Book Profit on HDFC LTD and Buy Kajaria Ceremics, Zensar Tech Stocks Today

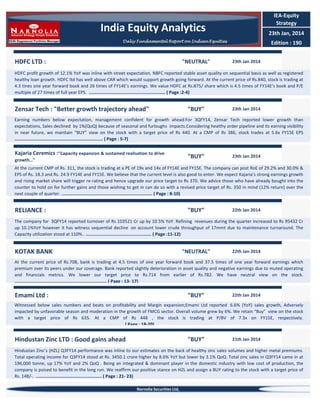

- 1. IEA-Equity Strategy India Equity Analytics 23th Jan, 2014 Daliy Fundamental Report on Indian Equities HDFC LTD : "NEUTRAL" Edition : 190 23th Jan 2014 HDFC profit growth of 12.1% YoY was inline with street expectation. NBFC reported stable asset quality on sequential basis as well as registered healthy loan growth. HDFC ltd has well above CAR which would support growth going forward. At the current price of Rs.840, stock is trading at 4.3 tines one year forward book and 26 times of FY14E’s earnings. We value HDFC at Rs.875/ share which is 4.5 times of FY14E’s book and P/E multiple of 27 times of full year EPS. .......................................................... ( Page :2-4) Zensar Tech : "Better growth trajectory ahead" "BUY" 23th Jan 2014 Earning numbers below expectation, management confident for growth ahead:For 3QFY14, Zensar Tech reported lower growth than expectations, Sales declined by 1%(QoQ) because of seasonal and furloughs impacts.Considering healthy order pipeline and its earning visibility in near future, we maintain “BUY” view on the stock with a target price of Rs 440. At a CMP of Rs 386, stock trades at 5.6x FY15E EPS ................................................................... ( Page : 5-7) Kajaria Ceremics :"Capacity expansion & sustained realisation to drive growth…" "BUY" 23th Jan 2014 At the current CMP of Rs. 311, the stock is trading at a PE of 19x and 14x of FY14E and FY15E. The company can post RoE of 29.2% and 30.0% & EPS of Rs. 18.3 and Rs. 24.9 FY14E and FY15E. We believe that the current level is also good to enter. We expect Kajaria’s strong earnings growth and rising market share will trigger re-rating and hence upgrade our price target to Rs 370. We advice those who have already bought into the counter to hold on for further gains and those wishing to get in can do so with a revised price target of Rs. 350 in mind (12% return) over the next couple of quarter. ..................................................................... ( Page : 8-10) RELIANCE : "BUY" 22th Jan 2014 The company for 3QFY14 reported turnover of Rs 103521 Cr up by 10.5% YoY. Refining revenues during the quarter increased to Rs 95432 Cr up 10.1%YoY however it has witness sequential decline on account lower crude throughput of 17mmt due to maintenance turnaround. The Capacity utilization stood at 110%.. .................................................. ( Page :11-12) KOTAK BANK "NEUTRAL" 22th Jan 2014 At the current price of Rs.708, bank is trading at 4.5 times of one year forward book and 37.5 times of one year forward earnings which premium over its peers under our coverage. Bank reported slightly deterioration in asset quality and negative earnings due to muted operating and financials metrics. We lower our target price to Rs.714 from earlier of Rs.782. We have neutral view on the stock. ...................................................................... ( Page : 13- 17) Emami Ltd : "BUY" 22th Jan 2014 Witnessed below sales numbers and beats on profitability and Margin expansion;Emami Ltd reported 6.6% (YoY) sales growth, Adversely impacted by unfavorable season and moderation in the growth of FMCG sector. Overall volume grew by 6%. We retain “Buy” view on the stock with a target price of Rs 635. At a CMP of Rs 448 , the stock is trading at P/BV of 7.3x on FY15E, respectively. ................................................................................... ( Page : 18-20) Hindustan Zinc LTD : Good gains ahead "BUY" 21th Jan 2014 Hindustan Zinc’s (HZL) Q3FY14 performance was inline to our estimates on the back of healthy zinc sales volumes and higher metal premiums. Total operating income for Q3FY14 stood at Rs. 3450.1 crore higher by 8.6% YoY but lower by 3.1% QoQ. Total zinc sales in Q3FY14 came in at 196,000 tonne, up 17% YoY and 2% QoQ . Being an integrated & dominant player in the domestic industry with low cost of production, the company is poised to benefit in the long run. We reaffirm our positive stance on HZL and assign a BUY rating to the stock with a target price of Rs. 148/-. .................................................. ( Page : 21- 23) Narnolia Securities Ltd,

- 2. HDFC LTD Result Updated CMP Target Price Previous Target Price Upside Change from Previous NEUTRAL 840.5 875 4 - Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 500010 HDFC 931/632 131340 1.16 6338 Stock Performance 1M Absolute 6.6 Rel.to Nifty 5.7 1yr 2.4 -2.1 YTD 2.4 -2.1 Share Holding Pattern-% Current 4QFY13 3QFY1 Promoters - 3 FII 74.3 73.1 73.6 DII 12.9 13.8 13.0 Others 12.9 13.1 13.3 "NEUTRAL " 23th Jan, 2014 HDFC's profit growth of 12.1% YoY was inline with street expectation. NBFC reported stable asset quality on sequential basis as well as registered healthy loan growth. HDFC ltd has well above CAR against requirement which would support growth going forward. At the current price of Rs.840, stock is trading at 4.3 tines one year forward book and 26 times of FY14E’s earnings. We value HDFC at Rs.875/ share which is 4.5 times of FY14E’s book and P/E multiple of 27 times of full year EPS. Profit growth in line with street expectation HDFC Ltd’s 3QFY14 result was in line with street expectation as profit grew by 12% YoY to Rs.1278 cr on standalone basis. Profit of the NBFC grew by 13.4% YoY on consolidated basis to Rs.1935 cr versus Rs.1706 cr in last quarter. NII grew by 12.8% YoY to Rs.1940 with inclusion of investment sale. Adjusted the same, NII grew by 17% YoY to Rs.1905 cr versus Rs.1624 cr last quarter corresponding year. Stable operating cost led operating growth at 12.5% YoY Other income was Rs.46 cr versus Rs.105 cr in last quarter and Rs.95 cr in previous quarter. Due to lower support from other income, total revenue grew by 13% YoY to Rs.1951 cr. Operating expenses increased to Rs.168 cr ( Up by 17% YoY) led operating profit growth of 12.5% YoY to Rs.1783 cr. Stable asset quality and balance sheet keep growing On asset quality side, NBFC’s gross non performing asset stood at 0.77% of loan of loan portfolio versus 0.79% in previous quarter and in absolute term in amounted to Rs.1478 cr. Loan book of the company corpus increased by 19.2% YoY to Rs.192266 cr as on December 2013. The total assets increased to Rs 218286 cr as HDFC Vs Nifty against Rs 183770 cr as at December, 2012 registering an increase of 19 per cent. Margin compression, spread would declined going forward Net interest margin for the quarter stood at 4% despite of 25 bps reduced home loan for retail customers during the quarter as against 4.06% in 2QFY14. Spread which is the difference of interest income and interest expenses, maintained at 2.25%. Going forward, there would be some pressure in spread as NBFC’s balance sheet keeps increasing with the support of borrow fund. In rising interest rate and inflationary pressure era, we expect to come down to 2% in next couple of quarters. Financials NII Total Income PPP Net Profit EPS 2011 4483 5558 3890 3535 24.1 Narnolia Securities Ltd, 2012 5212 6198 5746 4123 27.9 Rs, Cr 2013 2014E 2015E 6179 7053 8193 7257 8131 9271 6718 7562 8530 4848 5438 6194 31.4 35.2 40.1 (Source: Company/Eastwind) 2

