Shifting Gears | Monetary Policy Statement (2022-23)

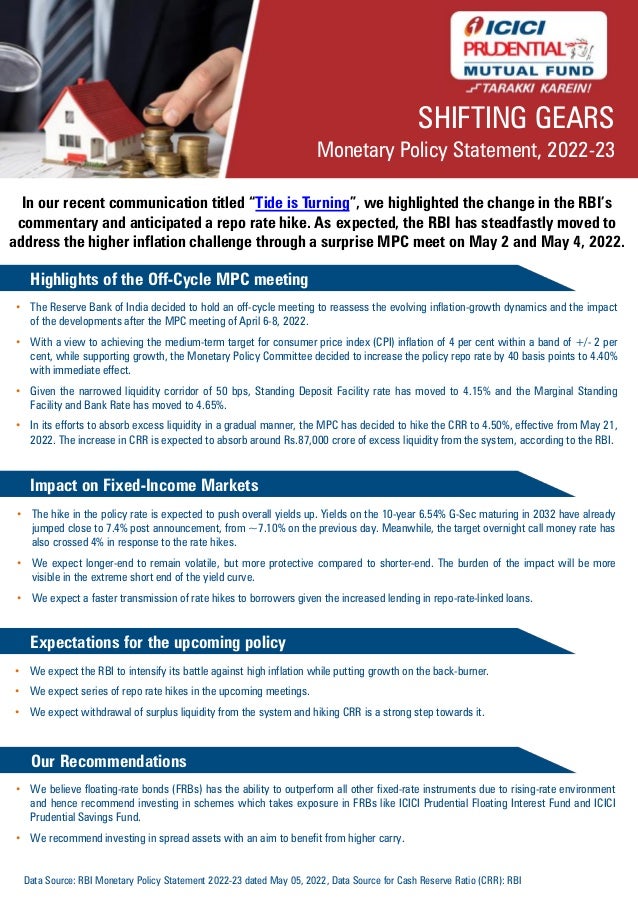

- 1. Highlights of the Off-Cycle MPC meeting • The Reserve Bank of India decided to hold an off-cycle meeting to reassess the evolving inflation-growth dynamics and the impact of the developments after the MPC meeting of April 6-8, 2022. • With a view to achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth, the Monetary Policy Committee decided to increase the policy repo rate by 40 basis points to 4.40% with immediate effect. • Given the narrowed liquidity corridor of 50 bps, Standing Deposit Facility rate has moved to 4.15% and the Marginal Standing Facility and Bank Rate has moved to 4.65%. • In its efforts to absorb excess liquidity in a gradual manner, the MPC has decided to hike the CRR to 4.50%, effective from May 21, 2022. The increase in CRR is expected to absorb around Rs.87,000 crore of excess liquidity from the system, according to the RBI. Data Source: RBI Monetary Policy Statement 2022-23 dated May 05, 2022, Data Source for Cash Reserve Ratio (CRR): RBI SHIFTING GEARS Expectations for the upcoming policy • We expect the RBI to intensify its battle against high inflation while putting growth on the back-burner. • We expect series of repo rate hikes in the upcoming meetings. • We expect withdrawal of surplus liquidity from the system and hiking CRR is a strong step towards it. In our recent communication titled “Tide is Turning”, we highlighted the change in the RBI’s commentary and anticipated a repo rate hike. As expected, the RBI has steadfastly moved to address the higher inflation challenge through a surprise MPC meet on May 2 and May 4, 2022. Impact on Fixed-Income Markets • The hike in the policy rate is expected to push overall yields up. Yields on the 10-year 6.54% G-Sec maturing in 2032 have already jumped close to 7.4% post announcement, from ~7.10% on the previous day. Meanwhile, the target overnight call money rate has also crossed 4% in response to the rate hikes. • We expect longer-end to remain volatile, but more protective compared to shorter-end. The burden of the impact will be more visible in the extreme short end of the yield curve. • We expect a faster transmission of rate hikes to borrowers given the increased lending in repo-rate-linked loans. Our Recommendations Monetary Policy Statement, 2022-23 • We believe floating-rate bonds (FRBs) has the ability to outperform all other fixed-rate instruments due to rising-rate environment and hence recommend investing in schemes which takes exposure in FRBs like ICICI Prudential Floating Interest Fund and ICICI Prudential Savings Fund. • We recommend investing in spread assets with an aim to benefit from higher carry.

