under trial run. UAIL’s commercial production started in December 2013. Management guided for FY15E and FY16E volumes of over 1mt and 1.5mt (full capacity), respectively. Integration of Aluminium smelters (a) Newly commissioned aluminium smelters (UP and Odisha) to ramp up volumes going forward and (b) Cost benefit of cheap alumina for its existing smelters with high quality, proximate and captive bauxite mine, whose production is currently running at ~4mtpa run-rate. We are expecting a good amount profit addition from these plants in H1FY15. Company Update CMP Target Price Previous Target Price Please refer to the Disclaimers at the end of this Report. Stock Performance-% Share Holding Pattern-% 1 yr Forward P/B Source - Comapany/EastWind Research Political sentiment: High trihydrate alumina content (40%) i.e., it is gibbsite form of bauxite with only 2% bohemite (low quality bauxite) Bauxite properties are such that process is carried out at relatively low temperature and pressure leading to savings in energy cost. Novelis’ business has started to improve with the benefit and strong demand from automobiles. However, the pricing pressure is impacting margin. Novelis is one of the world’s leading aluminium rolling and recycling companies supplying premium products in the markets of North America, Europe, Asia and South America. The company is the largest single producer of aluminium rolled products with an estimated share of 14% of the world’s supply. Novelis’ sales volumes are expected to grow at a CAGR of 5.7% in FY13-16E. On the back of increasing share of the automobile segment in the overall sales mix, we expect the EBITDA/ton to improve. Nifty Average Daily Volume (Nos.) Upside Change from Previous Market Data BSE Code HINDALCONSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) 137/83 "Buy" 25th March' 14 Narnolia Securities Ltd,

- 9. 9 Hindalco is a metal major with business interests in copper smelting & aluminium manufacturing domestically. It is also a leading aluminum converter globally through subsidiary Novelis. On the domestic aluminium business front, the company is undergoing an ambitious capacity expansion wherein its aluminium (primary metal) production capacity will increase from 560 KT currently to 1278 KT by FY15E. The planned capacity expansion is backed by corresponding alumina refinery with captive bauxite linkage. Bauxite conveyor expected to start in December 2014. Trading At : About The Company: Hindalco Industries Ltd. With greater comfort on sustainability and visibility of ramp up in UAIL operations, we raise our FY16E volume and consolidated EBITDA by ~2%. We continue to see Hindalco benefiting over next three years from volume growth in Novelis and Indian operations. Although Hindalco has expanded its aluminium capacity recently, low aluminium prices, sticky costs and delay in commencement of mining from captive blocks have resulted in decline in profitability over the past few quarters. In the near-term, its profitability is likely to be muted due to higher costs at Mahan smelter and low aluminium prices. Currently the stock is trading at 0.7x in 1yr Forward P/B and we believe with the changing political climate and improving aluminium demand the stock will accumulate to 0.8x P/B. Hence at CMP Rs.121.5 we are bullish on the stock to a medium term target price of Rs.140 which is a 15% upside addition. The company has received stage-2 forest clearance for its Mahan coal block subject to certain conditions. The next important step would be signing of liming lease with the state government and subsequent mine development, which is likely to take ~18-24 months. High debt on the books continues to weigh on valuations. Concerns: View & Valuations: Source - Comapany/EastWind Research Source - Comapany/EastWind Research Narnolia Securities Ltd,

