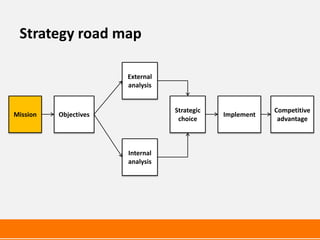

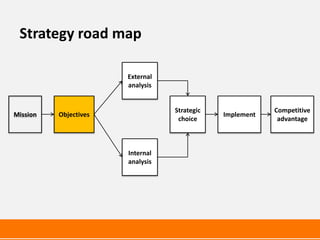

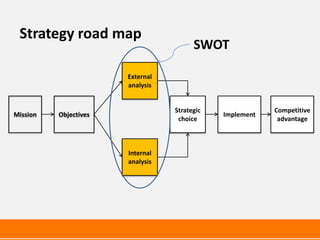

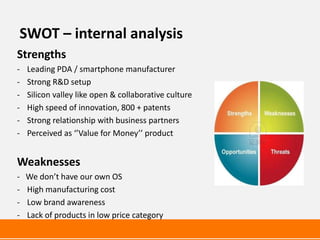

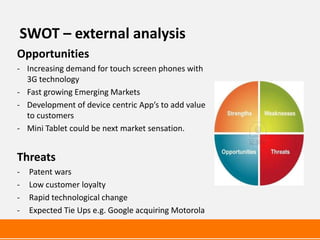

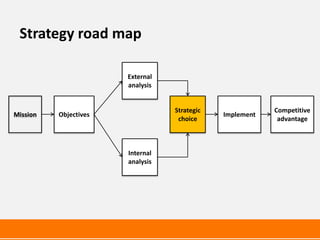

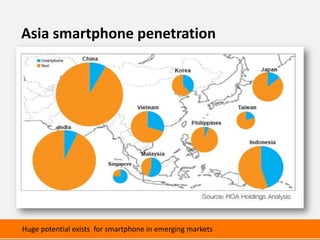

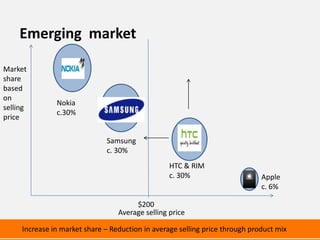

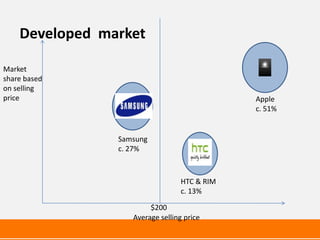

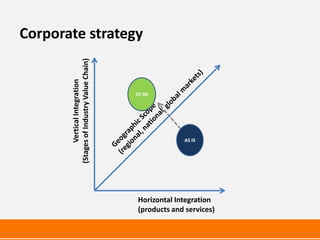

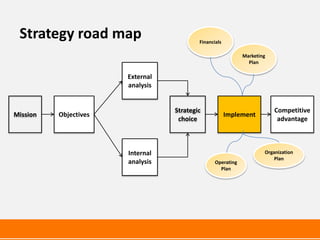

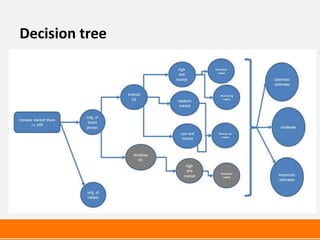

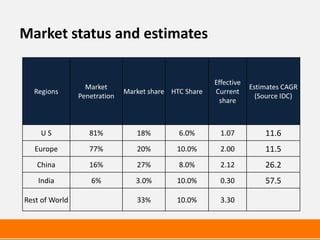

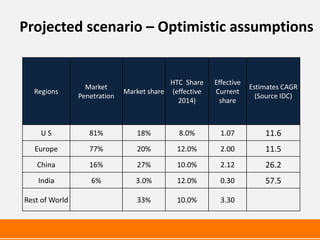

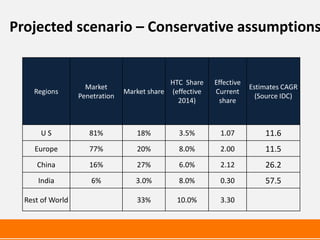

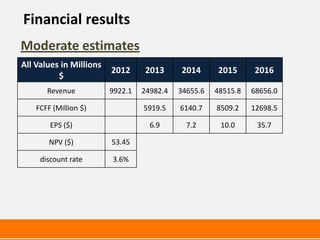

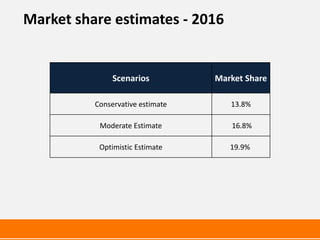

The document provides an overview of HTC's history and strategy for growth. It traces HTC's evolution from producing the world's first PDA and smartphone to becoming a top smartphone manufacturer. HTC's mission is to become the #3 player in the global smartphone market by 2016. To achieve this, HTC will leverage its strengths in hardware innovation, focus on emerging markets in Asia, and pursue strategic partnerships. The document outlines HTC's SWOT analysis and competitive positioning. It presents revenue projections and financial analyses under conservative, moderate, and optimistic scenarios to evaluate HTC's strategy for achieving its growth objectives.