- 3. HDFC LTD Quarterly Result NII grew on the back of healthy loan growth and stable spread Operating cost stable led PPP growth at 12.5% YoY Net profit of Rs.1278 cr was in line with expectation. Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 3

- 4. HDFC LTD HDFC Performance vs Nifty with base re-adjustment Quarterly Performance Rs Cr Income from Operations Profit on Sale of Investments Total Income Interest and Other Charges Staff Expenses Provision for Contingencies Other Expenses Depreciation Total Expenditure Profit from Operations before Other Income Other Income Profit Before Tax Tax Expense Net Profit After Tax 3QFY14 2QFY14 3QFY13 % YoY Gr % QoQ Gr 5985 5859 5146 16.3 2.2 35 87 96 -64.1 -60.1 6020 5946 5242 14.8 1.2 4080 4046 3521 15.9 0.8 71 67 64 10.3 5.4 25 15 40 -37.5 66.7 89 95 74 21.1 -6.3 8 9 6 41.8 -12.0 4273 4233 3705 15.3 1.0 1747 1713 1537 13.7 1.9 11 8 8 32.8 38.4 1758 1721 1545 13.8 2.1 480 455 405 18.5 5.5 1278 1266 1140 12.1 0.9 Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 4

- 5. Zensar Tech "BUY" 23rd Jan' 14 "Better growth trajectory ahead" Result update Buy CMP Target Price Previous Target Price Upside Change from Previous 386 440 400 14% 10% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 504067 ZENSARTECH 430/181 1691 20884 6339 Stock Performance 1M 13 12 Absolute Rel. to Nifty 1yr 32.6 28.4 YTD 16.5 12.8 Share Holding Pattern-% Current Promoters FII DII Others 1QFY14 48.27 11.99 0.96 38.78 48.35 11.68 1.26 38.71 1 year forward P/E 4QFY13 48.36 10.75 1.28 39.61 Earning numbers below expectation, management confident for growth ahead: For 3QFY14, Zensar Tech reported lower growth than expectations, Sales declined by 1%(QoQ) because of seasonal and furloughs impacts. PAT was down by 28%(QoQ), the profit growth has been impacted due to currency fluctuations during the period to the extent of Rs 19.06 Cr on a YoY basis and Rs 23.02 Cr on a QoQ basis. Management expects good growth starting from 4QFY14E with its Infrastructure Management (IM) business gaining momentum. The deal booking and pipeline is good and expects to perform well going forward. It expects double-digit growth in the Enterprise Services business for the FY15 on the back of healthy pipeline. In addition, it anticipates good growth from the IMS for the FY'15. On Margin front; During the Quarter, its EBITDA margin declined by 240bps to 14.7%and PAT margin down by 320bps to 8.6%. Post earning, management has expressed its margin at a range of 16-17% and PAT margin could be seen at a double figure for only organic business. On segmental growth; The Infrastructure Management(IM) business of the company, which has been restructured over the last few quarters, has shown a sharp increase in dollar revenues of over 12% on a sequential quarter basis. The company reported 12 new customer wins in the quarter including over USD27 mn of new business in IM. In INR term, Application Management Services (contributes 65% of Sales) declined by 4.5%(QoQ) and IM grew by 0.5% (QoQ). While, Products and License business jumped from Rs50cr (2QFY14) to 70cr. Mix geographical footing: During the quarter, revenue growth from Europe region was impressive with 10%(QoQ), while USA and ROW, both were down by 1% impacted by seasonal impact.Given the order book Enterprise, business expects to grow robustly going forward. Healthy order Pipeline: The Quarter has been upbeat with several new client additions, with the company’s focus on cloud, security and multi-vendor services reaping results. Recent Management comments also revealed favourable scenario of order booking. View and Valuation: The deal booking and pipeline is good and expects to perform well going forward. It expects double digit growth in the Enterprise Services business for the FY15E on the back of healthy pipeline. Also, it anticipates good growth from the IMS for the FY'15E. Order pipeline continues to be stable at $ 200 mn mainly on the back of good demand seen in Mobility, Cloud Computing and social networking side. Considering healthy order pipeline and its earning visibility in near future, we maintain “BUY” view on the stock with a target price of Rs 440. At a CMP of Rs 386, stock trades at 5.6x FY15E EPS. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 592.01 87.26 50.8 14.7% 8.6% 2QFY14 599.7 102.54 70.6 17.1% 11.8% (QoQ)-% (1.3) (14.9) (28.0) (240bps) (320bps) 3QFY13 525.5 70.1 48.7 13.3% 9.3% Rs, Crore (YoY)-% 12.7 24.5 4.3 140bps (70bps) (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 5

- 6. Zensar Tech Sales and Sales Growth-% (Source: Company/Eastwind) Margin-% (Source: Company/Eastwind) Sales and Sales Growth-% Revenue Mix-Geographies USA Europe Africa Row 1QFY13 72% 9% 8% 11% 2QFY13 71% 9% 9% 11% 3QFY13 72% 9% 9% 10% 4QFY13 74% 9% 9% 8% 1QFY14 76% 8% 9% 7% 2QFY14 75% 9% 10% 6% 3QFY142 75% 10% 9% 6% 64% 21% 15% 66% 22% 12% 68% 21% 11% 64% 24% 12% 65% 23% 12% 68% 23% 9% 65% 23% 12% 33% 35% 17% 15% 30% 31% 34% 40% 40% 36% (Source: Company/Eastwind) 18% 17% 18% 12% 12% 12% 37% 33% 18% 12% 37% 36% 18% 9% 35% 36% 17% 12% 52% 20% 7% 21% 53% 21% 11% 15% 61% 20% 2% 15% 63% 20% 2% 17% 61% 21% 2% 16% Revenue Mix-Service Type Application Management Services Infrastructure Magt Services Products and License Revenue Mix-Project Type Fixed Price Time & Materials Support Services Product Sales Revenue Mix-Vertical Manufacturing , Retail & Distribution Insurance, Banking & Finance Govt , healthcare & Utilities * Alliance & Others 54% 20% 11% 15% 54% 19% 10% 17% (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 6