- 10. FY11 FY12 FY13 FY14E 72078 80821 80193 81139 431 783 1012 1360 72509 81604 81205 82499 64102 72856 72395 72681 7976 7965 7798 8457 2725 2645 2822 3076 1839 1758 2079 2600 964 786 886 1201 366 211 -20 - 57 -50 16 - 2456 3397 3027 2940 8.5 10.6 8.4 7.8 FY10 FY11 FY12 FY13 191 191 191 191 21346 28824 31179 34597 21545 29023 31911 35330 10763 13736 37127 49857 13236 13956 3731 6442 3901 4138 5289 5691 9742 12980 11052 9613 1016 1077 1377 1610 69235 84376 101402 120590 7876 12272 15429 16435 21124 20133 19871 21490 5801 13131 22798 33831 1983 2035 3774 3170 11275 14096 13246 14332 6544 8000 8017 8952 2195 2556 3296 3770 1134 1164 2159 3257 69235 84376 101402 120590 FY10 FY11 FY12 FY13 1.6 1.4 0.8 0.5 20.5 12.8 17.7 15.8 10.8 11.1 9.9 11.2 16.0 18.0 13.7 12.0 FY10 FY11 FY12 FY13 5542 6929 8534 6852 4944 6226 7602 2978 -5448 -6710 -13220 -13765 428 825 6237 10278 -76 341 619 -510 10 Depriciation Interest Cost Tax Minority Interest Source - Comapany/EastWind Research Cash from Finance Net Cash Flow during year Source - Comapany/EastWind Research ROE% Long-term loans and advances Inventories Trade receivables Cash and bank balances Long-term borrowings Long-term provisions Share in Profit/(Loss) of Associates PAT Source - Comapany/EastWind Research Net Cash From Operation Cash From Investment Source - Comapany/EastWind Research Cash from Operation Short-term loans and advances Total Assets RATIOS P/B EPS Debtor to Turnover% Creditors to Turnover% CASH FLOWS Source - Comapany/EastWind Research Tangible assets Capital work-in-progress Trade payables Short-term provisions Total liabilities Intangibles Source - Comapany/EastWind Research Hindalco Industries Ltd. Source - Comapany/EastWind Research Short-term borrowings B/S PERFORMANCE Share capital Reserve & Surplus Total equity Net Revenue from Operation Other Income Total Income P/L PERFORMANCE Expenditure EBITDA Narnolia Securities Ltd,

- 11. Jindal steel & Power 265 285 NA 8% NA 532286 24796 11158 6495 1M 1yr YTD Absolute 6.9 -21.7 -27.9 Rel. to Nifty 0.5 -36.3 -37.6 3QFY14 2QFY14 1QFY13 Promoters 59.7 59.1 59.1 FII 21.9 21.3 20.8 DII 4.7 6.2 6.7 Others 13.7 13.3 13.4 Financials : Q3FY14 Y-o-Y % Q-o-Q % Q3FY13 Q2FY14 Revenue 5377 12.0 7.9 4802 4984 EBIDTA 1701 -5.0 16.7 1790 1457 Net Profit 562 -35.2 24.3 867 452 EBIDTA% 32 -15.1 8.2 37 29 NPM% 10 -42.1 15.2 18 9 (In Crs) 11 Market Data Challenging Fundamentals NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) 362/181 The Company has embarked on expansion projects of US$9bn in steel and power, backed by resource availability and steady cash flows. Improving free-cash-flows and volumes would be visible from end-FY15. Profitability is geared to iron ore and coal, which, against the present backdrop of improving iron-ore prices and higher coal consumption, would drive a re-rating. The stock quotes at 1.1x FY14e P/B. We initiate our coverage on this stock with a target of Rs.285/share on the basis of improving steel business, and Recommend Neutral. The consolidated turnover was up by 12% to Rs.5377 Cr against Rs. 4683 Cr in previous year period. Net Profit is after tax for the quarter is Rs. 562Cr (Rs. 867 Cr in Q3FY13). The steel business in volume and value terms grew by 11% and 7% respectively compared to the previous quarter. BSE Code JINDALSTEL Initial Coverage Neutral Upside Please refer to the Disclaimers at the end of this Report. Stock Performance-% Share Holding Pattern-% 1 yr Forward P/B Source - Comapany/EastWind Research Nifty Balance sheet at inflection point: In the past three years, 3bn dollar has been spent on expansion, and a further 6bn will be expended in the next three years. The expansion has been supported by the strong business cash flows. However, the net-debt-to-EBITDA level has hit 3.7x due to delayed cash flows, though the leverage ratio is likely to have peaked. Steel segment improving : Steel sales volumes of Jindal Steel and Power are likely to have improved in 3QFY14, to 0.75m tons. On the changing business and client mix, prices are likely to have been better. Export opportunities in the quarter due to favorable currency could have offset the impact of iron ore realizations and would have improved EBITDA, aided by stable costs. The Shadeed Oman HBI business, iron ore and coking coal mine are likely to have been stable.Management expects the company’s total steel capacity, both in India and overseas, to increase around 8 million ton as compared to current 3 million ton by the end of the fiscal. JSPL achieved a spectacular growth in its export volumes which in volume and value terms grew by 32% and 104% for the same period last year. The Company has received Rail order from DFCC for the prestigious Delhi – Kolkata corridor and export order from Ferrotech Alloys, UK. JSPL’s retail segment has been very successful and the sale during Q3 FY14. Jindal Power Ltd., a subsidiary of JSPL sales grew by 17.7% while PBT and PAT increased by 16.9% and 15.7% respectively in Q3 this year compared to Q3FY13.Net Sales of the company is expected to grow at a CAGR of 6% over 2012 to 2015E respectively. Average Daily Volume (Nos.) Change from Previous CMP Target Price Previous Target Price "Neutral" 24th March' 14 Narnolia Securities Ltd,

