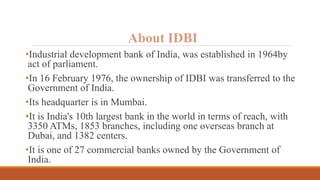

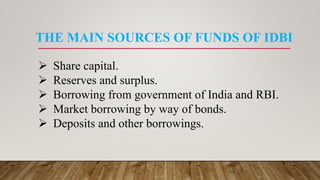

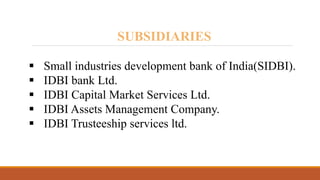

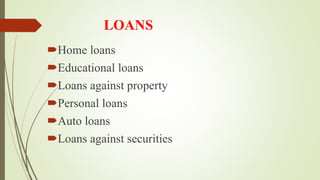

Industrial Development Bank of India (IDBI) was established in 1964 by an act of parliament and is now owned by the Government of India. IDBI is headquartered in Mumbai and operates over 3,350 ATMs and 1,853 branches. It obtains funds from share capital, reserves, government and RBI borrowing, bond issuances, and deposits. IDBI has subsidiaries including SIDBI, IDBI Bank Ltd., and companies focused on capital markets, asset management, and trusteeship services. IDBI provides direct assistance, indirect assistance, and promotional activities to industries, and offers various savings, deposit, loan, and payment products and services.