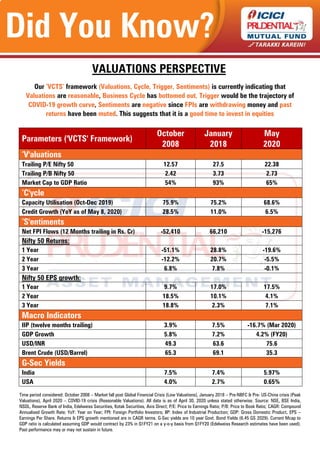

The 'vcts' framework indicates that current valuations are reasonable and suggests it's a good time to invest in equities, despite negative sentiments from foreign portfolio investors withdrawing funds. Key financial metrics reveal a market cycle bottom with a mixed performance in historical returns and growth rates. The framework aims to help navigate markets efficiently using various data points, and past performance may not be indicative of future results.