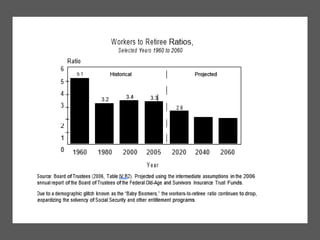

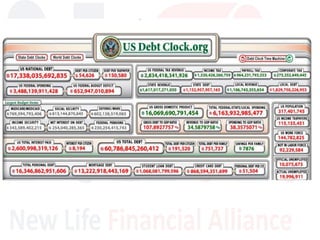

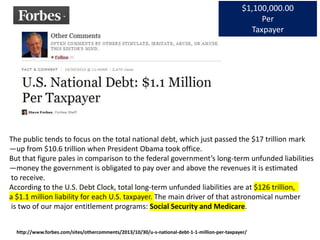

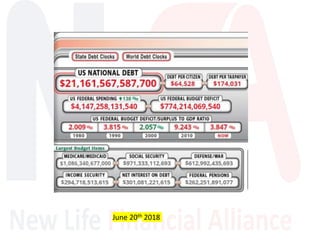

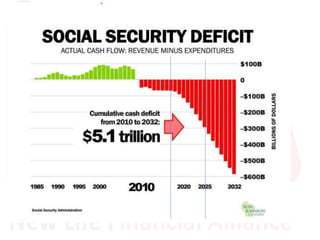

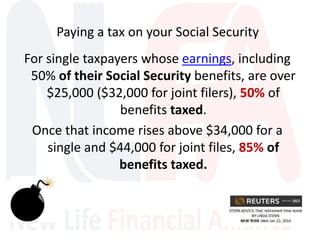

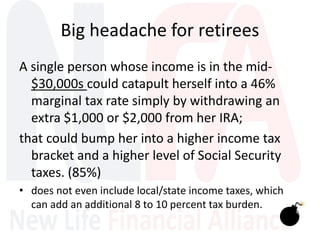

The document discusses the impending retirement of the baby boomer generation, which poses significant financial challenges due to a staggering national debt and long-term unfunded liabilities linked to Social Security and Medicare. As these individuals prepare to retire, concerns arise over their financial security, particularly with rising costs and potential devaluation of their benefits. Additionally, the document highlights tax implications for retirees, emphasizing the need for proper planning to mitigate financial burdens in retirement.