- 12. Coverage : Products • Mining Plants Locations • Jindal Industrial Park (Chhattisgarh) • Raipur Division (Chhattisgarh) • Tamnar (Odisha) • Angul (Odisha) • Zambia • Barbil (Odisha) • Tanzania • Tensa - (Jharkhand) • Patratu (Jharkhand) • Australia 12 Jindal steel & Power • Fabricated Sections Stabilizing Power segment: With a steady performance and power sales to Rs.1130 Cr in 3QFY14 (Rs.1068Cr in 3QFY13), the PLF in 3QFY14 would have held at ~100%, helping maintain realizations. Capped realizations and the power-surplus situation would have posed downside risks to earnings. Jindal Steel and Power Limited (JSPL) is one of India’s major steel producers with a significant presence in sectors like Steel, Mining, Power Generation and Infrastructure. With an annual turnover of over US$ 3.6 billion, JSPL is a part of the over US$ 18 billion diversified O. P. Jindal Group. In the recent past, JSPL has expanded its steel, power and mining businesses to various parts of the world particularly in Asia, Africa and Australia. The company has committed investments exceeding US$ 30 billion in the future and has several business initiatives running simultaneously across continents. The company produces economical and efficient steel and power through backward and forward integration. • Rails Revenue & Growth • Angels & Channels • TMT Re-bars • Wire Rods • Oman (Middle East) EBIDTA & Margin Debt Structure EBIDTA & Margin • Mozambique • South America • Madagascar Jindal Steel and Power Limited started as a steel manufacturing company, enhanced the company position as a major steel producer and diversified into various other sectors such as: • Petroleum • Cement and Infrastructure.• Power Generation & Trading Global Presence Earning Ratios Earning Ratios Business Areas • Semi-Finished Products • Power • Ferro Chrome • Silico Manganese • Sponge Iron • Parallel Flange Beams • Plates & Coils Narnolia Securities Ltd,

- 13. FY10 FY11 FY12 FY13 11092 13112 18209 19807 60 82 142 136 11152 13194 18351 19943 4197 5078 5311 6151 273 415 591 641 774 1303 5513 7020 5244 6795 11415 13812 5848 6317 6793 5994 997 1151 1386 1539 358 260 360 758 4553 4988 5189 3833 919 1184 1186 922 3573 3754 3965 2910 34 27 22 14 6.3 4.6 2.8 1.5 FY10 FY11 FY12 FY13 93 93 93 93 10324 14017 18018 21159 10417 14110 18111 21252 5330 5549 11180 15402 3274 8428 4569 8247 17 25 34 33 2266 2573 1251 1398 2036 3081 4111 4884 25122 36091 45008 57073 14 20 31 20 9883 14824 16463 19255 7947 10041 92 19230 1090 1527 2181 2421 1431 2773 3580 4524 753 1154 1307 1954 113 480 149 200 3464 4852 6927 8079 25122 36091 45008 57073 FY10 FY11 FY12 FY13 6.3 4.6 2.8 1.5 32.0 28.5 21.6 14.6 52.4 47.9 37.0 30.1 17.8 12.8 11.2 6.1 4.2 1.9 2.3 3.2 #N/A #N/A #N/A #N/A 13 Short-term provisions Interest Cost ROE% P/B Short-term borrowings Long-term provisions Trade payables B/S PERFORMANCE Share capital Reserve & Surplus Total equity Long-term borrowings Trade receivables Short-term loans and advances Total Assets P/B Total liabilities Cash and bank balances Intangibles Tangible assets PBT Net tax expense / (benefit) PAT Weighted Average Cost of Debt % Debt/Equity (debt/debt+networth or EBITDA % ROCE% RATIOS NPM % Capital work-in-progress Long-term loans and advances Inventories Other Expenses Expenditure EBITDA Depriciation Jindal steel & Power P/L PERFORMANCE Cost Of Projects & Contractual Employee benefit Expence Net Revenue from Operation Other Income Total Income Narnolia Securities Ltd,

