This document provides an overview and analysis of the herbal supplement industry for a marketing presentation by Tiffany Peterson and Gabriela Khowploum. Key points include:

- The US supplement market is valued at $35 billion annually and is expected to grow to $60 billion by 2021. Herbal supplements are expected to have the largest market share.

- Major competitors include Herbalife, Nature's Sunshine, NBTY, and USANA in the US and companies like Arkopharma and Nelsons internationally. A similar product to Immun'age called Zuccari Papaya Pura is sold on Amazon.

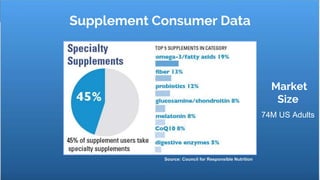

- Market research on supplement consumers found that over half exercise regularly and trust in supplement safety