- 7. Zensar Tech Clients/Headcounts Metrics; Revenue Mix-Geographies 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY142 47 6 1 1 43 7 2 1 41 7 2 1 40 8 2 1 49 6 1 1 47 6 1 1 49 6 2 1 35% 40% 69 35% 42% 59 35% 42% 56 35% 43% 55 37% 43% 66 39% 46% 61 36% 43% 59 69% 31% 81% 7286 72% 28% 82% 6825 70% 30% 83% 6504 69% 31% 82% 6508 68% 32% 81% 6519 67% 33% 80% 6657 69% 31% 79% 6741 Number of million dollar $1mn+ $5mn+ $10mn+ $20mn+ Client Contribution to Business top 5 clients top 10 clients DSO Effort & Utilization Onsite Offshore Utilization (Including Trainees) Headcount Financials; Rs, Cr Net Sales Other Operating Income Total income from operations (net) Purchases of stock-in-trade Employee Cost Other expenses Total Expenses EBITDA Depreciation Other Income Extra Ordinery Items EBIT Interest Cost PBT Tax PAT Growth-% Sales EBITDA PAT Margin -% EBITDA EBIT PAT Expenses on Sales-% Employee Cost Other expenses Tax rate Valuation CMP No of Share NW EPS BVPS RoE-% Dividen Payout ratio P/BV P/E FY10 497.08 0.00 497.08 0.00 393.17 0.00 393.17 103.91 24.92 8.15 0.00 78.99 0.55 86.59 2.43 84.16 FY11 562.56 15.03 577.59 0.00 343.12 135.71 478.83 98.76 25.88 14.20 0.00 72.88 0.85 86.23 -2.24 88.47 FY12 700.15 12.57 712.72 0.00 411.36 165.98 577.34 135.38 25.05 27.91 0.00 110.33 1.03 137.21 42.67 94.54 FY13 2114.52 13.95 2128.47 236.86 1177.83 418.73 1833.42 295.05 33.16 8.66 0.00 261.89 9.95 260.60 86.07 174.53 FY14E 2330.91 18.65 2349.56 223.21 1268.76 505.16 1997.13 352.43 39.67 46.99 0.00 312.76 10.81 348.94 118.64 230.30 FY15E 3014.78 24.12 3038.90 303.89 1641.01 653.36 2598.26 440.64 51.31 75.97 0.00 389.33 8.65 456.65 155.26 301.39 17.8% 28.7% 38.9% 13.2% -5.0% 5.1% 24.5% 37.1% 6.9% 202.0% 117.9% 84.6% 10.2% 19.4% 32.0% 29.3% 25.0% 30.9% 20.9% 15.9% 16.9% 17.6% 13.0% 15.7% 19.3% 15.8% 13.5% 14.0% 12.4% 8.3% 15.1% 13.4% 9.9% 14.6% 12.9% 10.0% 79.1% 0.0% 2.8% 59.4% 23.5% -2.6% 57.7% 23.3% 31.1% 55.3% 19.7% 33.0% 54.4% 9.6% 34.0% 54.4% 10.1% 34.0% 272.10 2.16 293.93 38.96 136.08 28.6% 16.4% 2.00 6.98 157.85 4.34 366.96 20.38 84.55 24.1% 19.9% 1.87 7.74 180.00 4.34 417.42 21.78 96.18 22.6% 37.3% 1.87 8.26 248.58 4.36 751.69 40.03 172.41 23.2% 21.9% 1.44 6.21 386.00 386.00 4.37 4.37 938.54 1193.91 52.70 68.97 214.77 273.21 24.5% 25.2% 18.9% 15.3% 1.80 1.41 7.32 5.60 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 7

- 8. Kajaria Ceremics Ltd. "Buy" 23rd Jan' 14 "Capacity expansion & sustained realisation to drive growth…" Result update Buy CMP Target Price Previous Target Price Upside Change from Previous 312 350 285 12% 19% Market Data BSE Code NSE Symbol 52wk Range H/L Capital Mkt (Rs Crores) Average Daily Volume (Nos.) Nifty 500233 KAJARIACER 174/320 2,356 63,000 6,322 Stock 1M 6.3 5.3 Absolute Rel. to Nifty 1yr 35.4 29.8 YTD 61.8 50.4 Share Promoters FII DII Others 2QFY14 52.1 25.6 3.8 18.5 1 yr Forward P/B 1QFY14 4QFY13 53.5 53.5 18.4 15.6 3.1 3.2 25.0 27.6 Despite the slowdown in the overall industrial space, company performed well in 3QFY14 numbers. Company's consolidated revenues increased by 5.4 per cent to Rs 440.4 crore while net profit witnessed a growth by 17.6 per cent to Rs 30.0 crore on yoy basis for the December quarter. Company's EBITDA has gone up by 9.5% to Rs 66.4 crore against Rs 60.6 crore in Q3FY13. The EBITDA margin of the company too has improved by 56 bps and stands at 15.1% in current quarter. On the basis of the company current quarter sales have been adversely affected due to production shut down at Gujarat which impact the company revenue by Rs. 2025 crore. Kajaria’s thrust on capacity expansion and gaining market share is helping it to post strong topline growth. Further, KCL has plans to do a capital expenditure of about Rs 425 crore over the financial year FY13 to FY16. This investment will help company to have revenue of over Rs 2500 crore by FY16. We are remain bullish on the counter and continue to maintain our buy rating on stock with an upgraded price target of Rs 350. Growth story : The company had taken a price hike in October'13, further recent developments in Morbi are structural positives Near-term demand trends look reasonable and this category has been relatively resilient to the general slowdown witnessed in consumption. If recent price increases stick, margins could expand significantly in the next few quarters. Further, Next year, company looking at selling almost about 60 million square meters of tiles. Capacity expansion : KCL has plans to do a capital expenditure of about Rs 425 crore over the financial year FY13 to FY16. This investment will help company to have revenue of over Rs 2500 crore by FY16. In addition, the Joint Ventures of KCL with the private firms - Jaxx Vitrified and Cosa Ceramics, having annual capacity of 5.7 million square meters (MSM) and 2.7 MSM respectively, will increase the KCL's production capacity. Hence, with the increased capacities of its vitrified tiles and strong demand in the market, we expect KCL to deliver strong growth over the medium term. Valuation : At the current CMP of Rs. 311, the stock is trading at a PE of 19x and 14x of FY14E and FY15E. The company can post RoE of 29.2% and 30.0% & EPS of Rs. 18.3 and Rs. 24.9 FY14E and FY15E. We believe that the current level is also good to enter. We expect Kajaria’s strong earnings growth and rising market share will trigger re-rating and hence upgrade our price target to Rs 370. We advice those who have already bought into the counter to hold on for further gains and those wishing to get in can do so with a revised price target of Rs. 350 in mind (12% return) over the next couple of quarter. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 440.4 66.5 30.0 15.1% 6.8% 2QFY14 478.4 65.6 29.2 13.7% 6.1% (Source: Company/ Eastwind Research) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. (QoQ)-% -7.9 1.4 3.0 140 bps 70 bps 3QFY13 418.0 60.7 25.0 14.5% 6.0% Rs, Crore (YoY)-% 5.4 9.6 20.4 60 bps 80 bps (Consolidated) 8