- 14. 641 700 600 9 17 1M 1yr YTD Absolute 18.9 -19.7 -19.7 Rel.to Nifty 14.0 -30.2 -30.2 Current 4QFY13 3QFY1 3Promoters 58.9 57.9 57.9 FII 17.5 17.9 18.0 DII 18.5 18.4 19.1 Others 5.1 5.9 5.1 Financials Rs, Cr 2011 2012 2013 2014E 2015E NII 11807 13414 14857 16536 17691 Total Income 15420 17617 19072 20775 21930 PPP 9056 10614 10907 11155 12500 Net Profit 4433 4884 4748 3408 5209 EPS 140.6 144.0 134.3 94.1 143.9 14 Mkt Capital (Rs Cr) PNB Market Data Upside 890/400 BSE Code 532461 NSE Symbol PNB Company update ADD Over the last one month, PNB has outperform Nifty by 14% and Bank Nifty by 5.7% largely on account of external factor like economy and fiscal deficit showing some positive trend, softening of inflation from its peak level. Market sentiment are also boosted by recent opinion poll result which revealed BJP led NDA would come to power and economy would revived. Although we like Bank of Baroda over PNB but former is trading close to our target price. We value PNB at Rs.600 to Rs.775 per share implying 0.6 to 0.75 times of one year forward book depending upon current economy scenario and banks own fundamental. Looking at current fundamental and market sentiments we believe bank would trade in the range of Rs.600 to Rs.700. CMP Target Price Previous Target Price Average Daily Volume 19646 During the last quarter PNB experienced improvement of asset quality especially in fresh slippage front. Fresh addition in GNPA was declined by 52% sequential to Rs. 1142 cr as against average run rate in last ten quarter was Rs.2124cr. In percentage to gross advances, slippage ratio came down to 1.4% versus 3% in 2Q and 4.7% in 1Q. Cash recoveries were better which drag net NPA to 2.8% from 3.1% in previous quarter. Further bank restructure Rs. 2115 cr in 3QFY14 mainly come from power sector which was offset by similar amount of bond received from SEBs. Bank management has not indicated restructure pipeline in near term which means stable to improving asset quality trend could be seen. Margin expansion on the back of shifting concentration of portfolio mix and CASA growth In the subsequent section we will discuss two positive fronts that bank has witnessed in last quarter result (a) asset quality improvement especially in fresh slippage side, (b) margin expansion. We will discuss the possibility valuation contraction from current level. Please refer to the Disclaimers at the end of this Report. Creation of fresh slippage lower, impaired asset high but showing improvement During the last quarter bank’s margin expanded by 10 bps QoQ despite of moderate loan growth. Bank witnessed 9.7% YoY loan growth led by SME growth of 21.6% and retail segment growth of 17.5%. Retail and SME segment are high yield in nature. Further bank’s low cost deposits CASA increased by 13% in absolute term in which saving account supported with 14% growth current account 7% YoY. But overall deposits declined by 20% led by 33% declined of term deposits which inflated CASA ratio to 38.3% from 27%. Sequentially cost of fund declined by 25 bps while yield on loan declined by 11 bps on account of creation of low deposits franchise and shifting of portfolio. Change from Previous PNB Vs Nifty Share Holding Pattern-% 7.4 cr Nifty 6495 (Source: Company/Eastwind) Stock Performance 52wk Range H/L "ADD" 24th March2014 Narnolia Securities Ltd,

- 15. 15 PNB Please refer to the Disclaimers at the end of this Report. Management guided stable NIM, more focus on liability rather than asset yield According to bank management, PNB is focusing more on liability side rather than yield. Bank has reduced high cost bulk deposits from Rs.880 bn in Sept.2012 to Rs.220 bn in Dec.2013 and certificate of deposits came down to Rs.110 bn from Rs.240 bn in 3QFY13. Share of low cost deposits improved to 40% which would help bank to maintain NIM at 3.5% according to management. Valuation & View We upgrade PNB from neutral to add rating on account of improving sign of economy led by CAD number and softening of inflation. Recently market sentiments are also boosted up due to exit poll result which revealed that BJP led NDA government would be close to government formation in coming general election. In our valuation matrix, we value in the range of 0.6 times to 0.75 times of F14E book depending upon bank’s fundamental and market sentiment. Looking at current market sentiment and fundamental, we value bank in the range of Rs.600 to Rs.770 per share. We have added rating on the stock with current price target of Rs.700. Current Valuation Range Narnolia Securities Ltd,