- 2. Positioning our Scheme Portfolios to Reduce the Impact of Volatility 1. Higher allocation to Floating Rate Bonds 2. Actively Managing Duration Scheme Name (A) (B) (C) Change in Mod Duration (C-B) Mod Duration in Yrs (Oct 31,2021) Mod Duration in Yrs (Mar 31,2022) Mod Duration in Yrs (Apr 30, 2022) ICICI Prudential Liquid Fund 0.1 0.1 0.1 0.0 ICICI Prudential Money Market Fund 0.2 0.5 0.4 -0.1 ICICI Prudential Ultra Short Term Fund 0.2 0.3 0.3 0.0 ICICI Prudential Savings Fund 0.8 1.1 0.9 -0.2 ICICI Prudential Floating Interest Fund 1.6 1.3 0.9 -0.4 ICICI Prudential Credit Risk Fund 1.6 1.7 1.6 -0.1 ICICI Prudential Short Term Fund 1.6 1.5 1.8 0.3 ICICI Prudential Corporate Bond Fund 2.7 1.4 1.2 -0.2 ICICI Prudential Banking & PSU Debt Fund 3.9 2.2 2.1 -0.1 ICICI Prudential Medium Term Bond Fund 2.5 2.2 2.4 0.2 ICICI Prudential Bond Fund 4.2 2.8 3.1 0.3 ICICI Prudential All Seasons Bond Fund 2.3 2.3 2.8 0.5 ICICI Prudential Long Term Bond Fund 8.3 6.9 6.9 0.0 ICICI Prudential Gilt Fund 7.0 2.4 1.8 -0.6 Scheme Name Exposure to Floating Rate Instruments (Apr 30, 2022) ICICI Prudential Floating Interest Fund 75.6% ICICI Prudential Gilt Fund 66.1% ICICI Prudential Savings Fund 60.1% ICICI Prudential Corporate Bond Fund 45.9% ICICI Prudential Short Term Fund 40.0% ICICI Prudential Banking & PSU Debt Fund 32.4% ICICI Prudential All Seasons Bond Fund 30.4% ICICI Prudential Bond Fund 15.1% ICICI Prudential Medium Term Bond Fund 8.5% ICICI Prudential Credit Risk Fund 8.2% ICICI Prudential Floating Interest Fund 75.6% ICICI Prudential Gilt Fund 66.1% ICICI Prudential Savings Fund 60.1% SHIFTING GEARS Monetary Policy Statement, 2022-23

- 3. SHIFTING GEARS Monetary Policy Statement, 2022-23 As per SEBI Circular dated, June 07, 2021; the potential risk class (PRC) matrix based on interest rate risk and credit risk SR No. Scheme Name Position in the Matrix 1 ICICI Prudential Overnight Fund 2 ICICI Prudential Savings Fund 3 ICICI Prudential Floating Interest Fund 4 ICICI Prudential Medium Term Bond Fund 5 ICICI Prudential All Seasons Bond Fund 6 ICICI Prudential Corporate Bond Fund 7 ICICI Prudential Banking & PSU Debt Fund 8 ICICI Prudential Short Term Fund 9 ICICI Prudential Bond Fund 10 ICICI Prudential Liquid Fund 11 ICICI Prudential Money Market Fund 12 ICICI Prudential Long Term Bond Fund 13 ICICI Prudential Gilt Fund 14 ICICI Prudential Constant Maturity Gilt Fund 15 ICICI Prudential Credit Risk Fund 16 ICICI Prudential Ultra Short Term Fund

- 4. SHIFTING GEARS Monetary Policy Statement, 2022-23 Riskometer and Disclaimers as on March 31, 2022 Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis. Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details. Macaulay Duration : The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price. Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates.

- 5. SHIFTING GEARS Monetary Policy Statement, 2022-23 Riskometer and Disclaimers as on March 31, 2022 Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis. Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details. Macaulay Duration : The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price. Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates.

- 6. SHIFTING GEARS Monetary Policy Statement, 2022-23 Mutual Fund investments are subject to market risks, read all scheme related documents carefully. All figures and other data given in this document are dated. The same may or may not be relevant at a future date. The AMC takes no responsibility of updating any data/information in this material from time to time. The information shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Prudential Asset Management Company Limited. Prospective investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICI Prudential Mutual Fund. Past Performance may or may not be sustained in future. Disclaimer: In the preparation of the material contained in this document, ICICI Prudential Asset Management Company Ltd. (the AMC) has used information that is pub- licly available, including Budget speech and information developed in-house. The stock(s)/sector(s) mentioned in this slide do not constitute any recommendation and ICICI Prudential Mutual Fund may or may not have any future position in this stock(s). Some of the material used in the document may have been obtained from mem- bers/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any informa- tion. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. ICICI Prudential Asset Management Company Lim- ited (including its affiliates), the Mutual Fund, The Trust and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Further, the information contained herein should not be construed as forecast or promise or investment advice. The recipient alone shall be fully responsible/are liable for any decision taken on this material.