This document outlines the process for mapping inclusive excise purchases in SAP Business One. It involves:

1) Creating a G/L account called "Inclusive Excise Reversal" to track excise amounts.

2) Configuring tax codes - one with zero BED rate for dealer invoices, one with actual excise rate.

3) Entering excise details from manufacturer invoices using UDFs on GRPOs.

4) Passing a journal entry to nullify the excise amount and match the dealer's invoice.

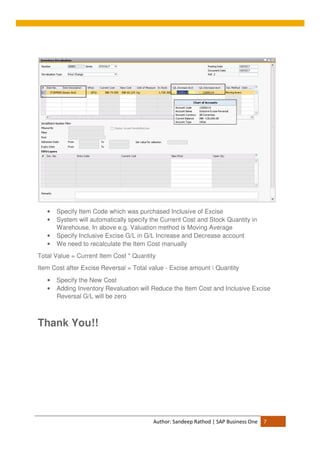

5) Revaluing inventory costs to remove the excise amount using an inventory revaluation document.