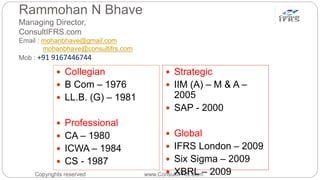

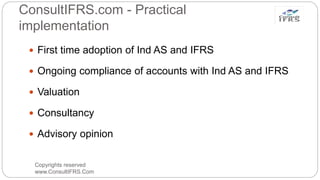

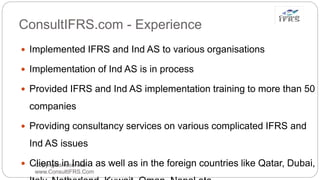

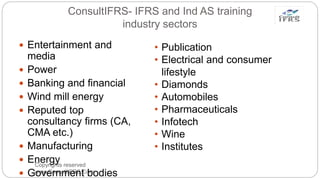

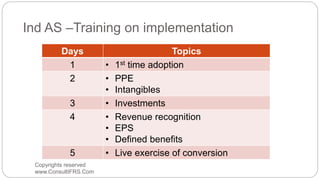

This document provides biographical and professional information about Rammohan N Bhave, the managing director of ConsultIFRS.com. It outlines his educational qualifications and professional experience working for 28 years in industry. It then summarizes the services offered by ConsultIFRS.com, including first time adoption of IFRS and Ind AS, ongoing compliance, valuation, consultancy, and training. Industry sectors that ConsultIFRS.com has experience implementing IFRS/Ind AS for and providing training to are also listed.