- 16. 16 PNB Financial & Assuption Source : Eastwind/ Company Please refer to the Disclaimers at the end of this Report. Narnolia Securities Ltd, Income Statement 2011 2012 2013 2014E 2015E Interest Income 26986 36476 41893 43513 49565 Interest Expense 15179 23062 27037 26977 31875 NII 11807 13414 14857 16536 17691 Change (%) 39.3 13.6 10.8 11.3 7.0 Non Interest Income 3613 4203 4216 4240 4240 Total Income 15420 17617 19072 20775 21930 Change (%) 27.6 14.2 8.3 8.9 5.6 Operating Expenses 6364 7003 8165 9621 9430 Pre Provision Profits 9056 10614 10907 11155 12500 Change (%) 23.6 17.2 2.8 2.3 12.1 Provisions 4622 3577 4386 6253 5059 PBT 4433 7037 6522 4902 7442 PAT 4433 4884 4748 3408 5209 Change (%) 13.5 10.2 -2.8 -28.2 52.8 Balance Sheet Deposits( Rs Cr) 312899 379588 391560 450294 517838 Change (%) 25 21 3 15 15 of which CASA Dep 120325 134129 153344 139752 153766 Change (%) 18 11 14 -9 10 Borrowings( Rs Cr) 31590 37264 39621 47857 44728 Investments( Rs Cr) 95162 122703 129896 143572 149094 Loans( Rs Cr) 242107 293775 308725 339598 356578 Change (%) 30 21 5 10 5 Ratio Avg. Yield on loans 8.7 9.7 10.3 9.6 10.5 Avg. Yield on Investments 6.0 6.4 7.4 7.2 7.8 Avg. Cost of Deposit 4.4 5.6 6.5 6.4 6.6 Avg. Cost of Borrowimgs 4.4 4.5 3.9 4.0 4.1 Valuation Book Value 682 820 924 1000 1107 CMP 1220 926 759 543 543 P/BV 1.8 1.1 0.8 0.5 0.5

- 17. Persistent System. Footing on Product Business, and working aggressively on new emerging services; 11% Key facts from Management Interview to Media( on 20 th March,2014) 1M 1yr YTD Absolute 1.1 76.8 85.7 Rel. to Nifty 3.4 75.8 82.3 Current 2QFY14 1QFY14 Promoters 38.96 38.96 38.96 FII 18.26 15.28 14.84 DII 18.78 21.23 19.31 Others 24 24.53 26.89 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% 432.75 432.37 0.1 332.98 30.0 104.3 100.8 3.5 82.4 26.6 64.2 60.8 5.6 49.5 29.7 24.1% 23.3% 80bps 24.7% (60bps) 14.8% 14.1% 70bps 14.9% (10bps) 17 BSE Code 533179 NSE Symbol PAT (1) Persistent System is setting up a unit related to product and Product services, named it “ Accelerite” to manage efficiently. They are taking some of its IP led products into this Accelerite. We expect that company is able to compete as a product company, which “Accelerite” will in the market. (2) Management expects that the overall trends are looking good on Industry per se and new emerging segment will play a major role for growth. Now, clients are moving into new changes and focusing into new services and solution. (3) For 4QFY14E, muted set of growth could be seen and expecting Intellectual Property (IP) growth this quarter. (4) The business outlook though is very positive in the sense, and they are seeing good opportunities, good pipeline growth and many good interesting deals being signed. (5) Persistent system is expecting to see IP led growth at a range of 18-19% in FY14E and 20%+ in FY15E driven by HPCA without any addition of new IPs. At same point of time, they are also looking to scale strong potential of rCloud after adding new capabilities. Persistent management suggests that deal pipeline are looking strong and seeing good activity and traction in the market across the board. Its focus on some of newer technologies like cloud, analytics and mobility, M2M, digital transformation are gaining a lot of traction because of pickup in demand environment. Because of actively investment in these themes, management is very confident to see healthy growth. View and Valuation: The company’s focus is shifting greater proportion to IP led services and company has marquee clientele in cutting-edge technologies around cloud, mobility, digital and analytics; witnessing faster growth. Considering the company’s premium valuation, we advice “Book Profit” on the stock. At a CMP of Rs 1059, stock trades at 13.4x FY15E earnings. Our view could be change with management guidance, higher currency flactuations and post earnings of coming quarter. Financials Revenue EBITDA We cover Persistent System as one of the few companies in the tier-II with potential to grow revenue at a range of 18-20%, specially focused on emerging business and relationship building with marquee clients. Despite better predictability of growth and attractive visibility of its expansion in new emerging verticals, we advice to book profit on the stock because of its premium valuation. Change