- 9. Kajaria Ceremics Ltd. Sales Volume Management Guidence FY15: Sales Value Expect 18-20% Revenue growth in FY15 out of which a volume growth of about 14 percent and price and value both should add about 4-5 percent. EBITDA margin to be somewhere around 16% in FY15, Expecting a growth somewhere between 50bps to 100bps. Mn sft Crore (Source: Company/Eastwind Research ) (Source: Company/Eastwind Research ) Sales Q-o-Q (Source: Company/Eastwind Research ) Margin % (Q-o-Q) (Source: Company/Eastwind Research ) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 9

- 10. Kajaria Ceremics Ltd. Key Financials PARTICULAR 2009A 2010A 2011A 2012A 2013A 2014E 2015E 664.9 736.4 952.3 1313.0 1612.0 1934.4 2321.3 Performance Revenue Other Income 1.0 0.0 1.1 1.5 3.0 3.0 3.0 953.4 1314.5 1615.0 1937.4 2324.3 665.9 736.4 EBITDA 94.9 115.7 147.9 206.8 244.5 285.3 359.8 EBIT 70.0 89.0 118.2 167.5 199.9 238.3 304.8 DEPRICIATION 24.9 26.7 29.7 39.3 44.6 47.0 55.0 INTREST COST 58.2 37.5 30.1 48.5 45.4 44.1 40.0 PBT 12.7 51.4 89.2 120.5 157.6 197.2 267.8 TAX 3.8 15.6 28.5 38.1 49.9 62.4 84.8 Extra Oridiniary Items Reported PAT NA NA NA NA NA NA NA 8.9 35.8 60.7 82.5 107.7 134.8 183.1 Dividend (INR) 1.7 8.6 17.1 21.4 25.7 29.9 34.2 DPS 0.2 1.2 2.3 2.9 3.5 4.1 4.6 EPS 1.2 4.9 8.2 11.2 14.6 18.3 24.9 EBITDA % 14.3% 15.7% 15.5% 15.7% 15.2% 14.8% 15.5% NPM % 1.3% 4.9% 6.4% 6.3% 6.7% 7.0% 7.9% Earning Yeild % 4.4% 7.9% 10.9% 6.6% 7.6% 5.9% 8.0% Dividend Yeild % 0.9% 1.9% 3.1% 1.7% 1.8% 1.3% 1.5% ROE % 5.5% 18.9% 27.3% 29.2% 30.2% 29.2% 30.0% ROCE% 1.8% 7.9% 11.9% 18.1% 20.4% 19.8% 22.0% Net Worth 162 189 223 282 357 462 611 Total Debt 325 263 288 175 170 220 220 Capital Employed 487 452 510 457 527 682 831 No of Share (Adj) 7 7 7 7 7 7 7 27 62 76 170 192 311 311 Total Income Yeild % Position CMP Valuation Book Value 22.0 25.7 30.2 38.3 48.5 62.7 83.0 P/B 1.2 2.4 2.5 4.4 4.0 4.9 3.7 Int/Coverage 1.2 2.4 3.9 3.5 4.4 5.4 7.6 P/E 23 13 9 15 13 17 12 (Source: Company/Eastwind Research ) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 10

- 11. RELIANCE "BUY" 22th Jan' 14 Good Growth Ahead Result Update BUY CMP Target Price Previous Target Price Upside Change from Previous 862 1040 21% - Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs, Cr) Average Daily Volume Nifty 500325 RELIANCE 954/765 279218 52019 6313 Result Highlights : Better-than-expected performance of the refining segment. Higher Other Income. The company for 3QFY14 reported turnover of Rs 103521 Cr up by 10.5% YoY. Refining revenues during the quarter increased to Rs95432 Cr up 10.1%YoY however it has witness sequential decline on account lower crude throughput of 17mmt due to maintenance turnaround. The Capacity utilization stood at 110%.The Petrochemical revenues for the quarter increased by 14.6% YoY to Rs25280 Cr driven by higher prices during the quarter. The Oil and Gas segment revenue witnessed a fall of 9.8% YoY to Rs1733 Cr on account of falling gas production from KG- D6. Company’s Q3FY14 EBITDA witnessed a sequential decline of 2.9% to Rs 7622 Cr mainly on account of fall in petrochemical margin and lower crude throughput at RIL’s refineries. Petrochemical EBIT for the quarter decreased by 15.2% sequentially to Rs2124 Cr due to lower volumes in polymers and polyester segments. The refining EBIT for the 3QFY14 came at Rs 3141 Cr down by 13 % YoY while Oil and gas EBIT came at Rs 540 Cr. Stock Performance-% Absolute Rel. to Nifty 1M -3 -4 1yr -4 -8 YTD 9 -7 Share Holding Pattern-% Promoters FII DII Others Current 2QFY14 1QFY1 4 45.3 45.3 45.3 18.3 17.7 17.4 11.5 11.8 11.6 25.0 25.2 25.7 1 Yr Price Movement Vs Nifty RIL’s GRM at US$7.6/bbl was relatively superior to Singapore-Dubai GRM (which has weakened to US$4.3/bbl in 3QFY14 vs US$5.4/bbl in 2QFY14 and US$6.6/bbl in 3QFY13) due to the strength in gasoil cracks and the widening light-heavy crude spread. Other Highlights: Shale gas: RIL has incurred a cumulative investment of USD6.8bn till date across its three shale gas JVs in the US. RIL’s share of revenue and EBITDA from the shale gas JVs during 3QFY14 amounted to USD221.3 Mn up 29% YoY and USD174 Mn,respectively.The Shale Business during 9MFY14 registered turnover USD 627Mn up 47% YoY and EBITDA for the period stand was USD 462Mn up 40% YoY. Retail business: Revenues grew to Rs3927Cr in the third quarter compared to Rs 2839 Cr for the same period last fiscal translating growth of 38% YoY. The Retail business reported an EBITDA of Rs1bn during the quarter. The company added 27 new stores in 3QFY14, taking the total number of stores to 1,577. The company’s outstanding cash on the standalone balance sheet as at end-3QFY14 was at USD14.4bn and outstanding debt was at USD13.2bn View and Valuation: The stock is trading at Rs 862 and in light of 3QFY14 performance, business outlook and management commentary we maintain our previous recommendation BUY for the stock with Target Price Rs 1040. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 103521 7622 5511 7.4% 5.3% 2QFY14 103758 9909 5490 9.6% 5.3% (QoQ)-% (0.2) (23.1) 0.4 (220bps) (10bps) 3QFY13 93886 8373 5502 8.9% 5.9% Rs, Crore (YoY)-% 10.3 -9.0 0.2 (160bps) (50bps) (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 11

