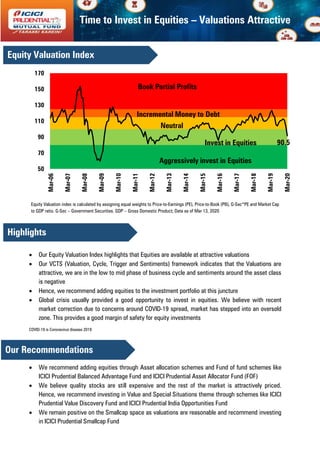

The document advocates for investing in equities due to attractive valuations, as indicated by the equity valuation index, amidst a low-to-mid business cycle phase and negative sentiment in the market. It recommends adding equities to investment portfolios through specific schemes, especially following the recent market correction due to COVID-19, which has created a favorable buying opportunity. The document emphasizes careful valuation analysis and investing in quality stocks and small-cap funds while advising that investment decisions should be made after consulting financial advisors.