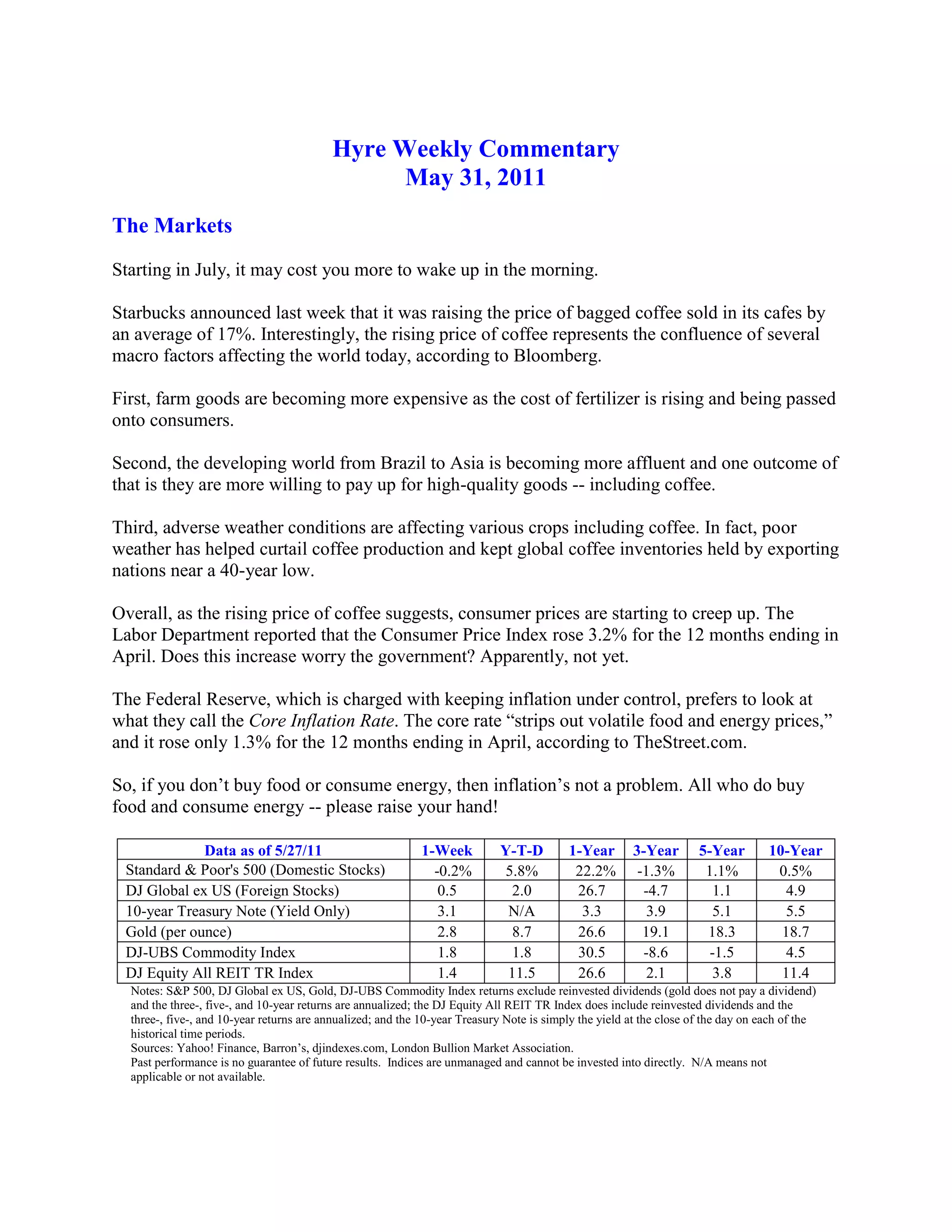

The document discusses rising consumer prices, including the price of coffee. It provides three reasons for higher coffee prices: increasing costs of fertilizer and farm goods, rising affluence in developing countries leading to higher demand, and adverse weather affecting coffee production. While core inflation remains low, food and energy prices are rising. The yield curve is also discussed as a potential indicator of future recessions.