- 12. RELIANCE Sales Trend (Rs/Bn) Sales was flat on sequential basis. (Source: Company/Eastwind) EBITDA & OPM % Yearly decline in EBITDA reflects lower refining margin and lower crude throughput (Source: Company/Eastwind) PAT & NPM % Growth in PAT due to strong financial performance of the refining segment and higher-thanexpected other income (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 12

- 13. KOTAK BANK Result update CMP Target Price Previous Target Price Upside Change from Previous NEUTRAL 702 714 782 2 -9 Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 500247 KOTAKBANK 804/588 54341 1.12 lakhs 6314 "NEUTRAL" 22th Jan, 2014 At the current price of Rs.708, bank is trading at 4.5 times of one year forward book and 37.5 times of one year forward earnings which premium over its peers under our coverage. Bank reported slightly deterioration in asset quality and negative earnings due to muted operating and financials metrics. We lower our target price to Rs.714 from earlier of Rs.782. We have neutral view on the stock. Muted revenue growth driven moderate NII growth negative non Interest Income Kotak Mahindra Bank reported moderate growth in core banking business with NII grew by 10.9% YoY to Rs.913 cr. Muted revenue growth was driven by lower loan growth, flat to negative non interest income, declined credit deposits ratio and NIM compression. Non- interest income reported flat to negative numbers to Rs.300 cr from Rs.305 cr in 3QFY13. Fee income registered growth of 6% YoY to Rs.226 cr Stock Performance 1M Absolute -3.6 Rel.to Nifty -4.1 from Rs.213 cr in corresponding quarter last year and treasury income reported 1yr 12.4 7.8 YTD 12.4 7.8 Share Holding Pattern-% Current 4QFY13 3QFY1 3 Promoters 43.7 43.7 43.8 FII 31.8 31.1 31.2 DII Others 1.7 22.9 KOTAK Bank Vs Nifty 2.3 22.9 2.2 22.9 128% YoY growth to Rs.144 cr versus Rs.63 cr in 3QFY13. Cost Income ratio increased led flat growth in operating profit Operating expenses increased by 13.1% to Rs.628 cr from Rs.555 cr in last year same quarter in which employee cost decreased by 5% YoY while other operating cost increased by 33% YoY. Operating profit reported growth of 2.1% YoY to Rs.585 cr largely due to lower other income. Cost income increased to 51.8% in 3QFY14 versus 49.2% in 3QFY13 and 50.3% in 2QFY14. Sequentially asset quality deteriorated In 3QFY14, bank’s asset quality deteriorated by 7% on sequential basis in absolute term while as a percentage to gross advance, it stood at 2% (slightly deteriorated by 4 bps). During quarter bank had made provisions of Rs.70 cr versus Rs.72 cr in previous year in which loan loss provisions were Rs. 25.44 cr and investment provisions to the tune of Rs. 43.3cr. As the result, net NPA increased by 20% QoQ while as a percentage to net advance, this ratio stood at 1.1% versus 1% in previous quarter. Provisions coverage ratio (without technical write off) declined by 590 bps on sequential basis to 45.7%. Financials NII Total Income PPP Net Profit EPS 2011 2098 781 1325 818 11.1 2012 2512 977 1655 1085 14.6 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. Rs, Cr 2013 2014E 2015E 3206 3682 3762 1161 1412 1412 2157 2585 2536 1361 1450 1601 17.7 18.9 20.8 (Source: Company/Eastwind) 13

- 14. KOTAK BANK Profit declined due to lower NII Growth, flat to negative other income growth along with muted performance in operating and financials metrics Kotak bank reported net profit de-growth of 6% YoY to Rs.340 cr largely due to lower loan growth, declined in credit deposits ratio, moderate NII growth , lower other income along with higher cost income ratio. Consequently ROA declined to 1.6% from 1.8% in 3QFY14 and ROE declined to 11.4% from 16.1%. On consolidated level, bank’s profit grew by 2.4% YoY to Rs.591.25 cr. Consolidated profit come from Kotak Mahindra Prime, Kotak Securities, Kotak Mahindra Capital, Kotak Mahindra Old Mutual Life Insurance and other businesses. Loan & deposits growth muted on YoY basis, saving deposits grew on the back of lucrative interest rate Loan increased by 5.8% YoY to Rs.53149 cr from Rs.50245 cr in corresponding quarter last year led by retail and corporate loan growth of 6% and 5% respectively. Deposits grew by 6% YoY led by saving deposits growth of 37.6% YoY largely due to bank’s lucrative interest rate on saving deposits. Demand deposits and term deposits registered growth of 6.1% and 0.6% respectively. CASA ratio, in absolute term grew by 22% YoY while in percentage to total deposits, it stood at 29.7% versus 25.9% in last quarter. Valuation &view At the current price of Rs.708, bank is trading at 4.5 times of one year forward book and 37.5 times of one year forward earnings which premium over its peers under our coverage. Bank reported slightly deterioration in asset quality and negative earnings due to muted operating and financials metrics. We lower our target price to Rs.714 from earlier of Rs.782. We have neutral view on the stock. Valuation Band Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 14

- 15. KOTAK BANK Fundamental through graph Muted growth in NII was on account of moderate growth in operating as well as financials metrics Lower non interest income and higher operating cost led operating growth of 2.1% YoY Profit declined by 6% YoY due to lower NII growth, flat non interest income, higher operating cost and higher provsions on yealry basis. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 15

- 16. KOTAK BANK Quarterly Performance Quarterly Result( Rs Cr) Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Others Total Interest Income Others Income Total Income Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions PBT Tax Net Profit 3QFY14 1702 484 6 0 2192 300 2492 1280 913 300 1212 277 350 628 585 70 515 175 340 2QFY13 1644 510 7 11 2172 297 2469 1248 924 297 1221 265 350 615 607 72 534 182 353 3QFY13 % YoY Gr % QoQ Gr 1597 6.5 3.5 492 -1.6 -5.0 5 21.3 -11.7 0 82.6 -96.3 2095 4.7 0.9 305 -1.7 0.9 2399 3.9 0.9 1272 0.6 2.5 823 10.9 -1.2 305 -1.7 0.9 1128 7.5 -0.7 292 -4.9 4.8 264 32.9 0.1 555 13.1 2.1 573 2.1 -3.6 42 64.6 -3.5 530 -2.9 -3.6 169 3.8 -3.7 362 -6.0 -3.6 Balalce Sheet( Rs Cr) Net Worth Deposits Borrowings Total Liabilities Investment Advances Total Assets 11896 54671 13673 84297 23615 53149 84297 11569 52642 14523 82185 22528 50609 82185 8992 51524 18566 82428 26587 50245 82428 Asset Quality GNPA NPA GNPA NPA PCR(w/o technical write-off) 1076.2 584.5 2.02 1.10 46 1005.9 486.9 1.99 0.96 52 740.0 322.7 1.47 0.64 56 32.3 2.8 6.1 3.9 -26.4 -5.9 2.3 2.6 -11.2 4.8 5.8 5.0 2.3 2.6 Source: Eastwind/ Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 16

