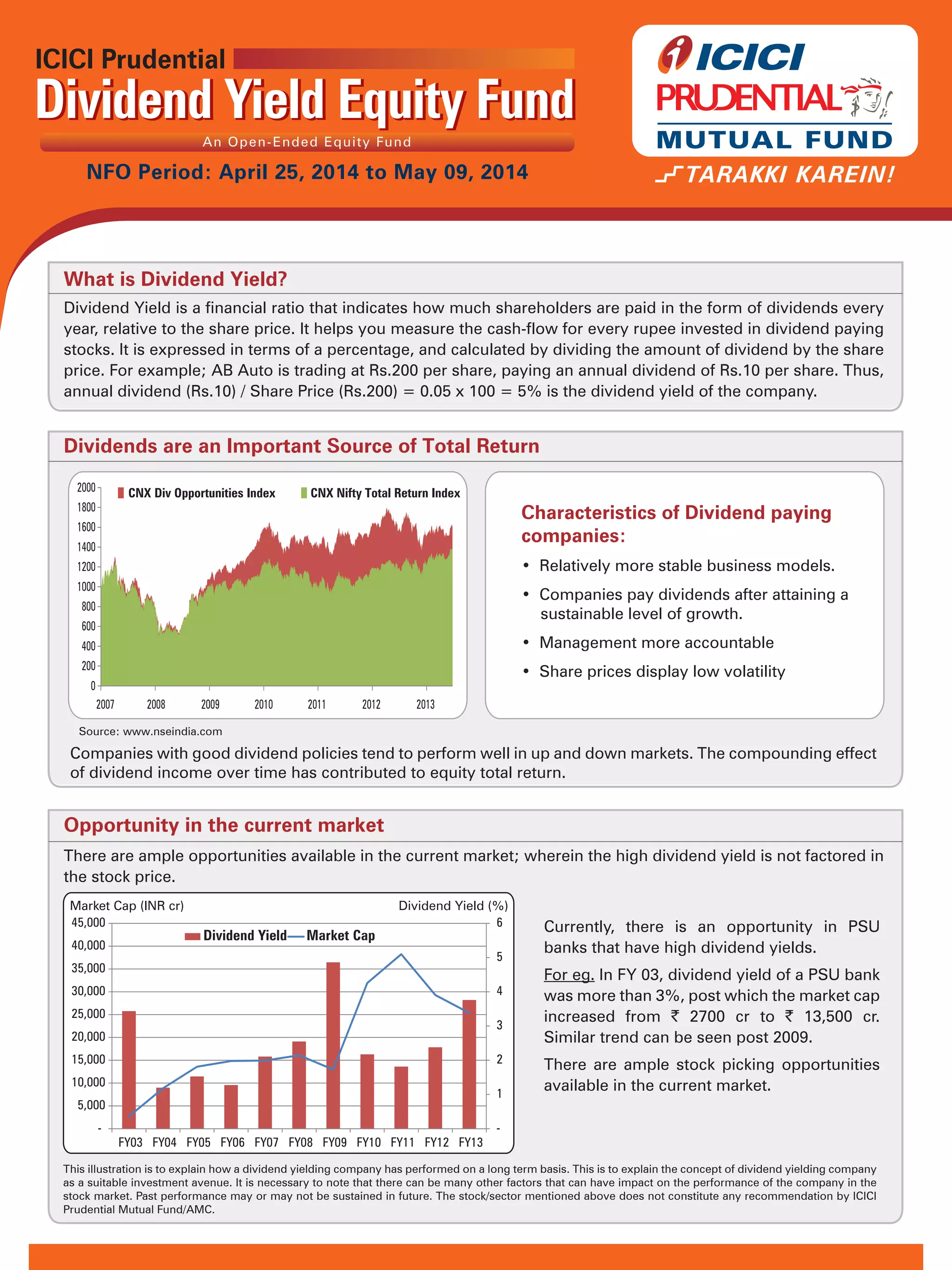

This document discusses dividend yield and dividend yield equity funds. It defines dividend yield as the annual dividend per share divided by the share price, expressed as a percentage. It notes that dividends are an important source of total return for investors. The document also describes the characteristics of companies that pay dividends, including more stable business models and management that is more accountable. It provides information on an open-ended equity fund that aims to invest in stocks with above-average dividend yields and identifies high-quality companies with a proven record of paying and growing dividends.