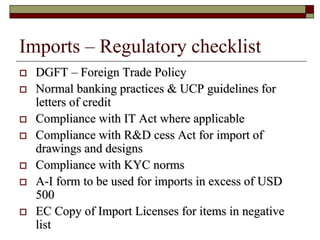

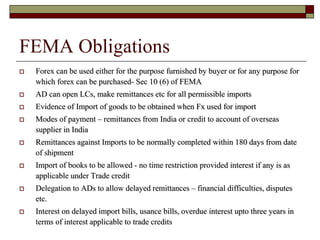

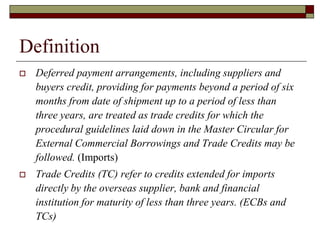

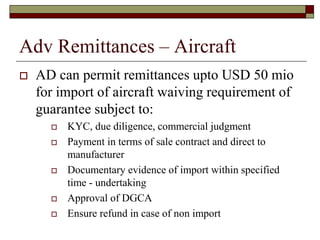

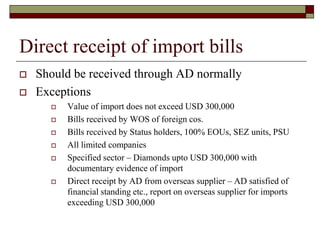

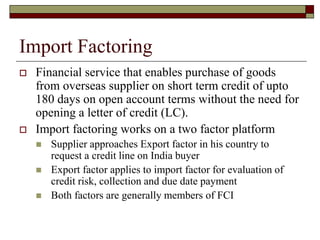

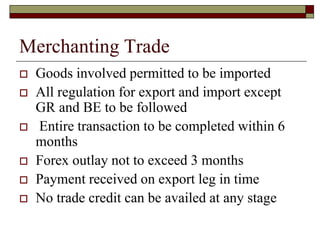

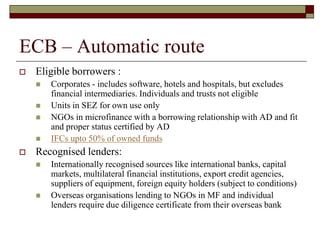

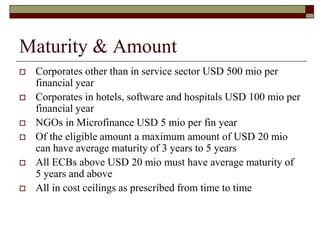

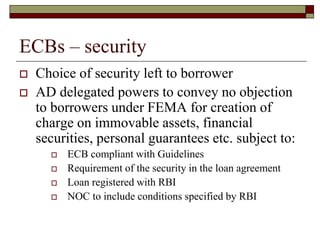

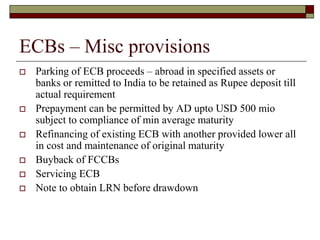

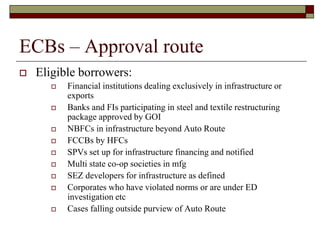

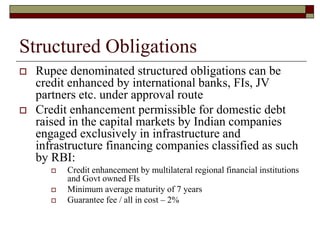

This document provides an overview of regulations and guidelines related to import financing in India. It discusses various import financing options such as buyers credit, suppliers credit, and external commercial borrowings. It outlines regulatory requirements for import documentation, payment methods, permissible end uses of funds, security options, and approval processes for import financing exceeding certain thresholds.