- 17. KOTAK BANK Financials & Assumption Rs Cr Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Others Total Interest Income Others Income Total Income Interest on deposits Interest on RBI/Inter bank borrowings Others Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions Net Profit 2011 2012 2013 2014E 2015E 3214 957 17 1 4190 781 4970 1498 349 246 2092 2098 781 2878 784 769 1553 1325 507 818 4867 1306 4 2 6180 977 7158 2504 775 389 3668 2512 977 3490 902 932 1835 1655 570 1085 6146 1870 24 2 8042 1161 9203 3346 1055 435 4837 3206 1161 4366 1075 1135 2210 2157 796 1361 6751 2079 27 20 8877 1412 10290 3926 0 1071 5195 3682 1412 5095 1129 1380 2509 2585 389 1450 8141 2006 7 20 10173 1412 11586 4515 0 2583 6411 3762 1412 5175 1188 1451 2639 2536 249 1601 Deposits Deposits Growth(%) Borrowings Borrowings Growth(%) Loan Loan Growth(%) Investment Investment Growth(%) 29261 22.5 11724 90.9 29329 41.2 17121 36.8 38537 31.7 16596 41.6 39079 33.2 21567 26.0 51029 32.4 20411 23.0 48469 24.0 28873 33.9 58683 15.0 14671 -28.1 55739 15.0 25718 -10.9 67486 15.0 35387 141.2 64100 15.0 30862 20.0 11.0 5.6 8.6 5.1 5.1 5.1 12.5 6.1 9.8 6.5 7.0 6.7 12.7 6.5 9.9 6.6 7.3 6.8 12.7 8.1 4.5 6.7 7.3 7.1 12.7 6.5 4.0 9.5 7.3 6.2 93 4.9 41.2 108 5.0 37.0 Eastwind Calculation Yield on Advances Yield on Investments Yield on Funds Cost of deposits Cost of Borrowings Cost of fund Valuation Book Value P/BV P/E 123 159 179 5.3 4.5 4.0 36.9 37.5 34.0 Source: Eastwind/ Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 17

- 18. Emami Ltd "BUY" 22nd Jan' 14 "The niche advantage." Results update BUY Witnessed below sales numbers and beats on profitability and Margin expansion; CMP Target Price Previous Target Price Upside Change from Previous 448 635 500 42% 27% For 3QFY14, Emami Ltd reported 6.6% (YoY) sales growth, Adversely impacted by unfavorable season and moderation in the growth of FMCG sector. Overall volume grew by 6%. International Business has performed well with 37% sales growth led by aggressive growth in GCC and SAARC. PAT up by 31%(YoY) due to judicious mix of benign RM cost and price hike on some selective brands. its market share increased across all brands during the quarter. We expect revenue growth could be seen better in 4QFY14 as the weather related headwinds for cooling oils is behind us and pricing on balms stabilize. As the company has already forward contracted menthol for the year, menthol prices continue to trend lower and price hikes for the year have been taken place. Margin expansion visibility remains high going forward. Margin Picked up: The OPM has increased by 520 bps to 30.2 % due to fall in RM cost by 60 bps to 28.1%, purchases of finished goods by 400bps to 4.6% and ASP cost by 160 bps to 15% of adjusted net sales. The mgmt said that the prices are likely to remain stable for the remainder of the fiscal year. The company has covered the Menthol prices for the whole year. Volume and Value growth: The volume of Navratna oil grew by 1%, Fair and Handsome was 2% and Balm volume grew by 4%. While, Boroplus volume decline by 4% on YoY basis impacted by unfavourable winter season. The value growth for , Fair and Handsome was 12%, Navratna oil was 6% while Balm was at 3%. While, Boroplus decline by 3% on YoY basis. Distribution Reach: Although rural continues to grow ahead of urban markets, the growth for Emami from rural area was at 13% and urban growth was flat on YoY basis. The company, which gets majority of its rural revenues from Uttar Pradesh, Bihar and West Bengal, is looking beyond these markets for its future growth. The company's direct outlet reach is 6 lakh. The company has added 20000 outlets in Q2 and expects to add 75000 – 100000 in FY14E. Product expansion: The company has launched Boroplus face-wash last month and there will be new launches in Q4 also. The mgmt said that for next 2 – 3 years it has strong pipeline of products to be launch. View and Valuation: Considering Emami’s focus on increasing rural penetration, effective cost management, continuous strengthening of its brand equity and new product funnel strongly in next 2- 3 years. The company's efforts are continue to strengthen its market share in most of the categories it is present, we are positive on the stock. We retain “Buy” view on the stock with a target price of Rs 635. At a CMP of Rs 448 , the stock is trading at P/BV of 7.3x on FY15E, respectively. Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 531162 EMAMI 539/368 10275 37072 6314 Stock Performance 1M -3.3 -3.9 Absolute Rel. to Nifty 1yr 15.2 11.1 YTD 15.3 10.8 Share Holding Pattern-% Promoters FII DII Others Current 2QFY14 1QFY14 72.74 72.74 72.74 16.69 16.68 15.46 2.02 2.18 3.27 8.55 8.4 8.53 1 yr Forward P/B Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 584.7 176.8 150.7 30.2% 25.8% 2QFY14 406.7 87.4 80 21.5% 19.7% (QoQ)-% 43.8% 102.3% 88.4% 870bps 610bps 3QFY13 548.65 136.9 114.9 25.0% 20.9% Rs, Cr (YoY)-% 6.6% 29.1% 31.2% 520bps 490bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 18

- 19. Emami Ltd Sales and Sales Growth(%) Sales for3QFY14E increased by 6.6%(YoY). Overall volume grew by 5%. However, the company continues to successfully strengthen its market share in most of the categories it is present. (Source: Company/Eastwind) Margin-% The OPM has increased by 520 bps to 30.2 % due to fall in RM cost by 60 bps to 28.1%, (Source: Company/Eastwind) Expenses on Sales Management is focussed to reduce its Ad revenue as before. (Source: Company/Eastwind) Ad spends: The ad spends in 3QFY14 have declined by 360bps YoY to 15% as a percentage of sales. The ad spends, as a percentage of sales, are expected to be in the range of 1718% in 4QFY14 and FY15. Tax: The effective tax rate was flat at 17% on YoY basis.and Company expects to see samr range of tax rate for FY15E (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 19