from Previous Nifty Share Holding Pattern-% 6483 Stock Performance PERSISTENT 52wk Range H/L 1220/477 Average Daily Volume 12139 Market Data "Persistently innovating.." CMP 1059 Target Price 1070 On recent management Interview, Persistent System announced its new footing of dedicated product business unit “Accelerite” to align its business strategy combined with Products and IP (Intellectual Property) based on SMAC (Social, Mobility, Analytics, Cloud) platform. Company update Book Profit Previous Target Price 960 Upside 1% 1 year forward P/E-x Rs, Crore (Source: Company/Eastwind) Mkt Capital (Rs Crores) Please refer to the Disclaimers at the end of this Report. 4236 EBITDA Margin PAT Margin "Book Profit" 21st Mar' 14 Narnolia Securities Ltd,

- 18. 18 Persistent System. (Source: Company/Eastwind) Operating Metrics Financials Please refer to the Disclaimers at the end of this Report. Narnolia Securities Ltd, 2QFY12 3QFY12 4QFY13 1QFY13 QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 Top1 16.0% 15.9% 17.2% 17.8% 20.7% 21.1% 21.6% 21.2% 22.5% 19.8% Top 5 38.6% 37.0% 36.6% 33.5% 36.3% 37.3% 36.7% 34.7% 36.4% 36.9% Top 10 49.4% 48.3% 48.8% 45.3% 47.0% 49.4% 47.9% 46.0% 47.3% 46.9% Onsite - Linear 12665 12387 12603 12789 12863 12772 14014 14567 14283 14510 Offshore - Linear 3803 3778 3895 3898 3978 4032 4143 4111 4109 4179 Yeild per Employee(excld- Trainee) 3208 3247 3350 3345 3746 3817 3769 3602 3919 3934 Total Employee 6900 6706 6628 6536 6370 6719 6970 7144 7457 7602 Attrition 17.7% 17.4% 18.3% 18.9% 16.9% 16.0% 14.4% 14.2% 14.0% 13.2% Utilization rate %(xclude IP Led ) 73.8% 74.1% 71.7% 74.1% 75.2% 77.3% 72.5% 70.0% 71.7% 72.9% Billing Rate-USD/ppm Employee Metrics Client Concentration Rs in Cr, FY10 FY11 FY12 FY13 FY14E FY15E Sales 601.16 775.84 1000.3 1294.5 1666.59 2061.72 Employee Cost 368.74 481.62 599.05 719 899.96 1123.64 Cost of technical professionals 0 30.67 41.68 54 91.66 113.39 Other expenses 86.05 105.24 135.2 218 291.65 366.99 Total expenses 454.79 617.53 775.93 990.78 1283.28 1604.02 EBITDA 146.37 158.31 224.37 303.72 383.32 457.70 Depreciation 33.52 42.39 61.1 78 100.55 93.54 Other Income 11.23 34.44 34.44 34.44 55.00 72.16 EBIT 112.85 115.92 163.27 225.44 282.76 364.16 Interest Cost 0 0 0.00 0.03 0.05 0.05 Profit (+)/Loss (-) Before Taxes 124.08 150.36 197.71 259.851 337.71 436.28 Provision for Taxes 9.05 10.62 55.09 75.37 92.03 119.98 Net Profit (+)/Loss (-) 115.03 139.74 142.62 184.481 245.69 316.30 Growth-% (YoY) Sales 1.2% 29.1% 28.9% 29.4% 28.7% 23.7% EBITDA 60.2% 8.2% 41.7% 35.4% 26.2% 19.4% PAT 74.1% 21.5% 2.1% 29.4% 33.2% 28.7% Expenses on Sales-% Employee Cost 61.3% 62.1% 59.9% 55.5% 54.0% 54.5% Other expenses 14.3% 13.6% 13.5% 16.9% 17.5% 17.8% Tax rate 7.3% 7.1% 27.9% 29.0% 27.3% 27.5% Margin-% EBITDA 24.3% 20.4% 22.4% 23.5% 23.0% 22.2% EBIT 18.8% 14.9% 16.3% 17.4% 17.0% 17.7% PAT 19.1% 18.0% 14.3% 14.3% 14.7% 15.3% Valuation: CMP 310 366.7 409.2 541 1059 1059 No of Share 4 4 4 4 4 4 NW 639.0 747.1 840.5 1018.3 1212.5 1477.3 EPS 28.8 34.9 35.7 46.1 61.4 79.1 BVPS 159.7 186.8 210.1 254.6 303.1 369.3 RoE-% 18.0% 18.7% 17.0% 18.1% 20.3% 21.4% P/BV 1.9 2.0 1.9 2.1 3.5 2.9 P/E 10.8 10.5 11.5 11.7 17.2 13.4

- 19. TCS Key facts from Management Commentary: 1M 1yr YTD Absolute -5.9 29.9 67.2 Rel. to Nifty -13.3 18.8 57.1 Current 2QFY14 1QFY14 Promoters 73.9 73.96 73.96 FII 16.33 16.09 15.67 DII 5.26 5.58 5.90 Others 4.51 4.37 4.47 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% 21294 20977.2 1.5 16069.93 32.5 6686.76 6633.0 0.8 4660.49 43.5 5333.43 4633.3 15.1 3549.61 50.3 31.4% 31.6% (20bps) 29.0% 240bps 25.0% 22.1% 290bps 22.1% 290bps 19 Average Daily Volume 1011877 NSE Symbol TCS 52wk Range H/L 2384/1300 Mkt Capital (Rs Crores) 433985 Now, revenue in 4QFY14E could be a bit lighter than what we had expected post 3QFY14 earnings. We are not much surprise on comments on weak revenue as well as ramping down on margin picture for current quarter. We believe that the 1QFY15E, the first seasonally strong quarter of the year, is the stern litmus test of TCS’s confidence for FY15E. (1) For 4QFY14E, revenue would be lower than preceding quarter because of seasonal impacts, and domestic revenue may clock negative growth largely impacted by upcoming general election. However, no pressure