- 20. Emami Ltd Key facts from Conference Call (Attended on 21st Jan 2013) ▪ The management expects sales growth of 15%, consolidated with 3.4% growth from new launches and 12% from existing brands while PAT guidance also continues to stand at 15% aided by strong gross margin expansion on the back of lower Mentha Oil prices. ▪ The mgmt has guided for a capex of Rs 70 – 75 crore each during FY14 and FY15. ASP for FY14 will be 16% - 17%. And 18% for FY15%. ▪ The management expects 25% growth from International business considering political uncertianty in Bangladesh for FY15E. ▪ The company has already taken price hikes and no further hikes are expected in FY14E. Total annualized price hike for FY14 is 4% YoY. ▪ Emami has a good cash balance of Rs5bn which it expects to utilize for acquisition. Financials Rs in Cr, Sales Raw Materials Cost Purchases of stock-in-trade WIP Employee Cost Advertisement and Publicity Other expenses Total expenses EBITDA Depreciation and Amortisation Other Income Exceptional Items EBIT Interest PBT Tax Exp PAT Growth-% (YoY) Sales EBITDA PAT Expenses on Sales-% RM Cost Ad Spend Employee Cost Other expenses Tax rate Margin-% EBITDA EBIT PAT Valuation: CMP No of Share NW EPS BVPS RoE-% Dividend payout-% P/BV P/E FY10 1037.98 380.53 0 0 57.91 194.42 158.66 791.52 246.46 117.52 7 89.97 128.94 20.98 204.93 35.21 169.72 FY11 1247.08 346.76 204.9 -28.48 72.87 219.41 178.17 993.63 253.45 116.09 33.1 113.9 137.36 15.23 269.13 40.41 228.72 FY12 1453.51 415.12 189.13 22.17 92.31 228.99 209.02 1156.74 296.77 120.89 54.12 84.15 175.88 15.21 298.94 40.12 258.82 FY13 1699.09 539.83 182.14 -6.52 115.55 279 241.82 1351.82 347.27 124 56 96 223.2 6.6 368.69 54 314.68 FY14E 1886.97 566.09 141.52 22.64 141.52 311.35 283.05 1466.18 420.79 103.61 56.61 94.35 317.18 6.86 461.28 76.11 385.17 FY15E 2177.55 675.04 174.20 21.78 174.20 348.41 332.08 1725.71 451.84 119.57 65.33 119.77 332.28 5.14 512.22 87.08 425.15 35.5% 91.0% 85.0% 20.1% 2.8% 34.8% 16.6% 17.1% 13.2% 16.9% 17.0% 21.6% 11.1% 21.2% 22.4% 15.4% 7.4% 10.4% 36.7% 18.7% 5.6% 15.3% 17.2% 27.8% 17.6% 5.8% 14.3% 15.0% 28.6% 15.8% 6.4% 14.4% 13.4% 31.8% 16.4% 6.8% 14.2% 14.6% 30.0% 16.5% 7.5% 15.0% 16.5% 31.0% 16.0% 8.0% 15.3% 17.0% 23.7% 12.4% 16.4% 20.3% 11.0% 18.3% 20.4% 12.1% 17.8% 20.4% 13.1% 18.5% 22.3% 16.8% 20.4% 20.8% 15.3% 19.5% 197.70 15.13 625.42 11.22 41.34 27.1% 23.4% 4.78 17.62 249.40 15.13 689.85 15.12 45.59 33.2% 23.2% 5.47 16.50 260.80 15.13 706.63 17.11 46.70 36.6% 23.8% 5.58 15.25 397.40 15.13 777.47 20.80 51.39 40.5% 44.6% 7.73 19.11 448.00 22.70 1069.71 16.97 47.13 36.0% 24.1% 9.51 26.40 448.00 22.70 1388.64 18.73 61.18 30.6% 25.0% 7.32 23.92 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. (Source: Company/Eastwind) 20

- 21. Hindustan Zinc LTD. "BUY" 21st Jan' 14 Good gains ahead Result Update BUY CMP Target Price Previous Target Price Upside Change from Previous 135 148 143 10% 3% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume (Nos.) Nifty 500188 HINDZINC 143/94 56133 5613 6291 Stock Performance-% 1M 4.3 0.0 Absolute Rel. to Nifty 1yr -1.7 9.2 YTD -3.4 11.3 Share Holding Pattern-% 3QFY14 64.9 1.8 31.4 1.8 Promoters FII DII Others 2QFY14 1QFY14 64.9 64.9 1.8 1.5 31.4 31.5 1.8 2.1 1 yr Forward P/B 450 400 350 300 250 200 150 100 50 Jul-13 Jan-14 Jul-12 Jan-13 Jul-11 Jan-12 Jul-10 Jan-11 Jul-09 Jan-10 Jul-08 Jan-09 Jul-07 Jan-08 Jan-07 0 Source - Comapany/EastWind Research The attorney-general’s clearance for the Centre’s proposal to divest its residual stake in Hindustan Zinc Ltd (HZL) lifted the Street’s mood. As the government holds 29.5 per cent (minority) stake in HZL, the attorney-general said HZL was no longer a public sector company. With the majority 64.92 per cent stake with Vedanta, the group will be eyeing the government’s stake as well as the remaining 5.58 per cent owned by others. A reason to wait and watch , is since the government is looking at auction, how much will Vedanta be able to garner and what price it is willing to pay is not known. In the past it has said it wanted majority control when Vedanta had earlier offered Rs 149 a share (13.7 per cent more than the current price). If this is any benchmark, investors stand to gain. Q3FY14 Performance : Hindustan Zinc’s (HZL) Q3FY14 performance was inline to our estimates on the back of healthy zinc sales volumes and higher metal premiums. Total operating income for Q3FY14 stood at Rs. 3450.1 crore higher by 8.6% YoY but lower by 3.1% QoQ. Total zinc sales in Q3FY14 came in at 196,000 tonne, up 17% YoY and 2% QoQ . The company realised premium on metal sales amounting to ~US$241/tonne for zinc (Zn) & ~US$305/tonne for lead (Pb) . Lead sales volume for the quarter stood at 23500 tonnes (lower by 24% QoQ and 22% YoY), while silver sales volumes stood at 78500 kg (lower by 31% YoY and 14% QoQ) . EBITDA came in at Rs.1823.8 crore and inline to our estimate of Rs. 1829.6 crore. Subsequently, net profit stood at Rs. 1722.7 crore . Being an integrated & dominant player in the domestic industry with low cost of production, the company is poised to benefit in the long run. We reaffirm our positive stance on HZL and assign a BUY rating to the stock with a target price of Rs. 148/-. Investment Concern HZL’s revenues are directly linked with the global market for products essentially, Zinc and Lead which are priced with reference to LME prices and Silver to LBMA (London Bullion Metal Association) prices. Disruptions in mining due to equipment failures, unexpected maintenance problems , non-availability of raw materials of appropriate price, quantity and quality for our energy requirements, disruptions to or increased cost of transport services or strikes and industrial actions or disputes.Lower than expected demand by galvanizing industries for zinc and industrial batteries, car batteries industries for lead would affect the company estimates. Financials : Q3FY14 Y-o-Y % Q-o-Q % Q3FY13 Q2FY14 Net Revenue 3450 8.6 -9.8 3178 3826 EBITDA 1824 22.1 -3.1 1883 1494 Depriciation 210 18.6 12.9 186 177 Tax 305 50.2 20.1 254 203 PAT 1723 6.8 5.1 1640 1613 (In Crs) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 21