would be seen on revenue for FY15E. (2)Margin would decline by 40-50 basis points on cross currency movement and higher investments. However, company is expecting no hiccups on margin for long- term prospect. (3) The company is very optimistic on Europe, US and UK growth could be inline. Latin America will see good growth. Europe will continue to do well, and the US and the UK will be close to industry average. Middle East and APAC could be seen on flattish node. (4) Across vertical, Media and Entertainment has reported better, Telecom remains challenged. While, there could be some ray of growth because of higher penetration in Europe. Market Data BSE Code 532540 Previous Target Price 2360 Upside 23% Change from Previous 6% Mid Quarter's Analyst Meet: Lower than expected growth for 4QFY14E, but still better outlook for FY15E than FY14E, " Strong Fundamentals" CMP 2041 Target Price 2510 Company update Buy On Mid Quarter Analyst Meet, TCS also commented on weak revenue growth momentum for 4QFY14E followed by Infosys due to weak seasonality. Growth in 4QFY14E would be lower than the preceding quarter and margin would decline 40-50 basis points on cross currency movement and higher investments. However, sigh of relief was seen on FY15E outlook and comments on overall demand environment. 1 year forward P/E Rs, Crore (Source: Company/Eastwind) Please refer to the Disclaimers at the end of this Report. (5) Currency will play a small role with marginal impact of cross currency movement and average currency movement. There may be some accounting changes related to recognition of forex gains or losses, but it is not likely to be material. View and Valuation: We continue to remain positive on its demand outlook and margin profile, the management expects for robust deal pipeline going forward and also expects to materialize its emerging space like Digital as well as Cloud, Mobility, Analytics and Big data. We expect, TCS will be star performer in growth sense than other peers. Hence, we are maintaining 17% (revised from 18%) revenue growth in dollar term for FY14E because of improved demand environment, while NASSCOM expects 12-14% for the Industry. At a price of Rs 2041, it is trading at 18x FY15E earnings, We maintain" BUY" view on the stock with a target price of Rs 2510. Financials Revenue EBITDA EBITDA Margin PAT Margin PAT Share Holding Pattern-% Nifty 6524 Stock Performance "BUY" 20th Mar' 14 Narnolia Securities Ltd,

- 20. 20 TCS. Is there any setback? Please refer to the Disclaimers at the end of this Report. No sign of any ramp down: Management suggests that Continental Europe will likely grow ahead of overall company growth in FY15E. On vertical front, smaller verticals such as Energy & Utilities, Transportation and Life sciences & Healthcare might grow ahead of overall company average. While, its mature verticals like BFSI and Retails could grow flattish, Telecom continues to face structural issue. Contracts wins from continental Europe could change the shape of verticals. Still, we are not seeing any project ramp down. New emerging business on demand: A part of legacy business, the emerging opportunities in helping large corporations tap areas such as social media and data analytics are seen as increasingly contributing to the IT sector's next phase of growth. TCS and its Indian competitors are winning a significant share of several 2nd and 3rd generation renewal contracts as western companies look to both cut costs and modernise their IT infrastructure. Sales (USD) and Sales growth-% Considering above growth factors, we are not expecting any major concern with company's growth. The company is also focussed to drive operational improvements in the business and aims to expand reach in non-traditional markets and servicelines. (Source: Company/Eastwind) We expect 1% (QoQ) revenue growth in USD term for 4QFY14E, Unlike Infosys, TCS comments are based on potential impact from seasonally lower demand in its biggest market (US and Europe) and weak domestic demand environment. On previous comments, management had already quoted regarding demand volatility at home because of upcoming poll. Comparing with its nearest rival Infosys, TCS is not facing largely with any specific issue. Despite a weak commentary on 4QFY14E, management is aggressively confident to report better numbers in FY15E with healthy demand outlook. We are considering following factors for its growth story in FY15E. Healthy Demand Environment: TCS is much confident on healthy demand outlook and expects that FY15E could be better year than FY14E propelled by better discretionary spending in the US. Management suggests that except India, other emerging markets (contributes 18-19% of revenue) continue to see healthy demand. Also, in its FY15 revenue growth models, India (contributes 7% of sales) is the only market which TCS expects to be weak. Narnolia Securities Ltd,