- 22. Hindustan Zinc LTD. Silver(rs/ounce) Nov-13 Dec-13 Nov-13 Dec-13 Nov-13 Dec-13 Oct-13 Sep-13 Jul-13 Aug-13 Jun-13 Apr-13 May-13 Feb-13 Mar-13 1800 1600 1400 1200 1000 800 600 400 200 0 Jan-13 Source - Comapany/EastWind Research LME Price/Ton Lead Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 May-13 Apr-13 Mar-13 160000 140000 120000 100000 80000 60000 40000 20000 0 Feb-13 From the Management Corner : Volatile Desel Price and high Sulphuric acid price affecting the company,s PAT adversly.Company is tracking on 95% capacity utilization.Captive plants enjoy the lower Tax rate and company enjoys zero tax from tax free geographycal areas. Smelting Plants are improvised and management is confident that the smelting plants will maintain their stance for the coming quarters also. Outlook and valuation: With a cash-rich balance sheet and strong visibility over production growth of zinc, lead and silver over FY2013-15, we are positive on HZL.The Rampura Agucha underground mine project is operational via ramps (tunnel driven downward from the surface) and commercial production already ramp up in Q3 and will in Q4 of FY14 . The Kayad mine project will also commence commercial production in the current fiscal year. A cash-rich balance sheet, low cost of production and inexpensive valuations make HZL an attractive bet at the current price levels.HZL’s integrated business model ensures steady cash flow, which reiterates our positive stance on the company.we Valuing the stock at this level, we recommend BUY rating on HZL with a target price of Rs.143-148 for FY14. LME Price/Ton Jan-13 Lower Production Guideline HZL has marginally downward revised its mined metal production guidance for FY14 from 950,000 tonnes earlier to 900,000 tonnes. This reflects slower-than-expected ramp up of underground mining projects and some changes in mining sequence wherein preference has been given to primary mine development during this period. Source - Comapany/EastWind Research LME Price/Ton Zinc Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 125000 120000 115000 110000 105000 100000 95000 90000 May-13 FY14E 13577 1787 15364 1291 707 6484 7093 718 37 1097 6967 19.0 Apr-13 FY13 12700 2032 14732 1070 696 6218 6482 647 29 921 6899 21.0 Mar-13 FY12 11405 1543 12948 1228 568 5336 6069 611 14 1419 5526 21.0 Feb-13 FY11 9912 979 10891 1023 492 4417 5496 475 19 1059 4900 22.0 Jan-13 P/L PERFORMANCE Net Revenue from Operation Other Income Total Income Power, fuel & water Repairs Expenditure EBITDA Depriciation Interest Cost Net tax expense / (benefit) PAT ROE% Source - Comapany/EastWind Research 22

- 23. Hindustan Zinc LTD. B/S PERFORMANCE Share capital Reserve & Surplus Total equity Long-term borrowings Short-term borrowings Long-term provisions Trade payables Short-term provisions Total liabilities Intangibles Tangible assets Capital work-in-progress Long-term loans and advances Inventories Trade receivables Cash and bank balances Short-term loans and advances Total Assets RATIOS P/B EPS Debtor to Turnover% Creditors to Turnover% Inventories to Turnover% FY10 423 17701 18124 0 60 0 478 340 20238 109 6071 1113 361 452 152 928 96 20238 FY10 3.2 95.6 1.9 6.0 0.6 FY11 845 21688 22533 0 0 0 475 567 25053 109 7145 875 594 762 209 5633 158 25053 FY11 2.2 11.6 2.1 4.8 0.8 FY12 845 26036 26881 0 0 0 410 504 29485 47 8466 445 876 798 332 5255 233 29485 FY12 2.1 13.1 2.9 3.6 0.7 FY13 845 31431 32276 0 0 0 484 825 35465 10 8474 1082 1898 1111 403 6942 373 35465 FY13 1.7 16.3 3.2 3.8 0.9 CASH FLOWS Cash from Operation Changes In Working Capital Net Cash From Operation Cash From Investment Cash from Finance Net Cash Flow during year FY10 4001 77 4077 -3881 -187 8 FY11 4483 -212 4272 -3658 -363 250 FY12 4553 -61 4492 -3499 -1242 -248 FY13 4935 -183 4752 -3234 -1257 262 Net Revenue from Operatio n 4000 3500 3000 2500 30.0 Revenue Growth 4500 15.0 25.0 20.0 2000 10.0 1500 5.0 1000 0.0 500 0 -5.0 Source - Comapany/EastWind Research ZinC Productions: 250000 Zinc Production (tons) 200000 150000 100000 50000 0 Source - Comapany/EastWind Research 2500 EBIDTA % 2000 49 49 50 47 43 1500 60 EBIDTA 43 41 40 42 30 Trading At : 7000 EBIDTA & Margin : 1000 NIFTY HINDZINC 20 160 6000 140 5000 120 500 10 100 4000 80 3000 60 2000 0 40 1000 0 20 0 0 Source - Comapany/EastWind Research Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 23

- 24. N arnolia Securities Ltd 402, 4th floor 7/ 1, Lord s Sinha Road Kolkata 700071, Ph 033-32011233 Toll Free no : 1-800-345-4000 em ail: research@narnolia.com , w ebsite : w w w .narnolia.com Risk Disclosure & Disclaimer: This report/message is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Narnolia Securities Ltd. (Hereinafter referred as NSL) is not soliciting any action based upon it. This report/message is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any from. The report/message is based upon publicly available information, findings of our research wing “East wind” & information that we consider reliable, but we do not represent that it is accurate or complete and we do not provide any express or implied warranty of any kind, and also these are subject to change without notice. The recipients of this report should rely on their own investigations, should use their own judgment for taking any investment decisions keeping in mind that past performance is not necessarily a guide to future performance & that the the value of any investment or income are subject to market and other risks. Further it will be safe to assume that NSL and /or its Group or associate Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise, individually or otherwise in the recommended/mentioned securities/mutual funds/ model funds and other investment products which may be added or disposed including & other mentioned in this report/message.