- 21. 21 TCS. (Source: Company/Eastwind) Financials Please refer to the Disclaimers at the end of this Report. Narnolia Securities Ltd, Rs, Cr FY10 FY11 FY12 FY13 FY14E FY15E Net Sales-USD 6339.0 8187.0 10171.0 11569.0 13531.7 16012.2 Net Sales 30029.0 37325.1 48894.3 62989.5 81731.2 96073.3 Employee Cost 10879.6 13850.5 18571.9 24040.0 30060.7 35547.1 Overseas business expenses 4570.1 5497.7 6800.5 8701.9 11565.0 13930.6 Services rendered by business associates and others 1262.0 1743.7 2391.3 3763.7 4952.9 5764.4 Operation and other expenses 4622.8 5054.3 6694.8 8443.9 10044.8 12009.2 Total Expenses 21334.4 26146.2 34458.5 44949.6 56623.4 67251.3 EBITDA 8694.6 11178.9 14435.8 18040.0 25107.8 28822.0 Depreciation 601.8 686.2 860.9 1016.3 1279.2 1503.7 Amortisation 59.1 49.1 57.1 63.7 57.5 76.7 Other Income 272.0 604.0 428.2 1178.2 1348.6 1921.5 Extra Ordinery Items 0.0 0.0 0.0 0.0 0.0 0.0 EBIT 8033.7 10443.6 13517.9 16960.1 23828.6 27318.3 Interest Cost 16.1 26.5 22.2 48.5 35.9 33.8 PBT 8289.6 11021.2 13923.8 18089.8 25141.3 29206.0 Tax 1197.0 1830.8 3399.9 4014.0 5933.3 7009.4 PAT 7092.7 9190.3 10524.0 14075.7 19208.0 22196.5 PAT (Reported PAT) 7000.6 9068.6 10414.0 13917.4 19208.0 22196.5 Sales-USD 29.2% 24.2% 13.7% 17.0% 18.3% Sales 8.0% 24.3% 31.0% 28.8% 29.8% 17.5% EBITDA 21.3% 28.6% 29.1% 25.0% 39.2% 14.8% PAT 31.8% 29.6% 14.5% 33.7% 36.5% 15.6% EBITDA 29.0% 30.0% 29.5% 28.6% 30.7% 30.0% EBIT 26.8% 28.0% 27.6% 26.9% 29.2% 28.4% PAT 23.6% 24.6% 21.5% 22.3% 23.5% 23.1% Employee Cost 36.2% 37.1% 38.0% 38.2% 36.8% 37.0% Overseas business expenses 15.2% 14.7% 13.9% 13.8% 14.2% 14.5% Services rendered by business associates and others 4.2% 4.7% 4.9% 6.0% 6.1% 6.0% Operation and other expenses 15.4% 13.5% 13.7% 13.4% 12.3% 12.5% Tax rate 14.4% 16.6% 24.4% 22.2% 23.6% 24.0% CMP 780.8 1182.5 1322.0 1563.0 2041.0 2041.0 No of Share 195.7 195.7 195.7 196.0 196.0 196.0 NW 18466.7 24504.8 29579.2 38645.7 49940.0 62991.6 EPS 36.2 47.0 53.8 71.8 98.0 113.2 BVPS 94.4 125.2 151.1 197.2 254.8 321.4 RoE-% 38.4% 37.5% 35.6% 36.4% 38.5% 35.2% Dividen Payout ratio 28.1% 50.8% 37.5% 41.2% 41.2% 41.2% P/BV 8.3 9.4 8.7 7.9 8.0 6.4 P/E 21.5 25.2 24.6 21.8 20.8 18.0 Margin -% Expenses on Sales-% Valuation Growth-%

- 22. Narnolia Securities Ltd 402, 4th floor 7/ 1, Lords Sinha Road Kolkata 700071, Ph 033-32011233 Toll Free no : 1-800-345-4000 email: research@narnolia.com, website : www.narnolia.com Risk Disclosure & Disclaimer: This report/message is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Narnolia Securities Ltd. (Hereinafter referred as NSL) is not soliciting any action based upon it. This report/message is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any from. The report/message is based upon publicly available information, findings of our research wing “East wind” & information that we consider reliable, but we do not represent that it is accurate or complete and we do not provide any express or implied warranty of any kind, and also these are subject to change without notice. The recipients of this report should rely on their own investigations, should use their own judgment for taking any investment decisions keeping in mind that past performance is not necessarily a guide to future performance & that the the value of any investment or income are subject to market and other risks. Further it will be safe to assume that NSL and /or its Group or associate Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise, individually or otherwise in the recommended/mentioned securities/mutual funds/ model funds and other investment products which may be added or disposed including & other mentioned in this report/message.